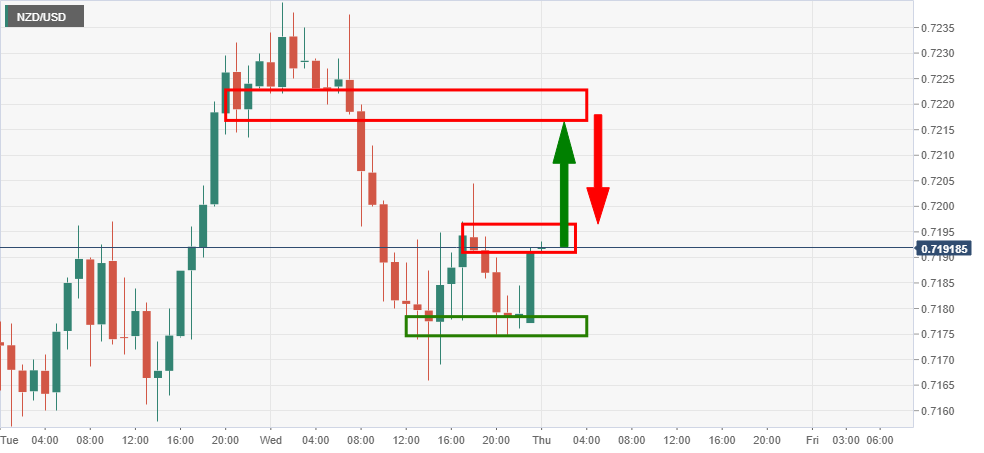

- NZD/USD carving out a bottom on the hourly chart.

- RBNZ in focus and could play out in the hands of the bulls.

NZD/USD is currently trading at 0.7191 between a low of 0.7173 and 0.7194 and attempting to regain ground, forming prospects of a double bottom.

It has been a volatile mid-week session with the kiwi pushed and pulled around an 80 pip range.

The main focus in the forex space has been with the US dollar, defying all the odds of a downside extension on the back of what is expected to be a super soft period for the greenback.

Markets are in anticipation of a prolonged bearish trend in the US dollar given the Federal reserve's commitment to easier money and lower interest rates combined with a heavy fiscal stimulus package from the Democrats.

However, US yields have thrown the dollar bulls a lifeline and recent turmoil in European politics has dented the appeal of the single currency.

Domestically, the bird is in favour of the bulls.

''As we noted yesterday, we no longer expect the Reserve Bank of New Zealand to take the OCR negative, and at the margin that adds upside risks to the NZD, especially given the recent wave of positive data and sentiment,'' analysts at ANZ bank said.

''But optimism is high now and we are at the end of a good run of seasonal strength, just as hopes of fiscal support are driving US bond yields higher, which speaks to USD support.''

RBNZ in focus

The analysts at ANZ have changed their call and now expect the OCR to be cut only one more time to 0.1% in May, reflecting a better economic outlook.

''That means we no longer expect a negative OCR unless downside risks materialise.

We could also imagine a scenario playing out where the RBNZ doesn’t need to cut again at all. However, the outlooks for employment and inflation will take some time to be assured.''

The analysts explained that this view suggests the RBNZ will remain cautious and more dovish than the market currently expects.

''As part of this, we expect that an emphasis that policy will remain expansionary for some time will be a feature of the February MPS, with an extension to the timeframe of LSAP purchases.''

NZD/USD technical analysis

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.