- NZD/USD seesaws inside a small trading range following the U-turn from three-week top.

- Covid woes challenge economic recovery hopes but RBNZ hawks stay firm.

- FOMC Meeting Minutes, virus updates will direct short-term moves.

NZD/USD consolidates the previous day’s losses above 0.7000, up 0.08% around 0.7020, amid Wednesday’s Asian session. In doing so, the quote struggles between hawkish bets for the Reserve Bank of New Zealand’s (RBNZ) next move and the coronavirus (COVID-19). However, the bears are hopeful as technical details join market fears.

Be it Bank of New Zealand or the Australia and New Zealand Banking Group (ANZ), not to forget Westpac, all seem to be on the same page while expecting a rate hike from the RBNZ during late 2021. These banks portray the Pacific nation’s ability to tame covid spread at home and upbeat fundamentals to back their bullish view.

Even so, virus resurgence at the largest customer Australia and fears of the covid strain, which mostly signal resistance to the vaccines, keep weighing on the sentiment and Antipodeans. Furthermore, recently weak US data, ISM Services PMI was the latest, probe economic recovery hopes and adds to the risk-off mood.

That said, S&P 500 Futures drop 0.10% while the US 10-year Treasury yields remain pressured around the lowest since late February by the press time.

Considering the lack of data/events and the covid woes’ dominance, not to forget the cautious sentiment ahead of the FOMC minutes, NZD/USD prices may remain pressured.

Technical analysis

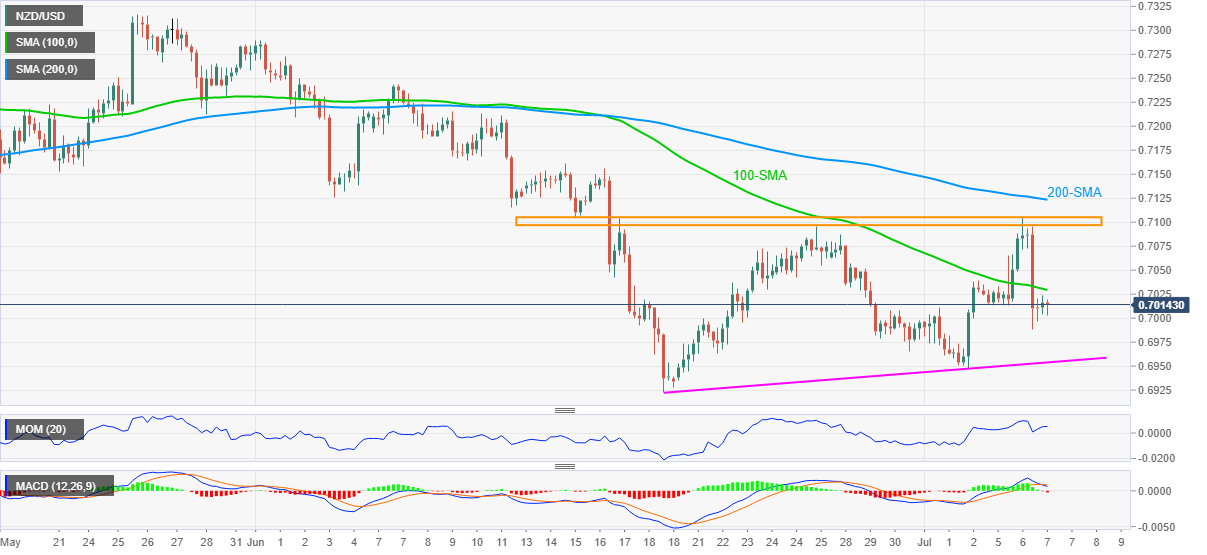

NZD/USD remains below the key horizontal hurdle from mid-June, not to forget 100 and 200-SMAs, by the press time. The bears can also observe, as well as cheer, the MACD conditions that recently flashed a sell signal and the Momentum line having a notable room to the south.

That said, the kiwi pair is on the way to test an ascending support line from June 18, around 0.6955. However, the 0.7000 threshold tests intraday sellers.

Meanwhile, 100-SMA guards the quote’s corrective pullback near 0.7030, a break of which could recall NZD/USD buyers aiming for the stated horizontal hurdle surrounding 0.7095–0.7105.

It should be noted that the 200-SMA level of 0.7125 can offer an extra check for the NZD/USD bulls beyond the key horizontal area.

NZD/USD: Four-hour chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.