- NYSE: NIO is set to end the week and the month on a positive note.

- Nio Inc's shares are seen as expensive while it remains unprofitable.

- Lessons from Elon Musk's Tesla are promising for the firm.

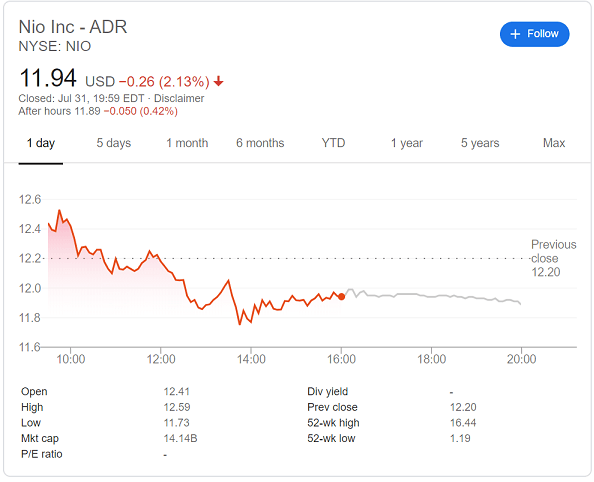

Is a market capitalization of around $14 billion rich for an electric vehicle company? Some analysts suggest that NYSE: NIO current valuation – with shares trading above $12 – is expensive. The primary reasoning for the downbeat assessment on Nio Inc - ADR stems from a basic business lacking – profitability.

However, it is essential to note that Nio, based in Shanghai, China, was founded only in late 2014 and may need more time to turn a profit. The largest EV firm, Tesla, struggled not only with income but also with cash flow.

On the other hand, Nio has the backing of Beijing. Authorities may encourage locals to purchase the company's cars and thus create a national champion. Elon Musk's Tesla may be the market leader – but while it sells in China, the local rival may gain market share.

Tense Sino-American relations may weigh on Nio's sales outside its home country, but the vast Chinese market allows ample room for growth.

NIO Stock Forecast

NYSE: NIO is set to open at $12.36, up over 1% according to pre-market trading. Nio shares would only claw back some of Thursday's losses. However, end-of-month flows could trigger higher volatility, potentially lifting the stock.

The next levels to watch are the weekly closing high of $12.70, followed by the mid-July peak of $14.09, and then by the high close of $14.90 achieved earlier in the month. The stretch target for bulls is $16.44, the 52-week high.

Support is found at Monday's low close of $11.69, followed by $11.09, a level recorded in the previous week. The psychologically significant $10 level is next.

Nio Inc - ADR has made a long journey from the 52-week low of $1.19 and is valued at over 11 times that price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.