- NZD/USD records sharp gains in the European session.

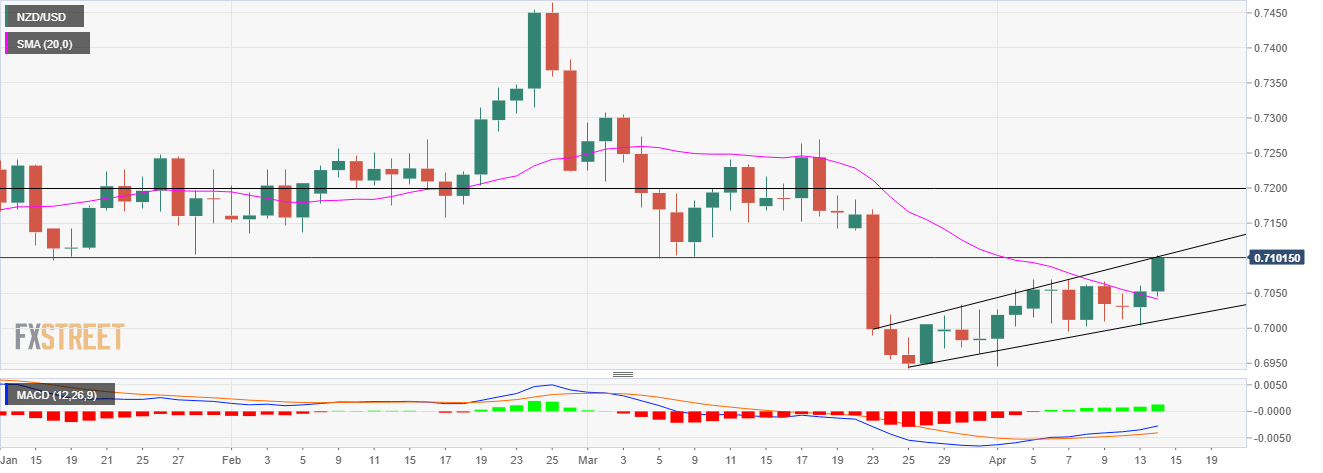

- Bulls are facing rejection just above 0.7100 inside the rising channel.

- Positive MACD favors upside bias.

The NZD/USD pair keeps the upside momentum in the European session. The pair refreshes the daily highs near 0.7121, having hit intraday lows at 0.7047 earlier in Asian session.

At the time of writing, NZD/USD is trading at 0.7115, up 0.9% on the day.

NZD/USD daily chart

On the daily chart, the NZD/USD pair has been trading with an upside conviction and is extending the overnight gains. The prices successfully breached interim resistance placed near the channel’s upper trend line at 0.7107. A sustained move above the said level would test March 23 highs in the vicinity of 0.7170 and further to the 0.7200 horizontal resistance zone.

The Moving Average Convergence Divergence (MACD) indicator reads below the central line with oversold conditions, which suggests prices could witness sharp upside on short-covering realizing the possibility of March 18 highs near 0.7230.

On the flip side, the prices could test the 50-day DMA placed at 0.7040 to reach near Tuesday’s low at 0.7004. A sustained move below the mentioned level would also mark the breaking of the upward channel’s lower line, where the price could plunge toward April 1 lows at the 0.6945 level.

NZD/USD additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.