Gold Futures: Further gains look likely

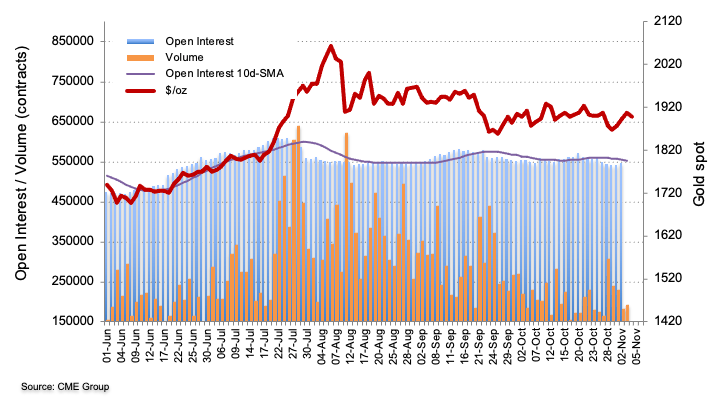

CME Group’s flash readings for Gold futures markets noted traders increased their open interest positions by nearly 5K contracts on Tuesday, reversing at the same time four consecutive daily pullbacks. In the same direction, volume went up by around 10.8K contracts after three drops in a row.

Gold met resistance at the 55-day SMA.

Tuesday’s positive price action in Gold prices was on the back of rising open interest and volume, leaving the prospects of extra gains well on the table with the next hurdle of not at the October peaks in the $1,930 mark per ounce. Read more...

Gold spot intraday: Key resistance at 1906.00

Pivot (invalidation): 1906.00

Our preference

Short positions below 1906.00 with targets at 1881.00 & 1872.00 in extension.

Alternative scenario

Above 1906.00 look for further upside with 1916.00 & 1925.00 as targets.

Comment

As Long as 1906.00 is resistance, look for choppy price action with a bearish bias. Read more...

Gold Price Analysis: XAU/USD remains vulnerable near $1890 amid resurgent USD demand

Gold witnessed some fresh selling during the early European session and might now be headed back towards the lower end of its daily trading range.

Currently hovering around the $1890 region, a strong bid tone surrounding the US dollar was seen as one of the key factors exerting some pressure on the dollar-denominated commodity. Early results of the US election indicated that the race for the White House has turned out to be far tighter than expected. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.