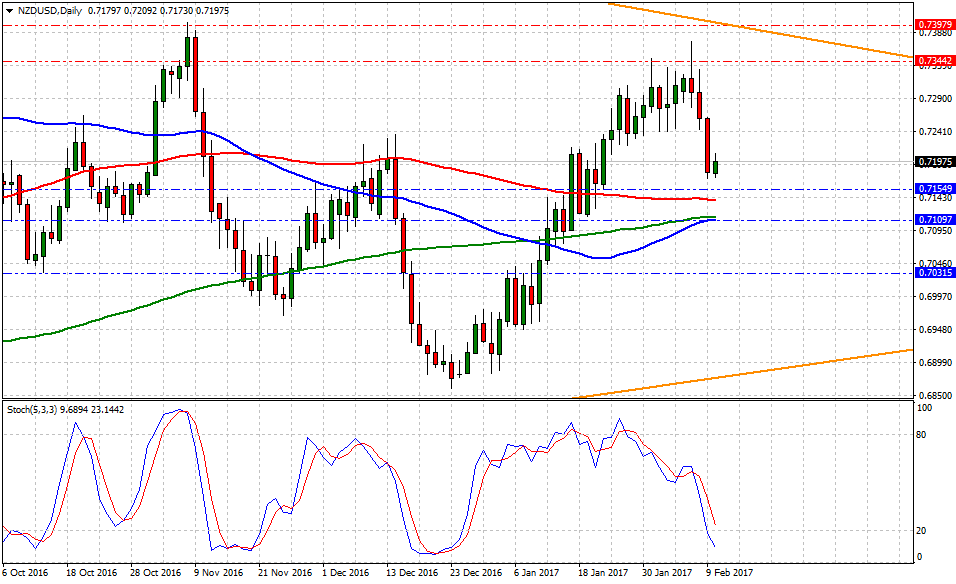

Currently, NZD/USD is trading at 0.7197, up +0.19% or 14-pips on the day, having posted a daily high at 0.7210 and low at 0.7173.

The New Zealand dollar vs. American dollar has been on the downward spiral due to a dovish policy statement where the RBNZ failed to impress market participants as the central bank explained how it expects to hike rates sometime in 2019. The Kiwi experienced an immediate 80-pips sell-off on the comments.

On the other hand, the US economic docket had the Michigan Consumer Sentiment Index which printed 95.7 'a worse than expected' result, lower from consensus and previous. Furthermore, dollar bulls used Trump's latest 'phenomenal taxes' rhetoric to get back on the horse and drag lower Kiwi traders as the exchange rate traded below 0.7200 psychological level.

If Trump delivers further tax cuts or investment remarks during the press conference with Japan's PM Abe, the US dollar could recharge its battery and consolidate to move to new highs.

Historical data available for traders and investors indicates during the last 6-weeks that NZD/USD pair had the best trading day at +1.60% (Jan.17) or 115-pips, and the worst at -1.26% (Jan.18) or 89-pips.

Technical levels to watch

In terms of technical levels, upside barriers are aligned at 0.7240 (horizontal resistance), then at 0.7348 (high Jan.31) and above that at 0.7402 (high Nov. 8). While supports are aligned at 0.7157 (low Jan.23), later at 0.7110 (50-DMA) and below that at 0.7035 (low Nov.28). On the other hand, Stochastic Oscillator (5,3,3) seems to shift from the oversold territory. Therefore, there is evidence to expect further kiwi gains in the near term.

Trump pulling back from the trade war expectation he built himself

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.