- Ocugen shares are highly volatile and retail follows closely.

- OCGN shares have spiked on the back of covid vaccine news

- OCGN wants to bring a covid vaccine to the US market.

Ocugen is a medical company that was focused on eye diseases but quickly changed focus once the pandemic hit. Ocugen now has one of its strongest business opportunities in the development of a covid-19 vaccine. OCGN has partnered with India's Bharat Biotech to bring its COVAXIN COVID-19 vaccine to the US market.

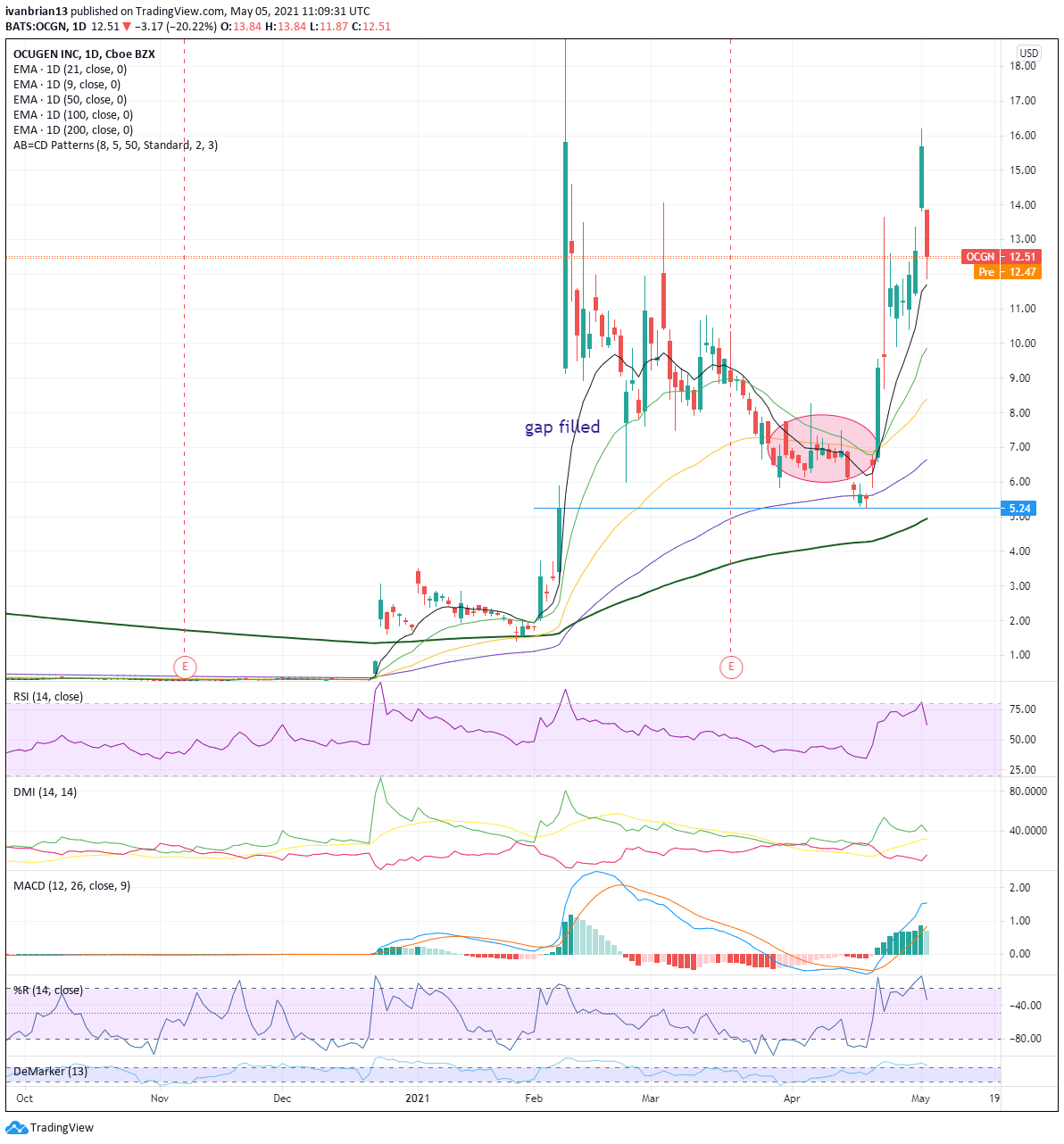

OCGN stock price

Ocugen shares have been highly volatile the past number of months. Operating in the biotech medical sector can be volatile anyway due to regulatory and trial data, but Ocugen has seen increased volatility as a result of its pivot toward covid vaccine development.

OCGN shares traded around $0.30 in December but spiked to nearly $20 by February. The catalyst was OCGN partnering with Bharat Biotech. Bharat is an Indian vaccine company that is working on bringing its COVAXIN COVID-19 vaccine to market. Ocugen will look after bringing COVAXIN to the US market, including regulatory approval and distribution.

On February 8, OCGN shares spiked on the news of a share placing. Normally, share placings are done at a discount to the market, but this was done at a premium. Retail traders jumped on the news and sent OCGN shares soaring.

Since then, it has largely moved sideways to lower as OCGN filled the gap caused by the initial spike and broke several key support levels along the way.

OCGN jumped again on April 22 as positive trial data for the COVAXIN drug was released to the market. OCGN shares failed to take out previous highs set back in February but did still manage to register an impressive 42% gain. Further spikes were seen on May 3 as Ocugen announced that COVAXIN proves effective against the main variants of the covid virus.

Ocugen is to release results for the first quarter 2021 on Friday, May 7. Earnings per share are expected to be $0.50.

OCGN technical levels

The failure to break new highs recently is in itself a bearish argument. Investors and traders now have more information following trial results and positive results in relation to COVAXIN's effectiveness against covid variants. With this new information, the risk profile of the investment has actually lowered since the highs seen on February 8. Remember, the move on February 8 was sparked by Ocugen announcing a premium share placing. At this time not enough was known about the trial results of COVAXIN or its viability against covid and covid variants. Now that they have that information or more information at least, the risk of success or failure of COVAXIN has tilted more toward success, but OCGN shares have not recaptured old highs. This tells us that the earlier move in February was too much pure speculation and froth or we are missing something.

For now, OCGN remains in bullish formation with a series of higher lows and sits comfortably above the main moving averages. Support is key at $11.70 and then $9.87. These levels are the 9 and 21-day moving averages respectively. A break below $9.87 would then see OCGN look to reestablish itself in the consolidation area below $7.

Resistance is from the February high of $18.77. Results will be important but more important will be news around the commercial and regulatory viability of COVAXIN.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.