- Gold remains in bearish territory but is attempting to recover from fresh cycle lows.

- The price has already corrected to a 38.2% Fibo so there are prospects for a move lower from here.

The price of gold is consolidating the overnight drop from a high of $1,858.87 to a fresh cycle low of $1,810.67. The US dollar has been strong into the end of the week and hit fresh two-decade highs on Thursday as investors move in droves into the safe-haven currency in the face of surging inflation and heightened risks surrounding the Russian invasion of Ukraine.

Finland said it would apply to join NATO "without delay." Sweden is expected to follow. Russia has said it will be forced to take "retaliatory steps" which has weighed on the euro, putting a bid in the US dollar and consequently weighing on the price of gold.

The dollar index (DXY), which measures the greenback's strength against a basket of six currencies, rose 0.4% to 104.92 and is holding in positive territory in Tokyo on Friday, near to the highs.

"Dollar is rallying as things potentially look negative in the US, which is hurting gold. Also, the market is realising the likelihood of seeing pretty aggressive interest rate increases," analysts at TD Securities argued.

''A liquidity vacuum is dragging all assets lower, leaving gold to circle the drain in defiance of its safe-haven status, despite the fierce rally in Treasuries,'' analysts at TD Securities said.

A drop in the benchmark 10-year Treasury yields hit the lowest level in two weeks. The ten-years were down over 3% overnight while the more Fed tentative 2-years were losing 3.7%, weighed by Producer Prices that fell short of expectations.

The US Producer Price Index increased by 0.5% in April compared with a 1.6% jump in March. Excluding food and energy, the core PPI climbed by 0.4%, lagging the 0.7% gain expected. Core PPI grew by 1.2% in March. On a year-over-year basis, producer price inflation surged 11% in April, and core PPI jumped 8.8%, the Bureau of Labor Statistics said Thursday.

''With CTA trend followers joining into the liquidation party, substantial selling flow continues to weigh on the yellow metal at a time when liquidity is scarce,'' the analysts at TD Securities said.

''Prices are now struggling to hold onto the bull-market-era defining uptrend in the yellow metal under the pressure of this selling flow. For the time being, the trendline has held despite the strong CPI report, as the turbulence in risk assets sparked a bid in Treasuries, but we continue to see a significant amount of complacent length in gold which could weigh on prices, while the breadth of traders short has just started to rise from near-record lows.''

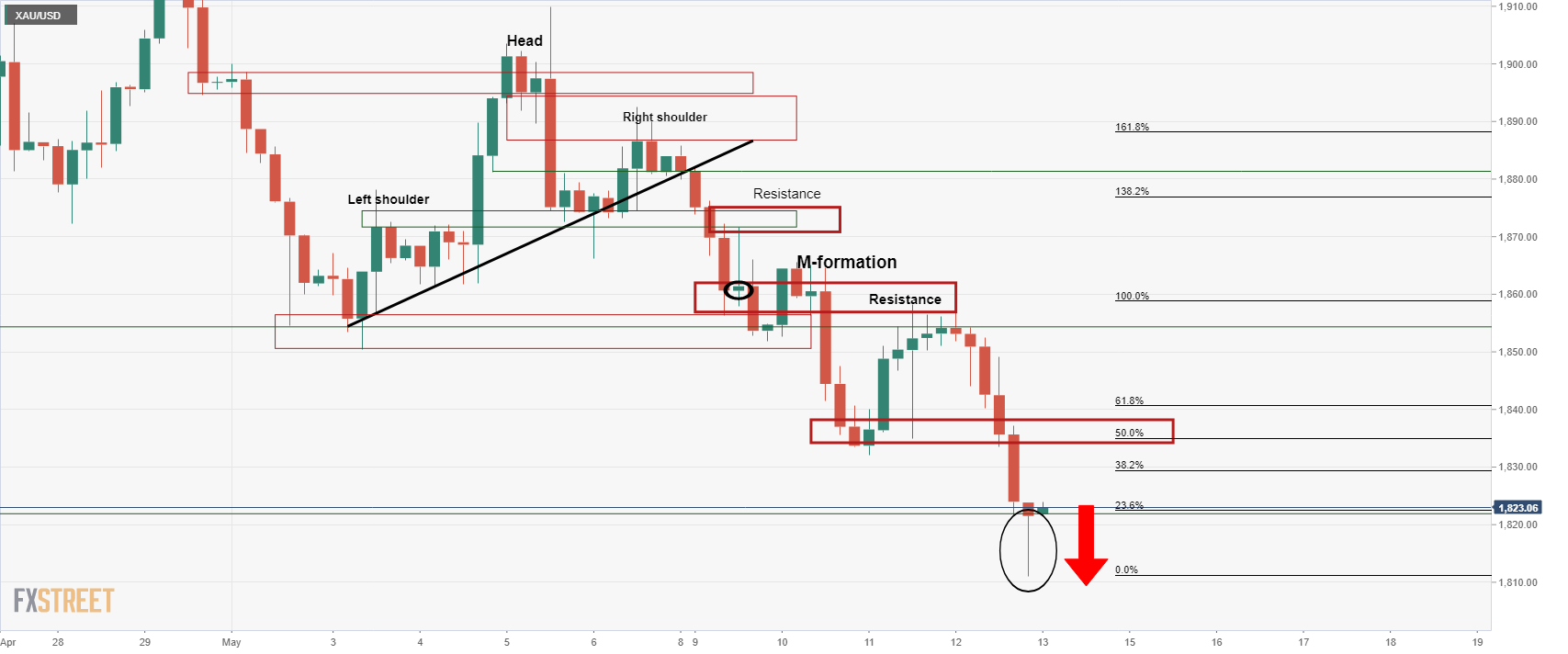

Gold H4 chart

The price has been rejected but nevertheless, the 4-hour candle closed bearishly so there is every chance that the bears will step in again at a discount on the lower time frames as follows:

Gold H1 chart

The price has already corrected to a 38.2% Fibo so there are prospects for a move lower from here as the correction decelerates. However, the price action is less than convincing. Some further mitigation of the price imbalance until the 61.8% Fibo towards the $1,830s.

On the way lower again, bears will be heading into new territories and a test below the psychological $1,800 round figure will be on the cards:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.