- NIO drops as the company suspends production for 5 days.

- NIO shares down 6% early on Friday, at $35.25

- The Chinese car maker had a big 2020 but other meme stocks have taken over.

Update March 26 1400 GMT: NIO shares drop 7% on Friday as the company says it is to suspend production for 5 days due to semiconductor shortages. NIO has been struggling for momentum this week as other meme stocks take centre stage. NIO has also seen huge gains for 2020 so a pull back was probably justified.

Update March 26: NIO closed 2.6% higher on Thursday as tech stocks bounced from early lows. Electric vehicle (EV) stocks caught some momentum as the sector leader, Tesla, rallied to close up 1.6%. NIO had a huge 2020 appreciation, so maybe retail has moved onto other areas, as GME and AMC also posted huge gains on Thursday.

Update March 25: NIO is catching a bounce on Thursday, but the move is not really a convincing one. NIO shares are up 1% at $37.46. The shares are likely catching some effects from a meme rally on Thursday with AMC and Gamestop charging higher. NIO has traditionally been a retail favourite and is up 1% despite the Nasdaq slipping 1% in the opposite direction.

NIO, like most meme retail stocks, is suffering of late as investors become more attuned to the fundamentals of what they are investing in. Now that the momentum trade is fading, just jumping on the trend is not going to work anymore.

NIO was aggressively bid up in 2020 on the back of EV sector hype, hopes for it being another Tesla, and general market frothiness. So is the party over?

Stay up to speed with hot stocks' news!

NIO is a Chinese EV manufacturer that designs, manufactures and sells smart vehicles. It is also involved in the autonomous driving sector.

Is NIO a good stock to buy?

In a word: No. There are too many unknowns, stretched valuations, and general froth in the market.

NIO released Q4 results on Monday, March 8.

EPS was -$0.16 versus an estimate of -$0.07, according to Refinitiv. Revenue came in slightly ahead of expectations at $1.03 billion versus $1.01 billion. This is a rise of 133% from a year earlier.

Overall, NIO had a very good 2020 with revenue more than doubling, and deliveries in Q4 were 17,353 versus 8,224 in Q4 2019. Total 2020 vehicle deliveries were 43,728 as against 20,565 in 2019.

The outlook for deliveries disappointed investors. CEO William Li on the analyst call said, "For the first half of this year, we would like to be more conservative."

He added that in the second half Nio is bullish on demand but does not have full visibility.

NIO is not forecast to turn a net profit until 2023, based on the latest Refinitv data, and even then at the current price that would give a P/E of 257. This is a P/E matched by very few companies except maybe Tesla. Investors will seize on NIO becoming the next Tesla.

But investors are saying that about XPeng, Lucid Motors, LiAuto, etc. It is not going to happen for all, if any, of them. Tesla was the pioneer of the whole EV sector. Now many others are following, including every legacy auto manufacturer on the planet. Volvo says it will be fully electric by 2025. Ford plans to be fully electric in Europe by 2025, similar for Jaguar, Landrover and others.

Most auto manufacturers already have electric cars in the pipeline or have already launched them. Volkswagen made the biggest announcement in the sector last week as it aims to drive battery prices down 50% and make half of all sales in the US electric by 2030. Apple and other cash-rich tech companies such as Amazon are entering the EV sector. So the space is getting more and more crowded.

A high valuation with no profit for two to three years in a crowded space with large, well-resourced competitors is just too much gambling for me. The price has moved too far, and I would prefer shares in the low $20s before even considering an investment.

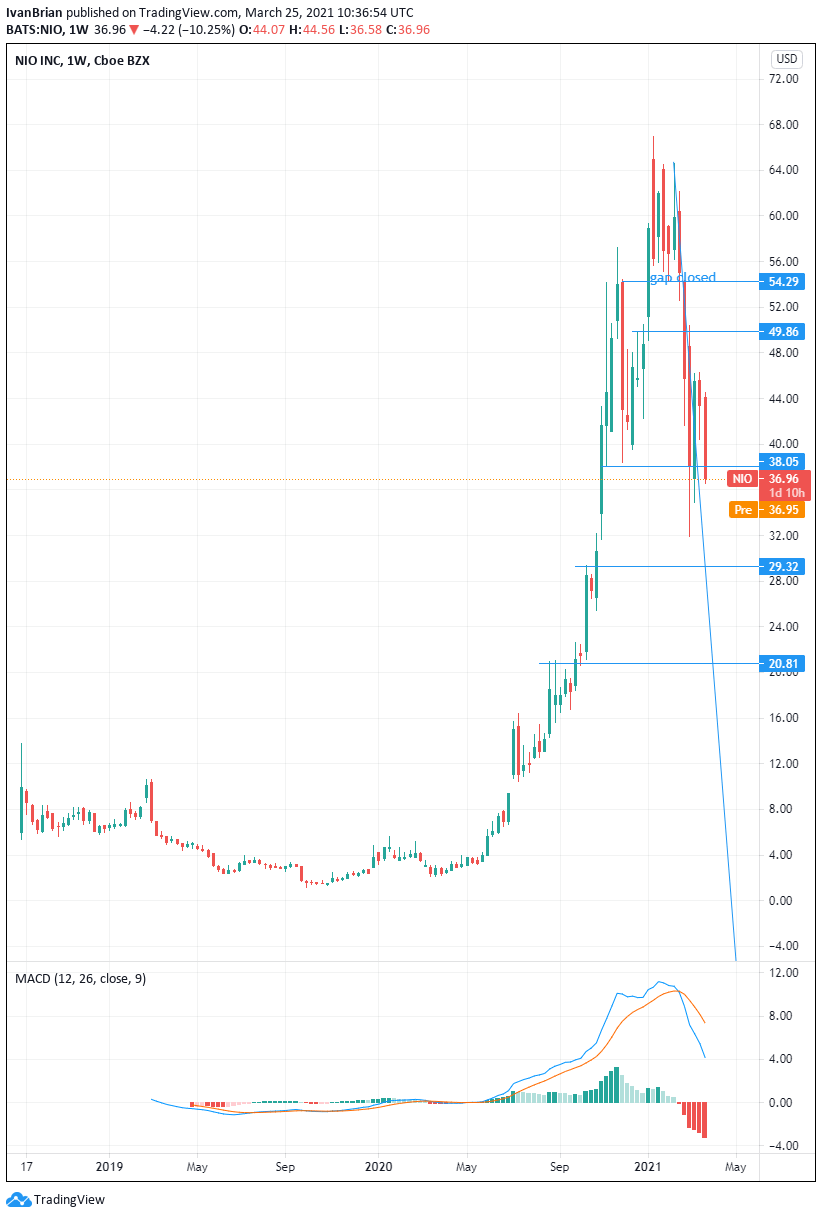

The chart also looks bearish on the longer term view. A bearish head-and-shoulders formation is forming with a downside target of $22.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.