- NASDAQ: INO extended its gradual rise on Wednesday, has consolidated since.

- President Trump's push for a coronavirus vaccine is boosting the stock.

- Support and resistance lines are far apart, leaving room for volatility.

Winter is coming – and with it rising coronavirus cases all over the world, raising the need for a vaccine, which NASDAQ: INO is developing. That is the obvious reason for the increase in the firm's shares in the past few days, making their gradual way higher.

Can Inovio Pharmaceuticals extend its gains? The company is based in Pennsylvania, a critical battleground state for the presidential elections. President Donald Trump must win there and in other places to clinch re-election, and he is currently trailing in the polls.

Trump suffered his personal episode of COVID-19 and his doctors used Regeneron's experimental drugs to help him battle the virus, sending the stock higher. After returning to the White House, the Commander-In-Chief has been active in pushing forward a vaccine. Will Trump trump INO after doing the same for Regeneron?

Apart from tweeting, Trump can try to influence the Food and Drugs Administration (FDA) for the rapid approval of a vaccine. Moreover, the White House's Operation Warp Speed (OWS) can grant additional funds to firms working on immunization, boosting their shares.

Inovio has several competitors, some of them in advanced stages. Nevertheless, hopes for a greater push for a vaccine will likely raise all boats.

Inovio Pharmaceuticals Stock

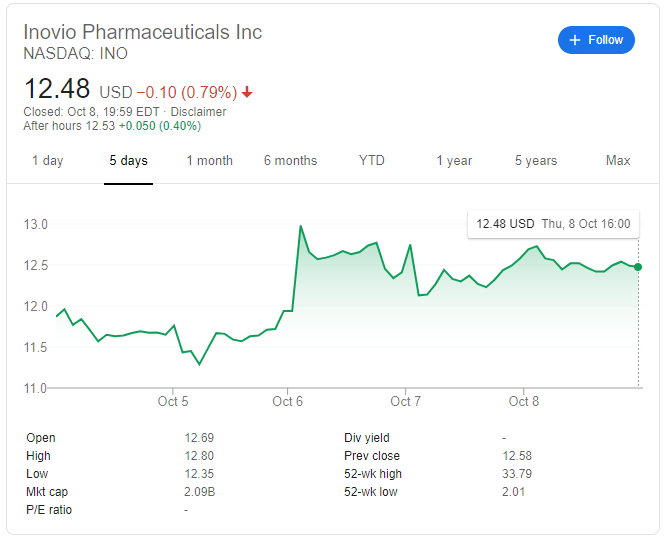

NASDAQ: INO had been on a gradual path of gains, closing at $12.58 on Wednesday, before consolidating on Thursday, losing just 0.79% to close at $12.48.

At the current price, Inovio is still below the middle of its recent trading range. The peak of $18.52 is the upper band and $9.72 has been the bottom closing price in the past month. The middle point is around $14.12, and an upward break above that level would open the door to a bullish rally.

More Who will be the next president? Markets seem to care more about Congress' actions (for now)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.