Gold Futures: Extra losses in the pipeline

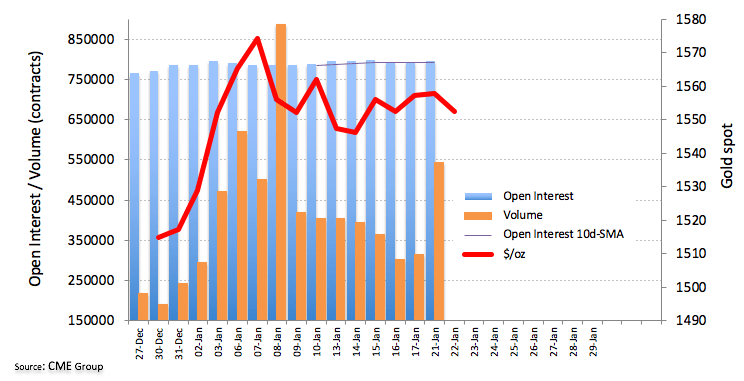

According to flash data from CME Group for Gold futures markets, traders added 886 contracts to their open interest positions on Tuesday, recording the second – albeit small – build in a row. Volume, too, rose for another session, this time by around 229.5K contracts.

The ounce troy of Gold keeps correcting lower on Wednesday following Tuesday’s pullback against the backdrop of increasing open interest and volume. With this in mind, the $1,536/32 band could be revisited in the near-term horizon, where coincide last week’s low and a Fibo retracement of the December rally. Read more...

Gold: the bulls may be starting to grow concerned

Following yesterday’s failed upside break, the bulls may be starting to grow concerned. This failed breakout has also now turned lower this morning, and the support of what has been a five week uptrend is being tested (supports at $1548 today). For now, this is all part of a consolidation of the past two weeks, and uptrends can often be broken by consolidation without any bearish connotations. So the 38.2% Fibonacci retracement again becomes a key gauge (at $1548), especially on a closing basis. However, the momentum indicators are flashing at least an amber warning light. They are all dipping back again, and if the RSI moves decisively below 60, whilst Stochastics fall away and MACD lines pick up negative pace, this would be a bigger concern. Read more...

Gold reverses an early dip to $1550 area, turns flat for the day

Gold reversed an early dip to the $1550 region and is currently placed near the top end of its daily trading range, albeit remained well below two-week highs set in the previous session.

Following an early uptick on Tuesday, the precious metal witnessed an intraday turnaround and dropped to near one-week lows. A late pick up in the US dollar demand was seen as one of the key factors that prompted some selling around the dollar-denominated commodity. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.