Gold analysis: Remains above 1,700.00

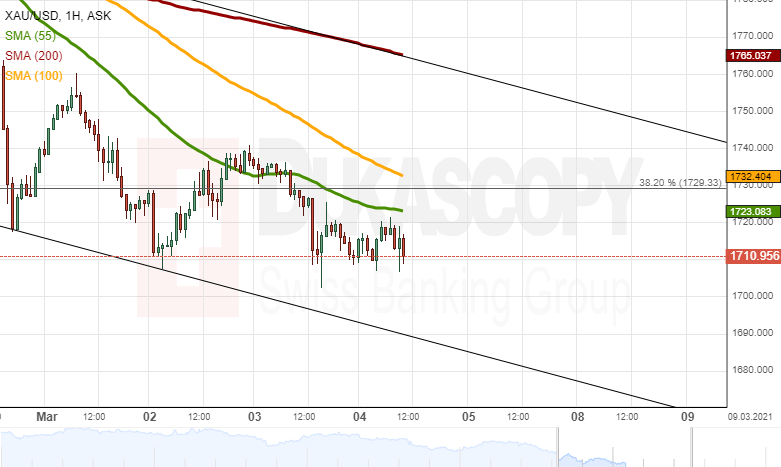

Instead of testing the support of the 1,700.00 level the price for gold began to trade sideways even before it was reached. Since the middle of Wednesday's GMT trading hours, the price has been fluctuating between 1,710.00 and 1,720.00. On Thursday, the bullion was being approached by the 55 and 100-hour simple moving average.

In the near term future, the price could be pushed down by the 55-hour simple moving average. In this case scenario the price would eventually test the support of the 1,700.00 level. Read more...

Gold Price Forecast: XAU/USD’s fate hinges on Treasury yields, Powell’s speech

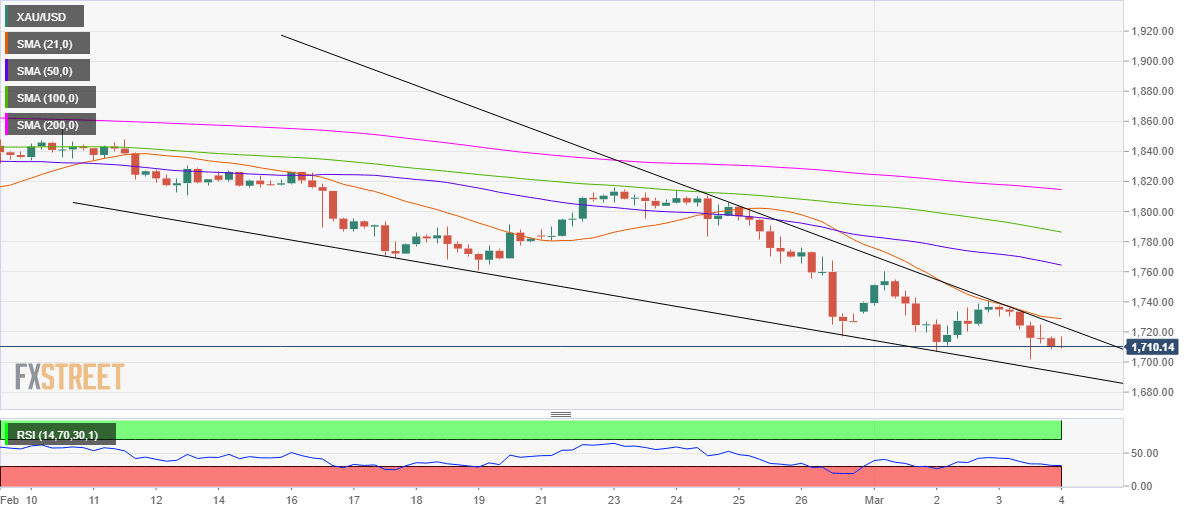

Gold (XAU/USD) reached fresh nine-month lows at $1702 amid a renewed uptick in the US Treasury yields, as the bond market turmoil resumed on Wednesday. Gold managed to recover some ground and finished the day at $1714, still losing significantly on a daily basis. The latest remarks from Chicago Fed President Charles Evans, citing that the recent rise in yields signaled optimism on the economic outlook, powered the latest leg up in the yields. Meanwhile, upbeat US ISM Services PMI outweighed the sluggish ADP jobs report, boosting the Treasury yields along with the greenback.

As risk-aversion continues to remain the main theme so far this Thursday, gold bulls are licking their bulls while attempting a tepid recovery. The surge in Treasury yields led to a sharp sell-off in the global stocks, as investors remain worried about a potential overheating of the economy. Read more...

Gold Price Analysis: XAU/USD bears turn cautious near descending channel support

Gold struggled to capitalize its modest intraday recovery gains, instead met with some fresh supply near the $1721 region. The commodity refreshed daily lows, around $1707-06 region in the last hour and remained well within the striking distance of nine-month lows touched on Wednesday.

The US dollar buying picked up pace since the early European session, which, in turn, was seen as a key factor exerting downward pressure on the dollar-denominated commodity. A softer risk tone around the equity markets and the US bond yields might help limit losses for the XAU/USD. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.