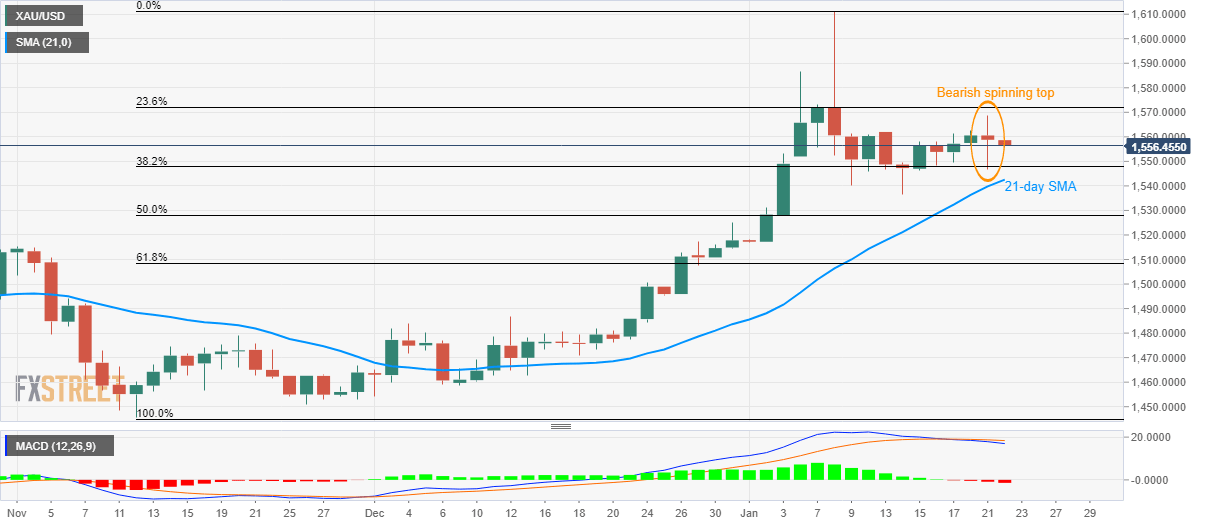

Gold Price Analysis: Stays below $1,560 following Tuesday’s bearish spinning top

Gold remains on the back foot while trading around $1,556.90 during the Asian session on Wednesday. The yellow metal portrayed a bearish candlestick formation, backed by bearish MACD, during the previous day.

As a result, the bullion’s prices are likely to decline further towards 38.2% Fibonacci retracement of its November-January rise, at $1,547, ahead of testing 21-day SMA level of 1,542.55. During the precious metal’s downside past-21-day SMA, 50% of Fibonacci retracement and November month high could please sellers around $1,528 and $1,515.

Gold remains under pressure around $1,551 as US dollar keeps the gains

Gold bounces off the intra-day low of $1,550.40, flashed a few minutes back, to $1,551.30 by the press time of the pre-European session on Wednesday. In doing so, the safe-haven ignores the geopolitical risks emanating from China and the uncertainty surrounding the US-China trade relations. The reason could be found in the US dollar strength that has a negative correlation with the yellow metal.

China’s outbreak of coronavirus took nine lives by the end of Tuesday, as confirmed by the China National Health Commission (NHC). The same renews fears of the return of the Severe Acute Respiratory Syndrome (SARS) virus that resulted in 774 deaths in 2002/03. The NHC said it will take strict monitoring measures over the Wuhan city that is known to be the epicenter of the virus.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.