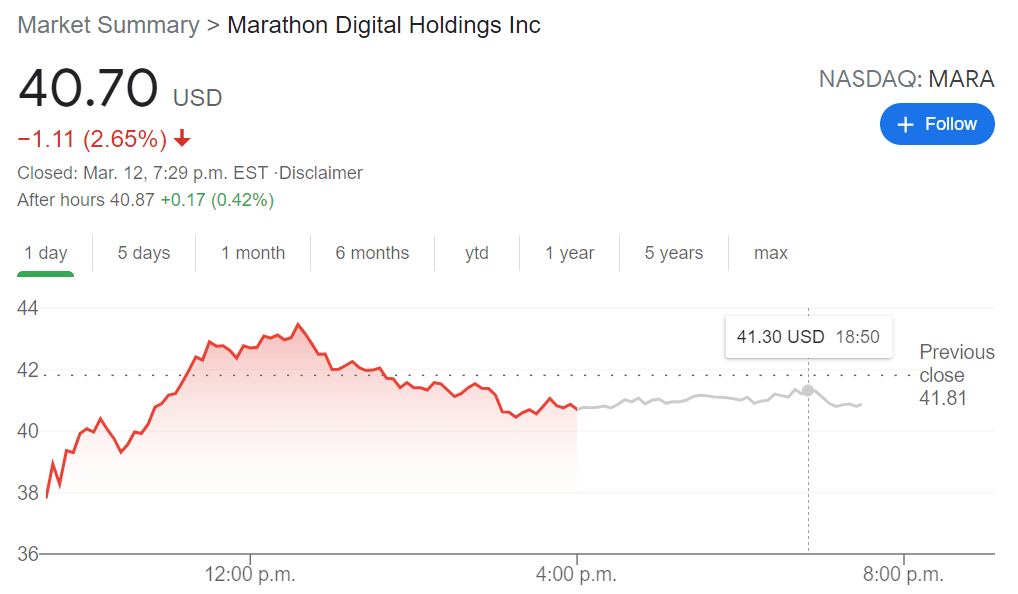

- NASDAQ:MARA fell by 2.65% to close the week on Friday as the broader markets remained flat.

- Marathon announces a major upgrade to its Bitcoin mining capacity.

- Marathon continues to surge, riding the coattails of the rising price of Bitcoin.

NASDAQ:MARA has already been a ten-bagger over the past year, that is, a stock that has multiplied over ten times in value. In fact, Marathon is a ten-bagger since August of 2020, meaning it has grown exponentially over the past eight months. On Friday, Marathon did shed 2.65% to close the week and ended the trading session at $40.70 as the broader markets pulled back after a two-day NASDAQ recovery. Still, the volatility of Bitcoin-based stocks is well represented in Marathon, as shares fell on Friday, but still managed to gain nearly 28% in aggregate throughout the week.

Stay up to speed with hot stocks' news!

Marathon reiterated its dedication to the cryptocurrency industry by investing in 6,300 more Antminer S-19 PRO ASIC miners which will drastically increase the hashrate at which it can mine Bitcoin. This increase in hashrate puts Marathon amongst the top Bitcoin mining companies in the world, and positions them firmly in the conversation of stocks that should continue to rise alongside the price of Bitcoin. Bitcoin mining companies have become a legitimate sector to invest in, although it is becoming increasingly apparent that the price of the stock is more reflective of the price of Bitcoin than the actual financial stability and operations.

MARA Stock news

After a brief correction earlier in February, Bitcoin has reclaimed its upwards trajectory and is threatening to once again overtake it's all-time high price of $58,000. With the impending $1.9 trillion stimulus package in the United States, and the sudden popularity in Blockchain related investments like NFTs or Non Fungible Tokens, Bitcoin should remain in the spotlight for the foreseeable future which can only be good for Marathon shareholders.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.