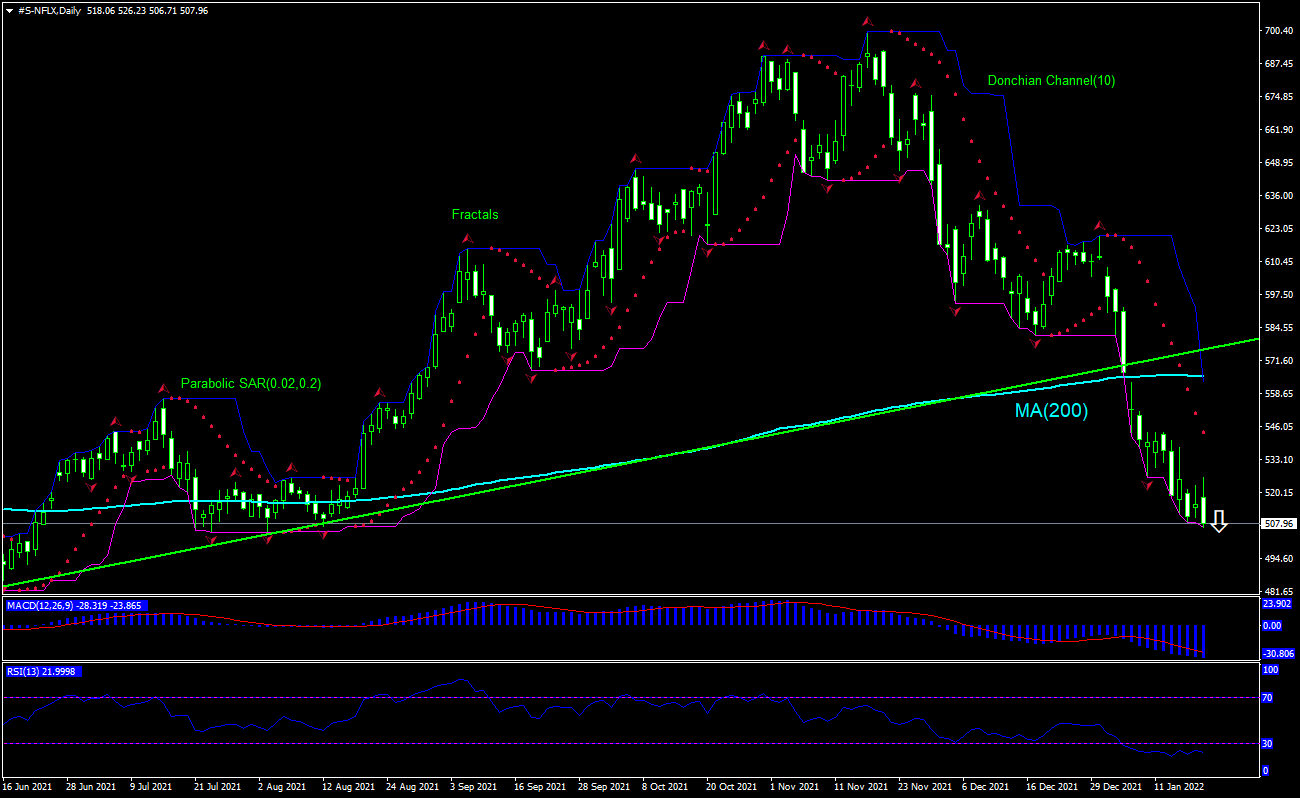

Netflix Inc. Technical Analysis Summary

Sell Stop: Below 506.71

Stop Loss: Above 565.41

| RSI | Buy |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| arabolic SAR | Sell |

Netflix Inc. Chart Analysis

Netflix Inc. Technical Analysis

The technical analysis of the Netflix stock price chart on daily timeframe shows #S-NFLX, Daily has breached below the 200-day moving average MA(200) which has leveled off. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 506.71. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper boundary of Donchian channel at 565.40. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (565.40) without reaching the order (506.71), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Netflix Inc.

Netflix stock edged down after better than expected Q4 results. Will the Netflix stock price rebound?

Netflix is an American subscription streaming service and production company which has approximately 204 million paid members in 190 countries with market capitalization at $270.94 billion. Main Netflix competitor include AT&T -owned WarnerMedia’s HBO Max launched in May 2020, Comcast-owned NBCUniversal which started two months later, Discovery‘s Discovery+ service which debuted in January 2021, ViacomCBS‘s Paramount+ launched in March last year. Other streaming services competitors include Amazon Prime Video, Apple's Apple TV+, Walt Disney's Disney+, Hulu and more. The Netflix stock is trading at P/E ratio (Trailing Twelve Months) of 55.15 currently, the company earned $28.63 billion revenue (ttm) and Return on Equity (ttm) of 39.39%. Netflix and other home entertainment services gained from Covid-19 stay-at-home restrictions. Third-quarter earnings included better-than-expected new subscriber growth—the company added 4.4 million net new subscribers, above its own forecast of 3.5 million. For the December quarter, the company was projecting 8.5 million net new subscriber additions, with revenue increasing 16% to $7.7 billion. And last week Netflix raised subscription prices in the US and Canada: a standard subscription, which includes HD-quality video and the ability to stream on two devices at the same time, is now $15.49 a month in US, up from $13.99. Basic service is now $9.99 a month, up from $8.99. Expectations of rising subscription and higher prices are bullish for Netflix stock price. Yesterday Netflix reported fourth quarter results that beat analysts' forecasts. However company reported 8.28 million net new subscribers, below its forecast of 8.5 million, and forecast new subscriber of 2.5 million for the first quarter of 2022, down from 4.0 million in the year ago quarter. And the chart analysis shows the current setup is bearish.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.