- The price of gold is trying to correct from daily support.

- Bullish correction eyed towards M-formation neckline but bears lurk at a daily 38.2% Fibo.

- US CPI was regarded as a meanwhile relief for financial markets.

At the time of writing, the gold price is some 0.8% higher and correcting from daily support located in the lows of the day at $1,832.07. At $1,853.40, gold is close to the day's highs of $1,858.30. The markets have been centred around US inflation on Wednesday when the Consumer Price Index was released earlier in the North America session.

While the US inflation data reinforces a hawkish sentiment from the Federal Reserve and justifies front loading called for by the Fed's chairman, Jerome Powell, markets were relieved that the data showed a decline in CPI on an annual basis.

CPI climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. Also, the index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005.

The dollar index, DXY, moved sharply off its lows on the knee jerk as the data came in higher than expected, so it was unlikely to cause the Federal Reserve to adjust its aggressive path of monetary policy. DXY, which hit a four-session low of 103.37 ahead of the report, immediately strengthened to a session high of 104.13 in the wake of the data.

However, the rally came in short of the 20-year high of 104.19 reached on Monday and traders were quick to move in again and sell the US dollar to a fresh season-low of 103.372 before making its way back towards the session highs in a firm but slow bullish drift.

US stocks back under pressure

Markets have digested the data that shows that inflation has slowed, and underlying price pressures remain elevated which is weighing on investor sentiment and US stocks.

''The fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued. ''This likely means gold traders will expect the Fed to step up their hawkish signals.''

The Dow Jones Industrial Average fell 0.8% giving up earlier gains. The S&P 500 slid 1.3% after increasing 0.5% earlier in the session. The Nasdaq Composite dropped 2.5% and is currently extending intraday declines while the 2-year yield increased to 2.857% and is aligned closely with Federal Reserve's interest rate policy.

''The positive surprise in core prices will not be favourable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now,'' analysts at TD Securities said.

The bearish outlook for gold

''Given that positioning is still tilted to the long end of exposure, continued higher-than-expected price prints could easily send gold below $1,830/oz in the not too distant future. Higher nominal and real rates along with less liquidity due to QT are the likely financial market catalysts driving gold,'' the analysts at TD Securities explained.

''If prices dip below the $1,830s support levels, technicians could pull the yellow metal down toward the $1790s fairly quickly.''

Gold technical analysis

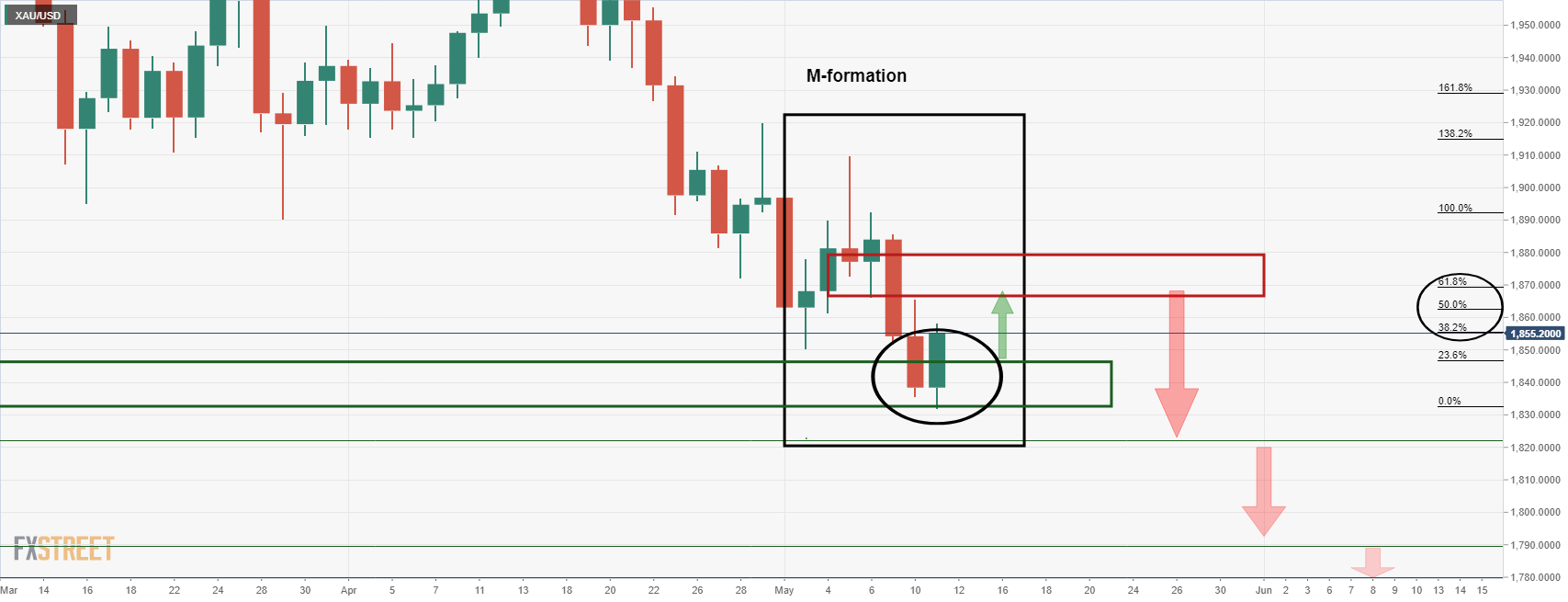

Gold prices had perked up on the news and were moving in on a the M-formation's neckline as follows:

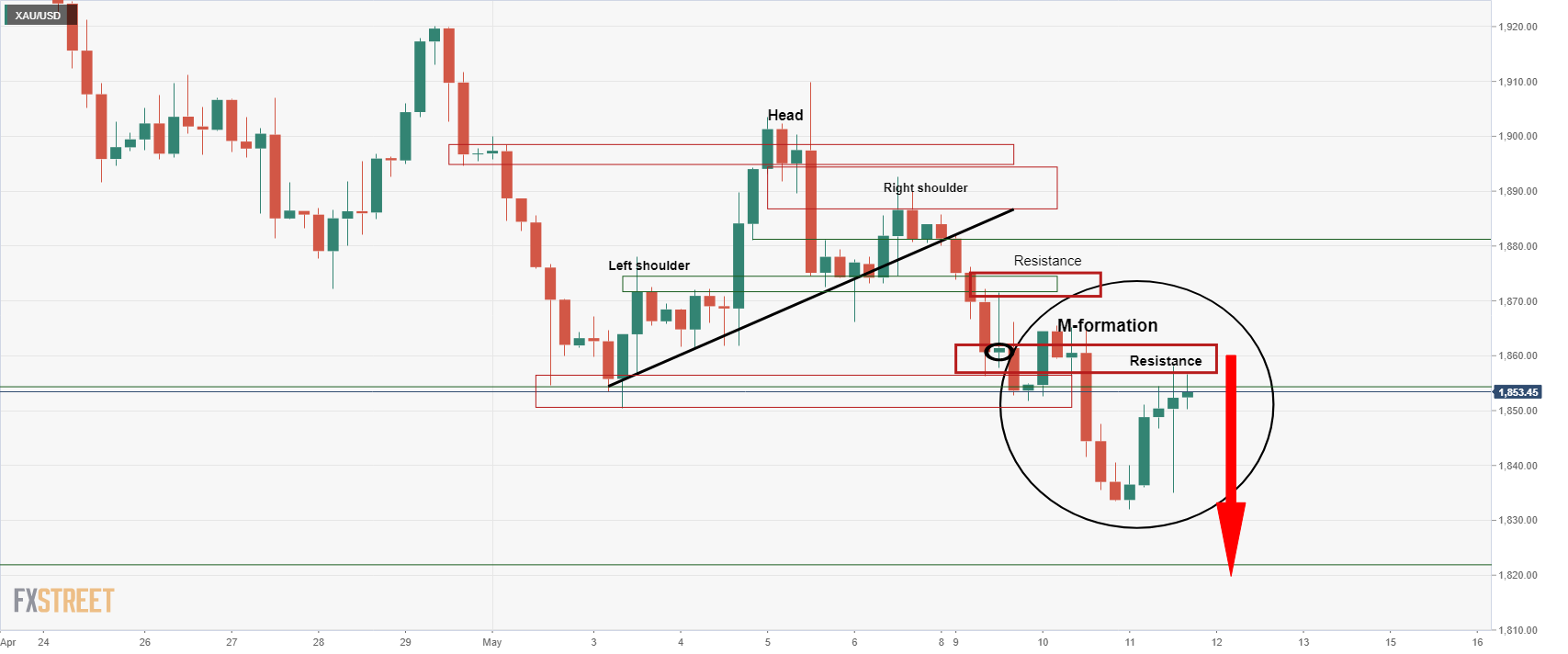

The above charts are daily charts and following a break of a 38.2% Fibonacci resistance at the current highs of the day, there would be prospects of a move into the 50% and 61.8% ratios that align with the M-formation's neckline. However, the 4-hour chart could put up some resistance in the way there:

The 4-hour chart has formed an M-formation also and the resistance of the neckline could lead to a downside continuation. This marks a 38.2% Fibonacci retracement on the daily chart as well.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.