- This week could be the fifth straight week higher in the S&P 500.

- Gold has had its worst week since May 2017 falling 3.23%.

Signals That The Risk Theme Has Changed

This week it seems we have seen some serious safe-haven outflows and stocks seem to have benefit.

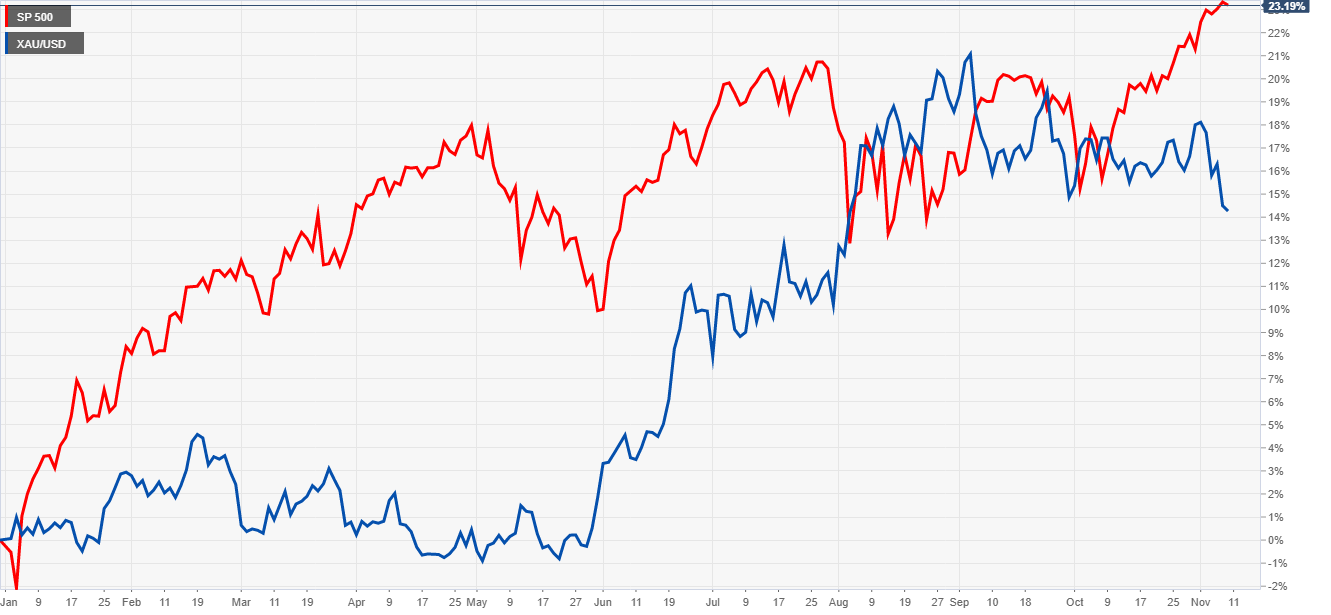

The chart below shows the spread between the S&P 500 (RED) and Gold (BLUE) for this calendar year.

For a long time, gold was pushing higher in relative terms and it even overtook stocks in late August.

Now it seems the divergence between the two has accelerated with stocks pulling away rapidly.

Now as we are FXStreet how does this relate to the FX markets. JPY and CHF are safe-haven currencies and have massively underperformed.

Both are showing signs of breaking out of technical patterns against the USD and if the risk strength persists this theme could last.

Why Has This Happened?

Well there are a few reasons. After the 2008-9 financial crisis, the worlds central banks took to quantitative easing. Not only this they also dropped interest rates. This pushed up asset prices as lending became cheaper. Why pay dividends to shareholders when you can borrow buy your own stock and keep the returns?

Of course, some companies needed the money for legitimate funding reasons. The fact remains that stock buybacks are at record levels.

Now the worlds central banks have started lowering rates and easing again. This supports stock markets.

The ECB are pumping in eur 20 billion per month and their rates are still negative. The Bank of Japan never stopped QE and now they are said to own around 80% of the countries ETF supply. The interesting thing about this is the fact that they will be pushing supply back to the brokers as the supply starts to wear thin.

The other big news is the trade war between China and the US.

Tariffs have been added and many issues remain outstanding but one of the reasons the stock market blipped was the increased tension causing slower growth.

As this seems to be unwinding the market are getting more confident that a resolution will be found.

Every upbeat trade headline that comes out pushes stocks higher. In fact to all-time highs.

So this coupled with the central bank easing story provide the perfect opportunity for a rally.

S&P 500 vs Gold

All information and content on this website, from this website or from FX daily ltd. should be viewed as educational only. Although the author, FX daily ltd. and its contributors believe the information and contents to be accurate, we neither guarantee their accuracy nor assume any liability for errors. The concepts and methods introduced should be used to stimulate intelligent trading decisions. Any mention of profits should be considered hypothetical and may not reflect slippage, liquidity and fees in live trading. Unless otherwise stated, all illustrations are made with the benefit of hindsight. There is risk of loss as well as profit in trading. It should not be presumed that the methods presented on this website or from material obtained from this website in any manner will be profitable or that they will not result in losses. Past performance is not a guarantee of future results. It is the responsibility of each trader to determine their own financial suitability. FX daily ltd. cannot be held responsible for any direct or indirect loss incurred by applying any of the information obtained here. Futures, forex, equities and options trading contains substantial risk, is not for every trader, and only risk capital should be used. Any form of trading, including forex, options, hedging and spreads, contains risk. Past performance is not indicative of future FX daily ltd. are not Registered Financial Investment Advisors, securities brokers-dealers or brokers of the U.S. Securities and Exchange Commission or with any state securities regulatory authority OR UK FCA. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest, with or without seeking advice, then any consequences resulting from your investments are your sole responsibility FX daily ltd. does not assume responsibility for any profits or losses in any stocks, options, futures or trading strategy mentioned on the website, newsletter, online trading room or trading classes. All information should be taken as educational purposes only.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.