Gold: Bulls beginning to take control once more [Video]

The bulls are just beginning to take control once more on gold. There have now been four positive closes in the past five sessions, and the market is again edging higher this morning. This has stabilised the supports within the $1902/$2015 five week range and the bulls are looking higher once more. Daily momentum is gradually ticking higher again, with RSI at a four week high today, and MACD lines threatening to cross back higher. These moves are still though relatively small, given the Average True Range continues to fall (today down at $31). Despite this, the hourly chart shows a move back above the old pivot line of $1955 (which has since become initially supportive) and the initial resistance at $1976 is being eyed. A move to test $1991 would then be next. Read More...

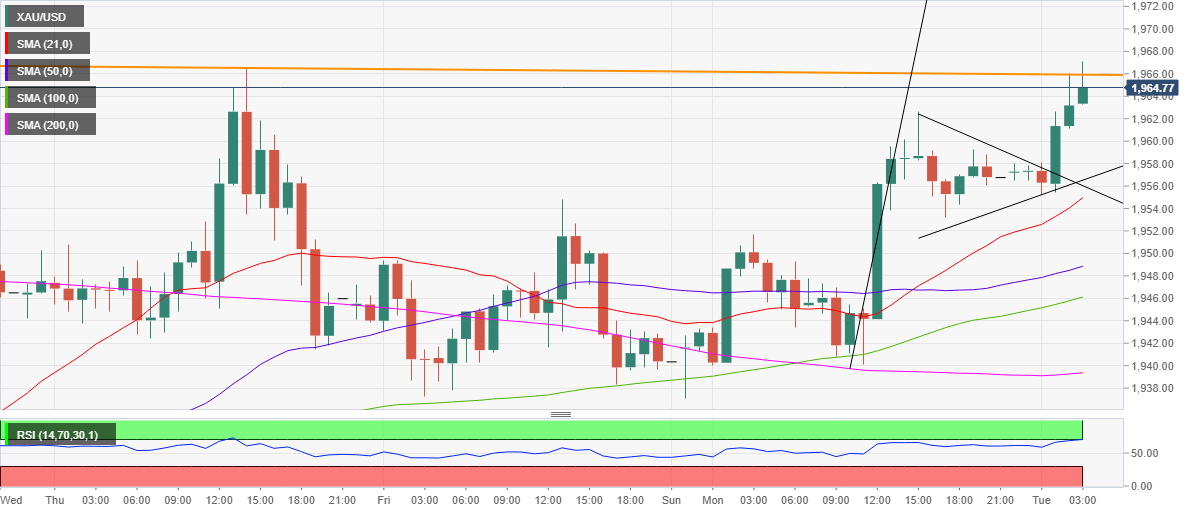

Gold Price Forecast: XAU/USD eyes $1980 amid weaker dollar, focus shifts to Wednesday’s FOMC

Gold (XAU/USD) built on Monday’s 1% rally after a steady start on Tuesday, reaching fresh nine-day highs at $1967. The US dollar was dumped across the board amid an improvement in the risk-sentiment, courtesy of the vaccine hopes, upbeat Chinese data and renewed US-Sino trade optimism. The Chinese activity numbers came in stronger than the estimates, suggesting the economic recovery is gathering steam. Also, news that China extended tariffs exemptions on some of the US good imports further fuelled the market optimism.

Traders now look forward to the US Industrial Production data and the sentiment on Wall Street for fresh trading impetus. Dovish Federal Reserve (Fed) expectations ahead of Wednesday’s monetary policy decision could also bode well for the XAU bulls. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.