Emini S&P December futures hit the 8 month trend line at 4090/95, the downward sloping 11 month trend line & upward sloping 2 month trend line at 4105/10.

A high for the day here although not much of a sell off yet despite overbought conditions. It is make or break day for stock markets with the release of the US non farm payroll number.

Nasdaq December consolidates after Wednesday's strong gains but unable to make a break above the November high.

Emini Dow Jones futures turns lower but no important sell signal yet despite severely overbought conditions.

Remember when support is broken it usually acts as resistance & vice-versa.

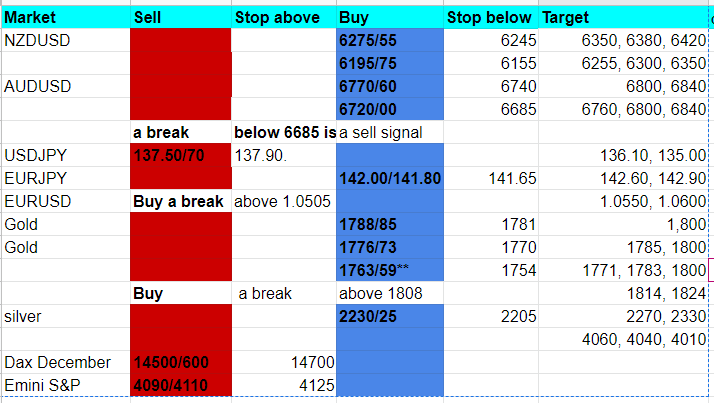

Daily analysis

Emini S&P December has rejected strong resistance at 4090/95 to 4105/10. Only a weekly close above here will convince me to turn bullish. We then target 4170/90.

Shorts at 4090/4110 can target 4060/50, perhaps as far as first support at 4020/10. A break below 4000 can target 3970/50, perhaps as far as strong support at 3930/10.

Nasdaq December bulls really need a clean break above the November high at 12118 for a buy signal targeting 12250 & 12400.

If we turn lower on the US non farm payroll number look for 12000/11900 then 11750/700. Further losses can target 11550/500.

Emini Dow Jones should meet support at 33900/800. A break below 33600 signals further losses towards support at 33300/200.

Above 34700 can target 35000/35100.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.