Gold: The lack of conviction suggests caution is required [Video]

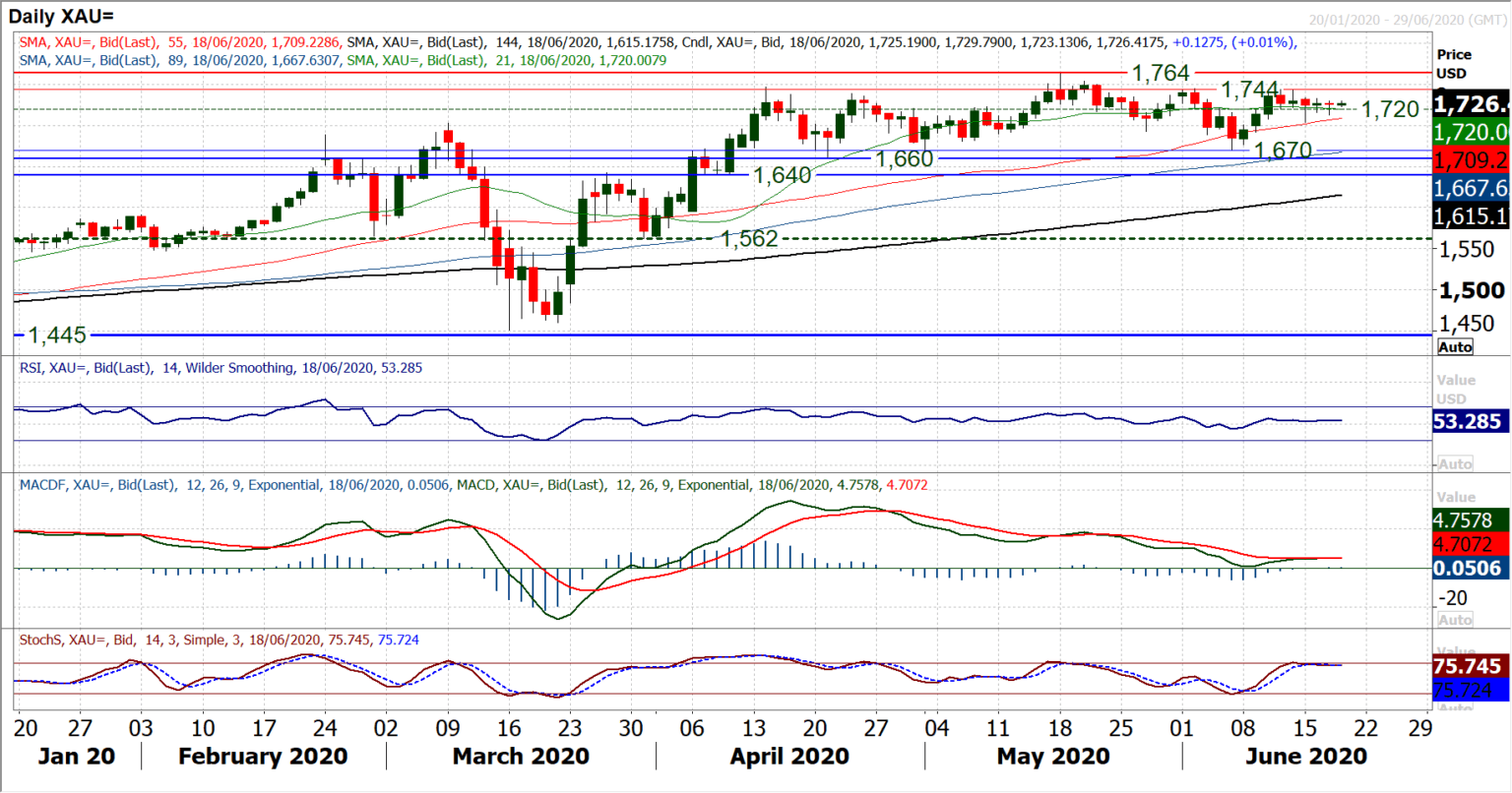

Several of the major (forex) markets we cover consistently have been lacking conviction recently, and gold goes into that category too. The past week has been one of false signals and sessions lacking conviction. A run of small candlestick bodies reflect this, where the last five closing levels have all been within $6. This has flattened out momentum indicators amidst this consolidation. The argument would be that there is still a mild positive bias within the medium term range between $1660/$1764 and moves into $1700/$1720 seems to be still supported. However, the lack of conviction suggests caution is required. Will near term support continue to be found in the band $1700/$1720? The hourly chart shows the outlook is all but flat, with consistent resistance between $1730/$1733. Hourly RSI struggling under 60 for the past week and MACD lines struggling around neutral are the momentum reflection of this. Read More...

Gold consolidates as coronavirus fears endure

Gold prices inched higher in early trading on Thursday, as an increase in coronavirus cases threatened to derail economic recovery from the pandemic. A more dovish than expected June FOMC meeting also buoyed the yellow metal.

In Beijing, a surge in virus cases has taken place, with 31 new cases reported on Wednesday, bringing the total to 137 over the past week. Flights have been canceled, schools closed and 29 neighborhoods locked down. Data from Johns Hopkins University indicates that coronavirus COVID-19 global cases have risen to 8,359,869 with 449,229 fatalities. Read More...

Gold fades a bullish spike to fresh weekly tops, slides below $1725 level

Gold struggled to capitalize on its intraday uptick to weekly tops and dropped to fresh session lows, below the $1725 level in the last hour.

A combination of supporting factors assisted the commodity to break through its daily consolidative trading range and build on the previous day's rebound from the $1712-13 region. Concerns about a surge in new coronavirus cases, coupled with geopolitical tensions in Asia continued weighing on investors' sentiment. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.