Gold Price Analysis: XAU/USD retreats further from weekly highs to the $1,950 area

Gold prices peaked before the American session at $1,972, the highest level since September 2 and then pulled back more than $20. It failed to hold onto gains and printed a fresh daily low at $1,948. It quickly bounced back above $1,950 and as of writing it trades at $1,954 modestly lower for the day.

The yellow metal retreated amid a recovery of the US dollar across the board. The US dollar Index climbed from 92.78 the lowest in almost a week to 93.15, erasing all losses. At the same time equity prices in Wall Street moved off highs and US yield remained in positive ground near daily highs.

Will Lagarde and Mnuchin push gold higher?

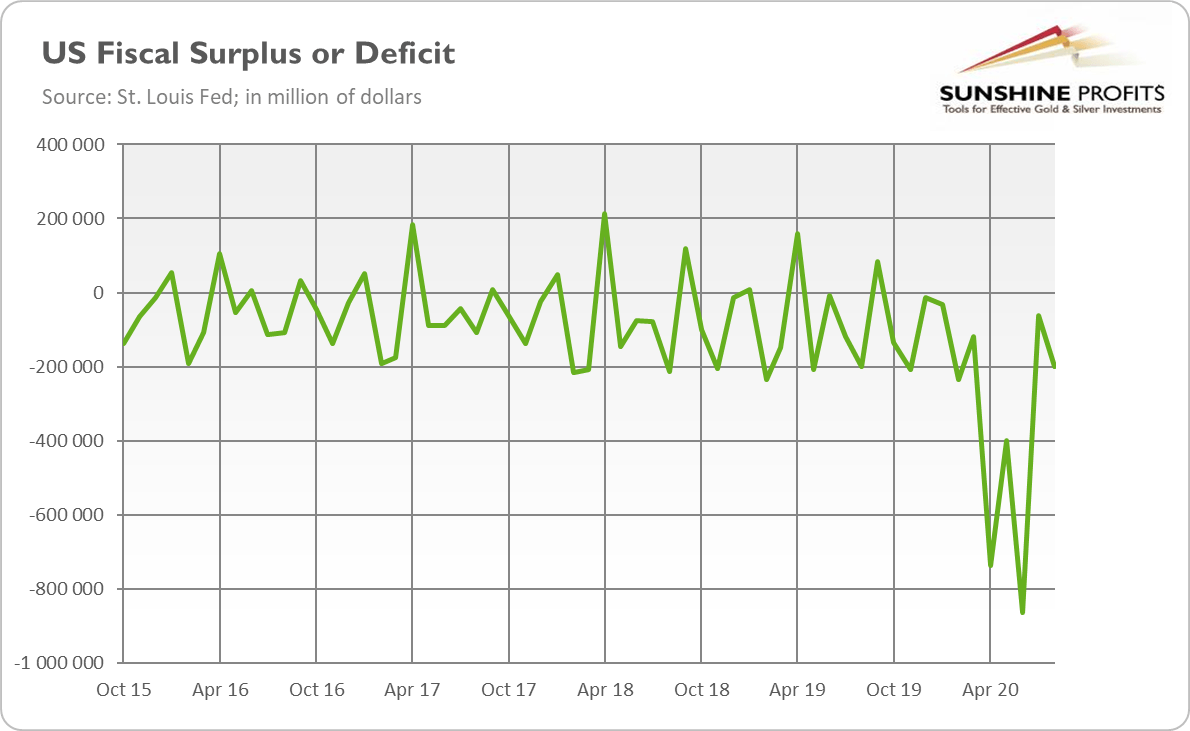

The ECB held its monetary policy stance steady. Meanwhile, the U.S. fiscal deficit reached its all-time high. What does it all mean for the gold prices?

On Thursday, the members of the Governing Council of the ECB met together to undertake monetary policy decisions. They decided to leave the interest rates and the conditions of the quantitative easing unchanged. This lack of action was widely expected, so attention shifted to the fresh economic projections and the Lagarde's press conference. Importantly, the ECB lifted its growth forecast for 2020 from -8.7 to ‘just' -8.0 percent. With inflation projections almost unchanged, the recent monetary policy statement sounded a little bit more hawkish than the previous one.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold dips on falling US yields as traders shrug off hawkish Fed remarks

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.