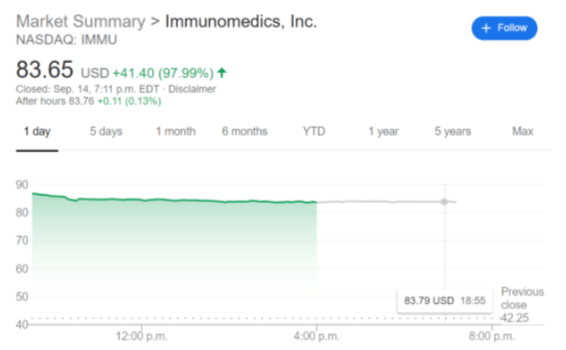

- NASDAQ:IMMU rockets up nearly 100% to rise even higher than Gilead.

- Cancer-treating drug, Trodelvy, was the key to the acquisition.

- Purchase price of Immunomedics is nearly a 110% premium compared to what shares were trading at before the deal.

NASDAQ:IMMU has hit the proverbial jackpot as pharmaceutical titan Gilead Sciences (NASDAQ:GILD) acquired the New Jersey-based biotech company in an all-stock deal worth $21 billion. Shares of Immunomedics jumped from a closing price of $42.25 on Friday and opened at $86.89 on Monday – a rise of nearly 100%. Gilead’s stock on the other hand fell to start the morning as investors and analysts were slightly critical of the price that it paid for Immunomedics, but the shares closed the day up 2.22%.

The catalyst for Gilead’s aggressive pursuit of Immunomedics revolved around the firm’s cancer treatment for triple-negative breast cancer patients called Trodelvy. The drug received accelerated approval from the FDA and Gilead has plans to expand to Europe in the first quarter of 2021. Wall Street analysts did not love the price of the purchase but were mostly in agreement that Gilead needed to pay up for Immunomedics in order to get Trodelvy, a legitimate cancer-treating drug, in its stable of products. One ISI Evercore analyst estimates that peak annual sales of Trodelvy could be worth as much as $4 billion a year for Gilead – which already has its coronavirus treatment Remdesivir coming down the pipeline after receiving emergency authorization from the FDA.

IMMU stock news

The deal for Gilead to acquire Immunomedics is set to close in the fourth quarter of 2020, so where IMMU’s stock goes from here is anybody’s guess. It is an all-stock deal so, presumably, IMMU investors would receive shares of Gilead when the acquisition finalizes. If Redmesivir and Trodelvy can hit the ground running in 2021, hesitant Gilead investors may soon see the merits of the steep price that was paid to acquire Immunomedics.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.