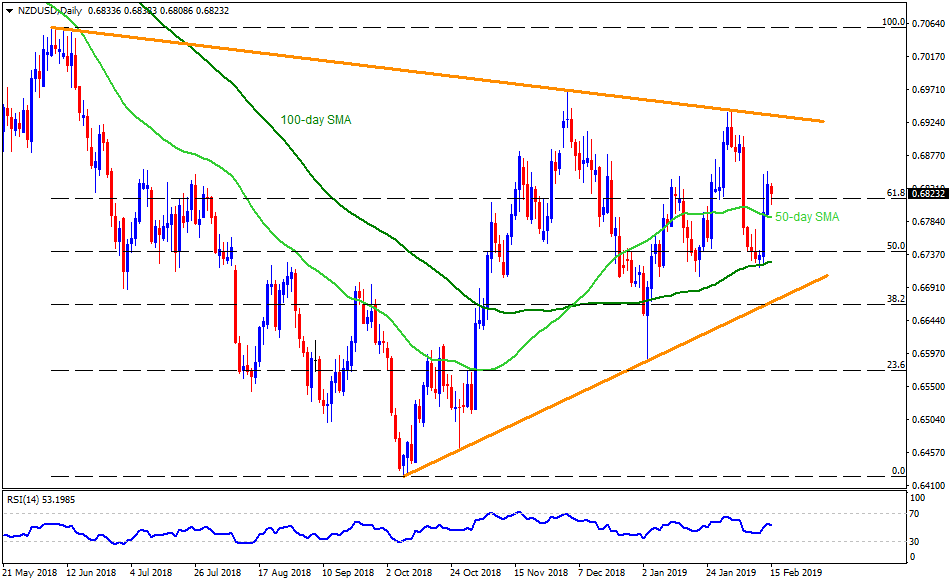

NZD/USD daily chart

- The NZD/USD pair refrained to extend prior gains beyond 0.6850 and trades near 0.6820 during early Friday.

- The pair has been trailing behind 0.6850 since last three days and weaker than expected China CPI portrayed one such pullback early today.

- As a result, prices may come back to 50-day simple moving average (SMA), at 0.6790 whereas 0.6770 and 100-day SMA level of 0.6725 could confine the pair’s downside afterward.

- In case the quote closes under 0.6725, an upward sloping trend-line connecting lows marked since October 2018, at 0.6665 might flash on Bears’ radar.

- Alternatively, an upside clearance of 0.6850 can propel the pair towards last-week’s high near 0.6905 while descending resistance line, at 0.6935 could challenge upside then after.

- If at all there prevail additional increase beyond 0.6935, 0.6975 and 0.7000 could lure the buyers.

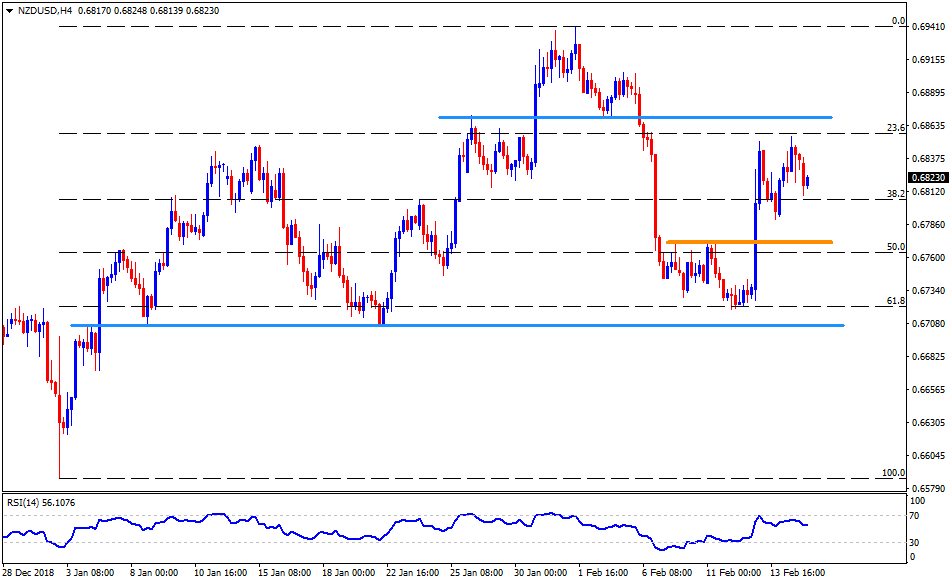

NZD/USD 4-Hour chart

- Observing H4 chart, it can be known that the 0.6705 may try to limit the pair’s decline after 0.6725, if not then 0.6665 and 0.6620 can play their role as support.

- Meanwhile, the 0.6870 horizontal-line may offer an intermediate stop to the price rise past-0.6850 towards 0.6905.

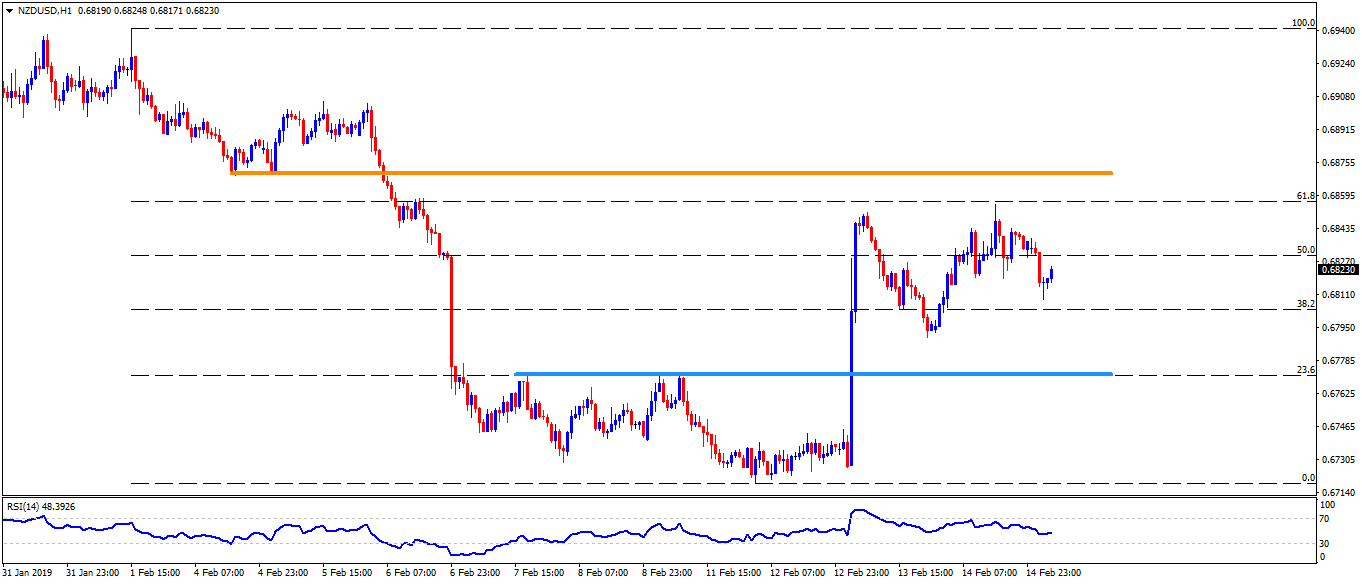

NZD/USD hourly chart

- 0.6770 and 0.6870 appear more clearly on H1 with 0.6790 and 0.6850 being intermediate halts during the move.

- Also, 0.6735 can offer rest to the pair after 0.6770 and before 0.6725.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.