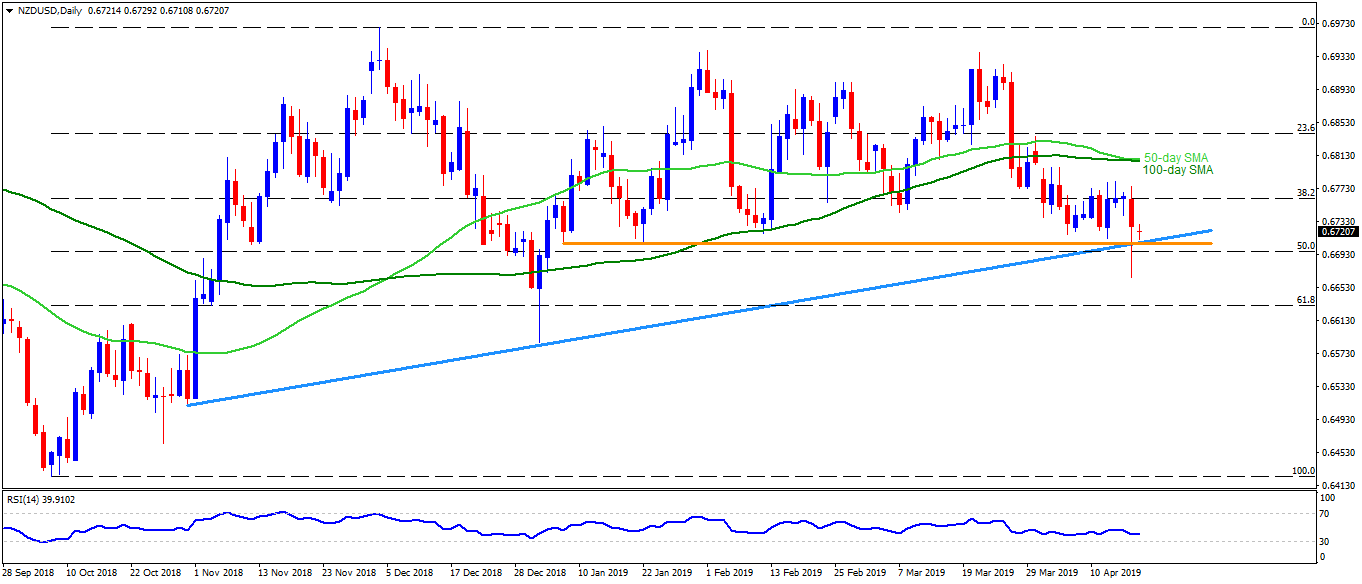

NZD/USD daily chart

- NZD/USD trades near 0.6720 ahead of European open on Thursday. The pair recently bounced off 0.6710 – 0.6700 support-confluence comprising an ascending trend-line stretched since October 31 and a horizontal-line including lows marked since January 08.

- Pair’s recent pullback can avail 0.6770 as an intermediate halt during its upside to 0.6800 and then to the 0.6810 joint between 50-day simple moving average (SMA) and 100-day SMA. During the quote’s extended rise past-0.6810, 0.6840, 0.6880 and 0.6900 could become bulls’ favorites.

- On the downside break of 0.6700, sellers may wait for 0.6690 to validate the downturn till 0.6650 and then to January lows near 0.6585.

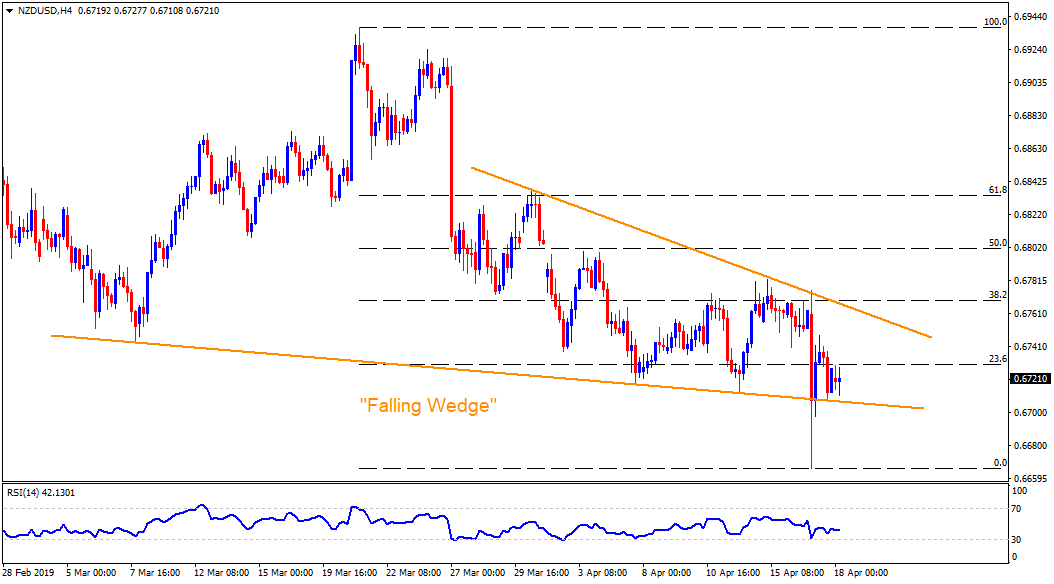

NZD/USD 4-Hour chart

- The pair forms “falling wedge” bullish formation on the four-hour (4H) chart that gets confirmed on the break of 0.6770, opening the door for its upward trajectory towards 0.6870.

- On the downside break of 0.6700 pattern support, recent lows near 0.6665 can gain bears’ attention.

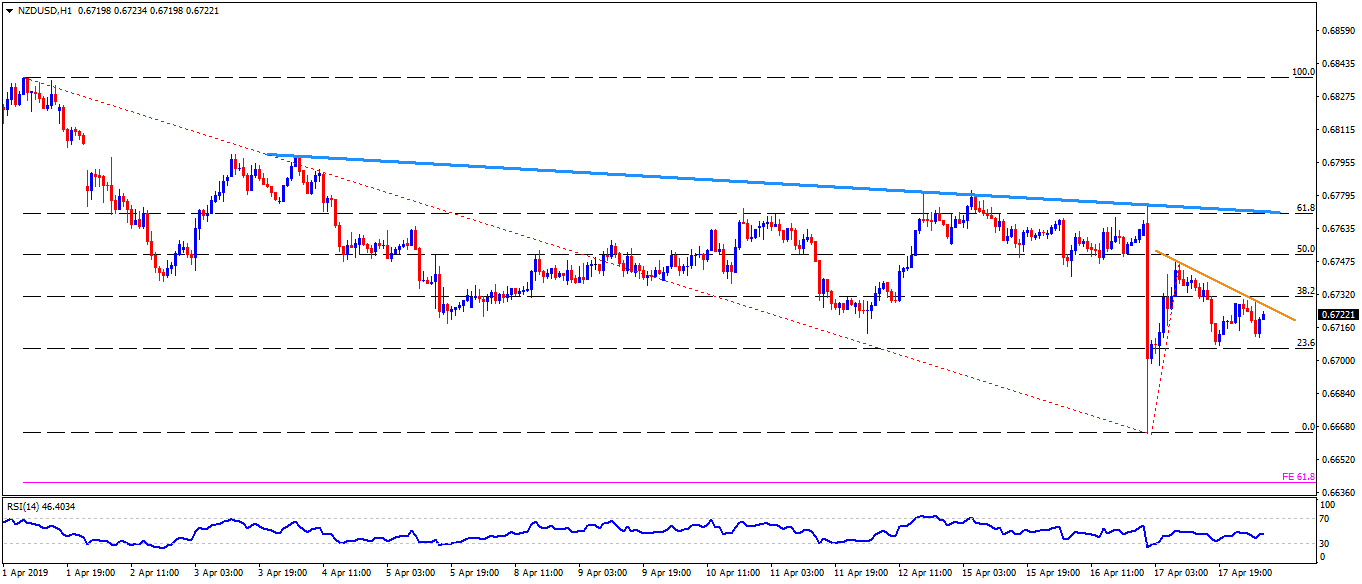

NZD/USD hourly chart

- While 0.6730 acts as closest resistance-line, 61.8% Fibonacci expansion of current month moves near 0.6640 can please bears between 0.6650 and 0.6585.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.