- NYSE:NIO turned lower on Tuesday as the focus shifted to US inflation data.

- Nancy Pelosi’s visit to Taiwan is not going over well with the Chinese government.

- Institutional investors are also rotating out of Nio as geopolitical tensions rise.

Update: NYSE NIO fell for the third straight trading day and hit the lowest in a week at $19.02. The stock price of the Chinese Electric Vehicle (EV) maker eroded 4.96% on Tuesday to settle at $19.17. NIO stock tracked the weakness across the major Wall Street indices, triggered by a sharp sell-off in the tech-intensive Nasdaq Composite Index after Micron Technology Inc. became the latest chipmaker to warn about slowing demand and fanning economic concerns. Markets also refrained from placing bets on riskier assets ahead of Wednesday’s critical US inflation data. The US Consumer Price Index (CPI) will set the tone for markets in the coming weeks, as it will heavily impact the Fed’s next rate hike decision. The main driver, however, behind NIO stock’s slump was the news that Advisor Group Holdings Inc. lessened its position in shares of Nio Inc by 1.5% during Q1, according to its most recent Form 13F filing with the Securities & Exchange Commission (SEC).

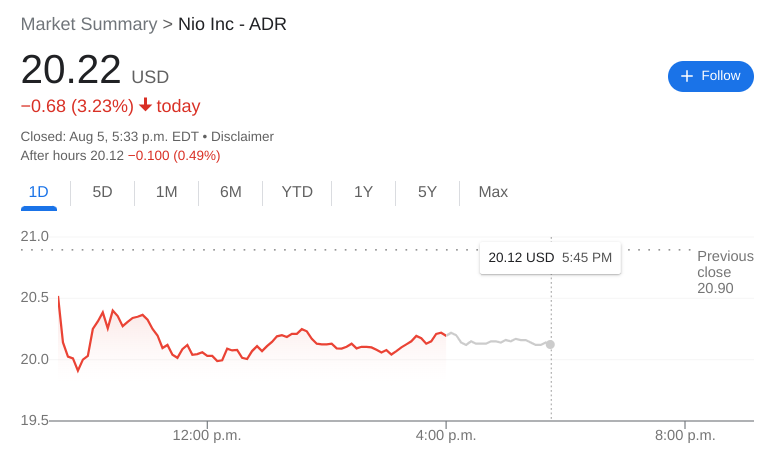

NYSE:NIO saw its win streak snapped at seven straight sessions, although Friday’s losses are not directly attributed to the performance of the company. Shares of NIO slipped lower by 3.25% and closed the trading week at $20.22. Stocks pulled back on Friday after a red-hot July jobs report blew out expectations. While this can definitely be seen as a positive, it likely means the Fed will be more aggressive in raising its rates in September. Overall, the Dow Jones added 76 basis points, the S&P 500 fell by 0.16%, and the NASDAQ dropped lower by 0.50% during the session.

Stay up to speed with hot stocks' news!

The reason for Nio’s decline on Friday? Speaker of the House Nancy Pelosi’s recent visit to Taiwan was against the wishes of the Chinese government. China has now ceased all cooperation with the US when it comes to climate cooperation. Could there be more shoes to fall from this? With rising geopolitical tensions between the two superpowers, investors were betting that this is just the start of the fallout. Most US-domiciled Chinese ADR stocks were on the decline Friday, as concerns about these companies being delisted from US exchanges is once again rearing its ugly head.

NIO stock forecast

At least one major institution is also feeling the heat from the tensions between the US and China. French banking group BNP Paribas disclosed that it had sold off about 90% or nearly 275,000 shares of Nio. Instead, BNP Paribas has added nearly 3.4 million shares of EV startup Polestar (NASDAQ:PSNYW) which is owned by Volvo and Chinese EV company Geely Motors.

Previous updates

Update: NYSE NIO ended Tuesday dip in the red, settling at $19.18 after losing 4.93%. Stock markets struggled to retain the green at the opening but quickly gave up amid lingering US inflation figures and renewed tensions between Europe and Russia. The latter reportedly suspended oil flows via the southern leg of the Druzhba pipeline amid transit payment issues, exacerbating the energy crisis in the Old Continent. Meanwhile, all eyes shift to US data.

The Consumer Price Index is expected to have contracted from a multi-decade high of 9.1% YoY in June to 8.6%. However, the core reading for the same period is foreseen to have advanced to 6.1% from the current 5.9%. Volatility was restricted ahead of the event as market players turned cautious. The Dow Jones Industrial Average shed 0.17%, while the S&P 500 lost 20 points. The worst performer was the Nasdaq Composite, which ended the day down 150 points or 1.19%.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.