How is gold faring in the middle of risk-on season?

The elephant in the room needs to be addressed, which is the movement in the price of Gold over the past couple of months. It all started back in August where the Yellow Metal recorded an all time high of $2,075 before beginning a steady decline. Several reasons can be attributed to this decline, the first and foremost is the overbought conditions that Gold has been experiencing due to the Coronavirus pandemic and everyone’s flight to safety.

The other and more important reason is that vaccines are finally being made and that means we are one step closer to beating this virus once and for all. This has issued wide spread euphoria in the market as we saw all matter of risky instruments increase in value meaning that Gold is losing in value. Read more...

The buyers and sellers case for gold

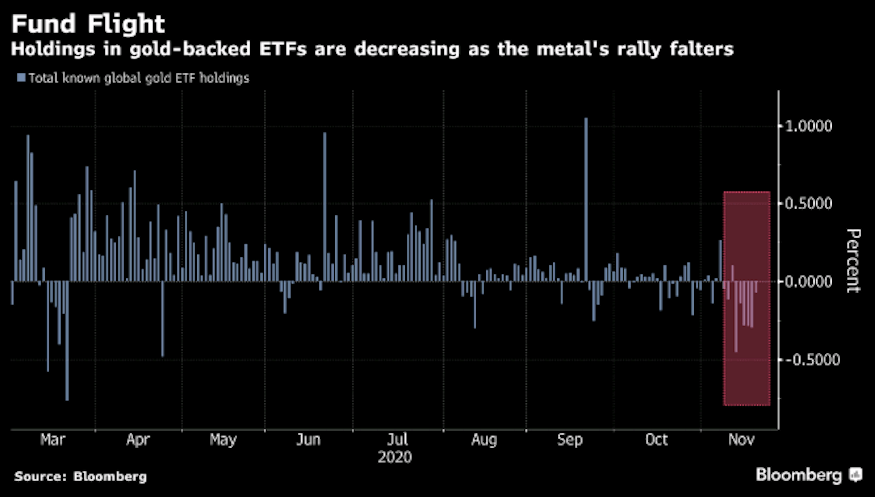

Gold investors will be looking at the FOMC minutes very carefully on Wednesday. Gold traders will want to get a clue on gold’s near term direction. Gold has been sold recently on a firmer dollar and hope of a coronavirus vaccine. The optimism surrounding the Pfizer and BioNTech vaccine resulted in US10 year yields moving higher towards 1.00% around Nov 09. The news also prompted the biggest daily loss in gold futures in around 7 years. Since then there there has been strong outflows in ETF holdings.

A vaccine is on the way. This will precede a return to normality and a return to rising rates. In this view gold can be sold now as the crisis and gold’s long term appeal is over. Or if not over, certainly less appealing right now in the immediacy. Read more...

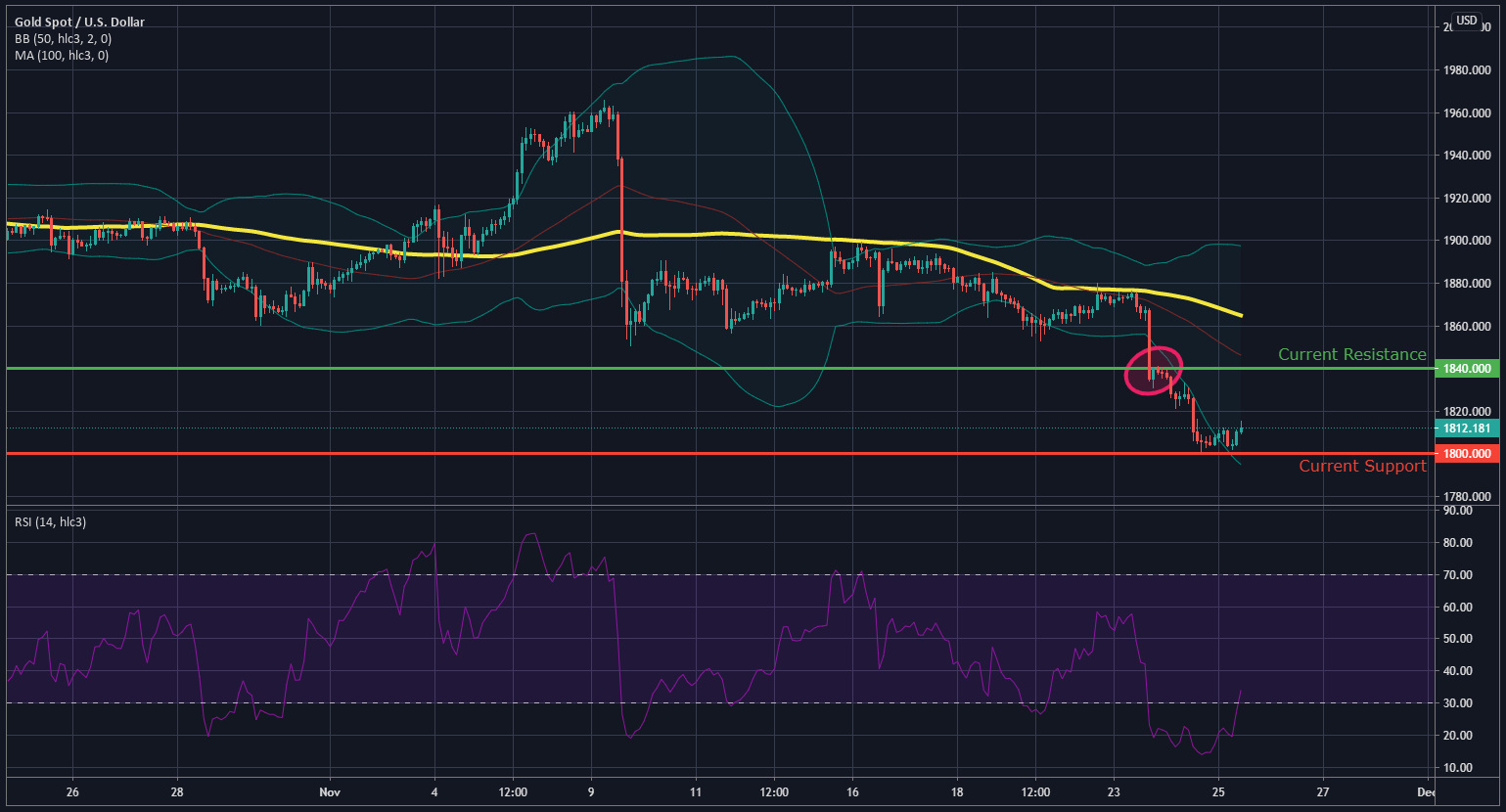

Gold Price Analysis: XAU/USD stages a modest recovery from multi-month lows

Gold edged higher during the early European session and was last seen trading near the top end of its daily range, just below the $1815 level.

The precious metal managed to find decent support near the $1800 mark, just ahead of a technically significant 200-day SMA and for now, seems to have stalled its recent downward trajectory. Sustained US dollar selling bias extended some support to the dollar-denominated commodity and prompted some short-covering amid near-term oversold conditions. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.