- Nasdaq breaks more records on Thursday as the index outperforms all others.

- Thursday sees the move accelerate with a gain of 1% so far!

- Tesla again the leader with a 4% surge.

Update: The Nasdaq continues to lead equities higher with another powerful surge in early trading on Thursday. Tesla (TSLA) once again leads the way with a 4% gain while other names on the move include Peloton (PTON), AMD and Match (MTCH). 14,250 holds the short term bullish trend in place.

The Nasdaq has taken over a leadership role in the equity indices space as markets overall remain strongly bullish amidst the highly accommodative Fed policy. The buy the dip strategy has proven once again to be the only show in town, and with monetary policy this accommodative, why not?

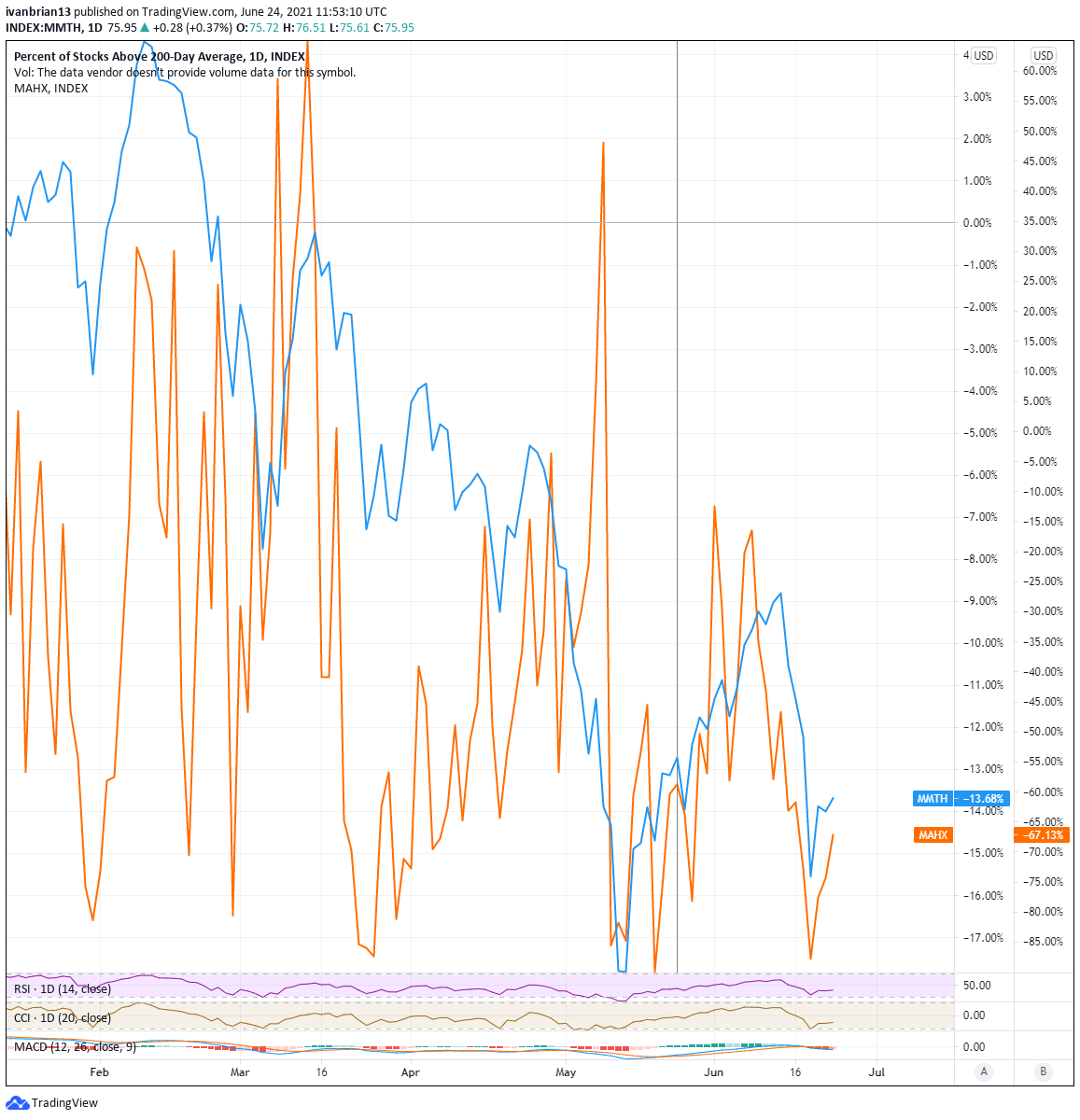

Market breadth remains a cause for concern with the number of stocks above their 200-day moving average well below peak and stocks making new highs also well below peak, though both have bounced this week. What we are seeing, however, is a strong surge led by strong stocks. Big tech and FAANG names continue to lead the way. GOOGL and FB made new record highs this week, and Apple finally showed some strength and broke out of its slumber, see here. Tesla staged a powerful break of the $635 level we identified on Wednesday, see here.

Nasdaq (QQQ NQ) stock forecast

Using the futures contract that mirrors the QQQ ETF shows the continued strong uptrend holding nicely. Friday's dip buying in the Dow and S&P 500 was not exactly a dip here as the Nasdaq has taken over the leadership role. The 9-day moving average (MA) is the perfect foil, guiding the trend higher. As long as it remains above this MA, the risk reward remains skewed to the upside. The Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI) and the Commodity Channel Index (CCI) are all trending higher, thereby confirming the price action. Support remains from the previous record high period in April/May at 14,053, as this corresponds with the lower end of the trend channel. Below that, 13,800-13,700 is a high volume zone, and 13,462 is the last "buy the dip" support zone.

The Relative Strength Index (RSI) does look to be heading for overbought regions, so keep a close eye on this one.

The hourly chart below gives us some more detail and shows that a break of 14,250 sees a bit of a volume gap beneath, so the price could accelerate to 14,130 if this breaks. 120 points is not much, but it is good enough for some intraday scalping if it works out.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.