- Gold price targets levels sub-$1800 as USD remains in a win-win situation.

- US Senate vote on infrastructure bill eyed amid lack of relevant economic news.

- Gold Weekly Forecast: Possible correction to $1,800 as key resistance holds.

Update: Gold extended the previous day's rejection slide from the very important 200-day SMA and witnessed some follow-through selling on Wednesday. The downward trajectory dragged the commodity to over one-week lows, around the $1,795 region in the last hour and was sponsored by a combination of factors. As investors assess the economic impact of the fast-spreading Delta variant of the coronavirus, a positive tone around the equity markets acted as a headwind for the safe-haven XAU/USD.

The risk-on flow was reinforced by a strong follow-through uptick in the US Treasury bond yields, which further contributed to driving flows away from the non-yielding gold. In fact, the yield on the benchmark 10-year US government bond shot to fresh weekly tops and underpinned the US dollar. This, in turn, was seen as another factor exerting some downward pressure on dollar-denominated commodities, including gold.

In the absence of any major market-moving economic releases from the US, the broader market risk sentiment will play a key role in influencing the commodity. Traders might further take cues from the US bond yields and the USD price dynamics to grab some short-term opportunities around gold.

Previous update: Gold price is extending previous losses following the rejection at the critical SMA200 one-day resistance at $1825. The rebound in the US Treasury yields is weighing on the yieldless gold amid risk-on sentiment, as the European market rises on strong earnings and positive close on Wall Street overnight. Meanwhile, broad-based US dollar strength also keeps gold price undermined, with the Delta covid variant concerns boosting the dollar’s safe-haven appeal. The greenback also draws support from the uptick in the yields, as the focus now shifts towards the US Senate’s early test vote on President Joe Biden’s infrastructure bill.

Gold’s fate hinges on the outcome of the key vote due later in the day and the dynamics in the yield and the dollar amid incoming virus updates and earrings reports. For now, the King dollar remains in a win-win situation, as a drive for safety remains in the backdrop.

Read: Gold Price Forecast: XAU/USD eyes a sustained move below $1800 amid bearish technicals

Gold Price: Key levels to watch

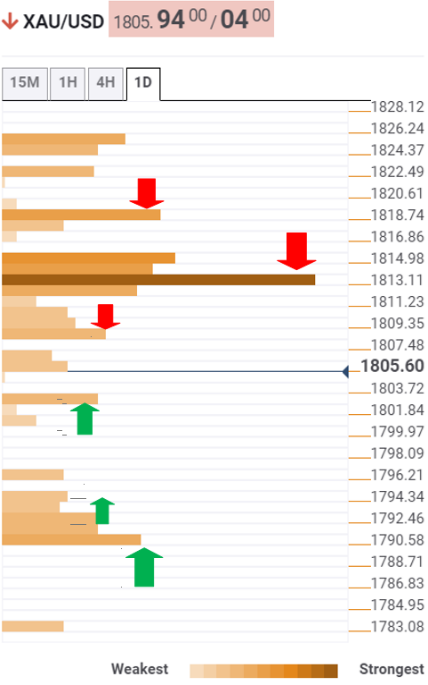

The Technical Confluences Detector shows that gold price is heading towards minor support around $1802, which is the convergence of the pivot point one-day S1, Bollinger Band four-hour Lower.

A sharp drop towards Bollinger Band one-day Middle at $1796 cannot be ruled on a breach of the latter.

The sellers will then need to clear a dense cluster of support levels around $1793, where the SMA100 one-day, pivot point one-day S2 and the previous week’s low meet.

The intersection of the Fibonacci 23.6% one-month and pivot point one-week S1 at $1790 will test the bearish commitments.

Alternatively, recapturing $1809 barrier (Fibonacci 61.8% one-week) is critical to initiate any meaningful recovery towards powerful resistance at $1814, SMA200 four-hour and Fibonacci 38.2% one-month coincide.

Acceptance above the latter will call for a test of the $1819 level, the confluence of the SMA5 one-day and Fibonacci 38.2% one-week.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.