- Gold moves into a key psychological area on its northerly trajectory.

- The Fed is what counts for the forthcoming sessions.

Gold (XAU/USD) has rallied on Tuesday, adding around 0.5% to the scale after climbing from a low of $1,834.95 to a high of $1,853.88 so far. The US dollar has come under pressure after reaching a two-week peak over tensions between Russia and the West. However, there was a five-year Treasury auction that has weighed on the US dollar considering the bond market's appetite for US Treasurys at the current coupon.

The angst in central Asia took a back seat today to the outcome of the Federal Open Market Committee's two-day meeting that draws to a close on Wednesday. Investors were expecting the Fed to announce the end of QE prematurely and signal a readiness to hike in March.

In turn, there was a focus on today's 5-year Treasury auction. The bid-to-cover ratio was high and so too was the yield with the US selling 5-year notes at 1.533% vs WI 1.547%on a $55 billion sale. That was the highest yield since October 2019. The prior was 1.263% and the bid to cover at 2.50 vs 2.41 prior. This indicates that the market could be pricing the Fed too hawkish for the medium term. This is a bullish theme for gold.

Moreover, markets will be looking to take profit in the Fed which could be playing out in the greenback as we approach month-end as well. Given the recent rout in markets, a growing cohort of participants will be hoping that the Fed will manage to provide a soothing tone for markets.

''Considering that Chair Powell's primary goal is to prevent a de-anchoring of inflation expectations, it's unlikely that the Fed will pivot from their plan to start hiking rates as soon as March, and start quantitative tightening soon after,'' analysts at TD Securities argued.

''Certainly, markets have priced-in a March hike for some time, which takes the sting out of this form of tightening, but participants have begun to question whether the strike on the Fed's put is further from the market in a regime where the central bank is battling inflation.''

''In this context,'' the analysts said, ''evidence that quantitative tightening might be more impactful for asset prices suggests that the Fed could still eventually use this tool to manage the strike on its put, without necessarily causing undue harm to its primary objective of keeping inflation expectations bounded. For precious metals, this signals few immediate avenues for relief.''

The analysts explained that ''while gold ETFs recorded massive inflows, these may have been distorted by options-related activity, with the concurrent rise in volatility suggesting only some additional safe-haven flows.

The evidence continues to overwhelmingly point to Chinese purchases as the single largest source of inflows, which are vulnerable with Lunar New Year around the corner. CTA trend followers are set to liquidate some gold length should prices break below $1815/oz.''

Gold and US dollar technical analysis

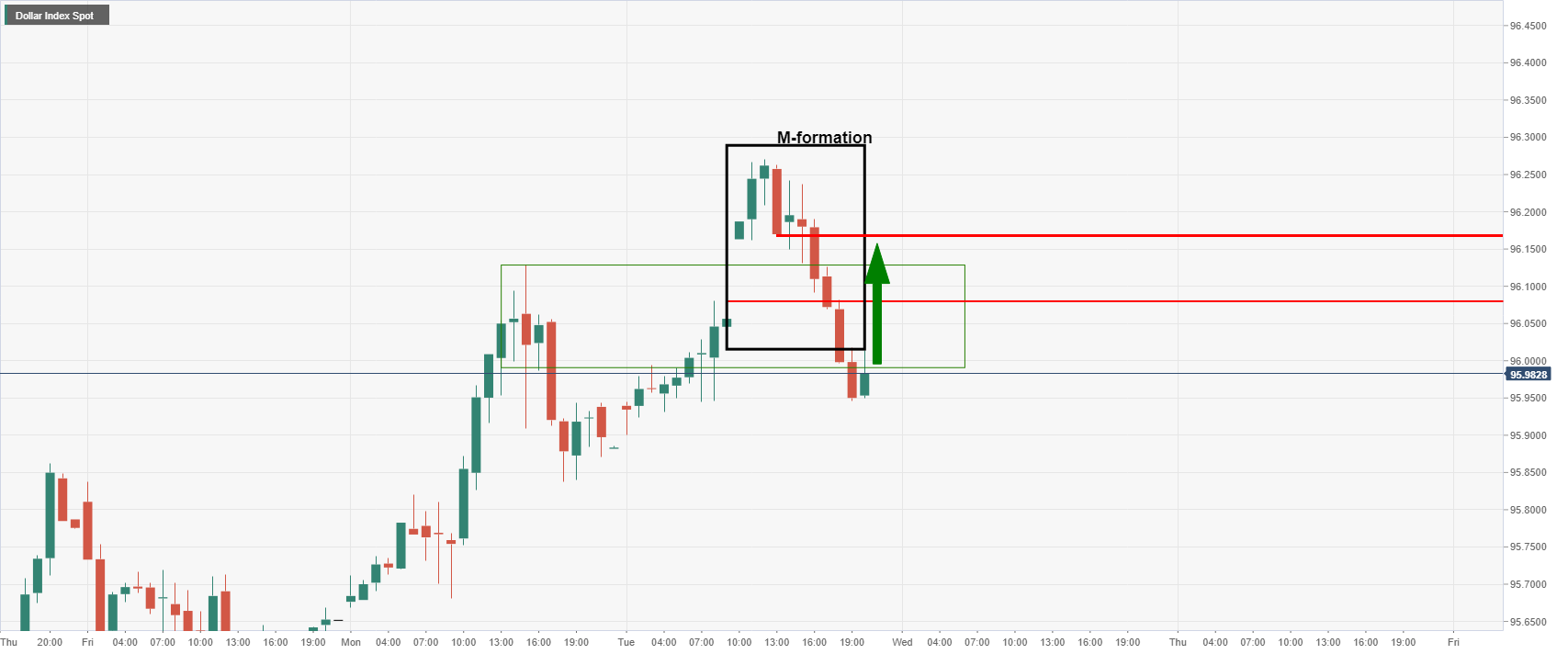

Firstly, the US dollar could be finding a bid here and the Russian risks remains a supporting factor:

Additionally, the M-formation is a reversion pattern, so a move higher in the greenback could infold in coming hours as markets get set for the Federal Reserve. Therefore, runaway gold prices may not be in store for the immediate future.

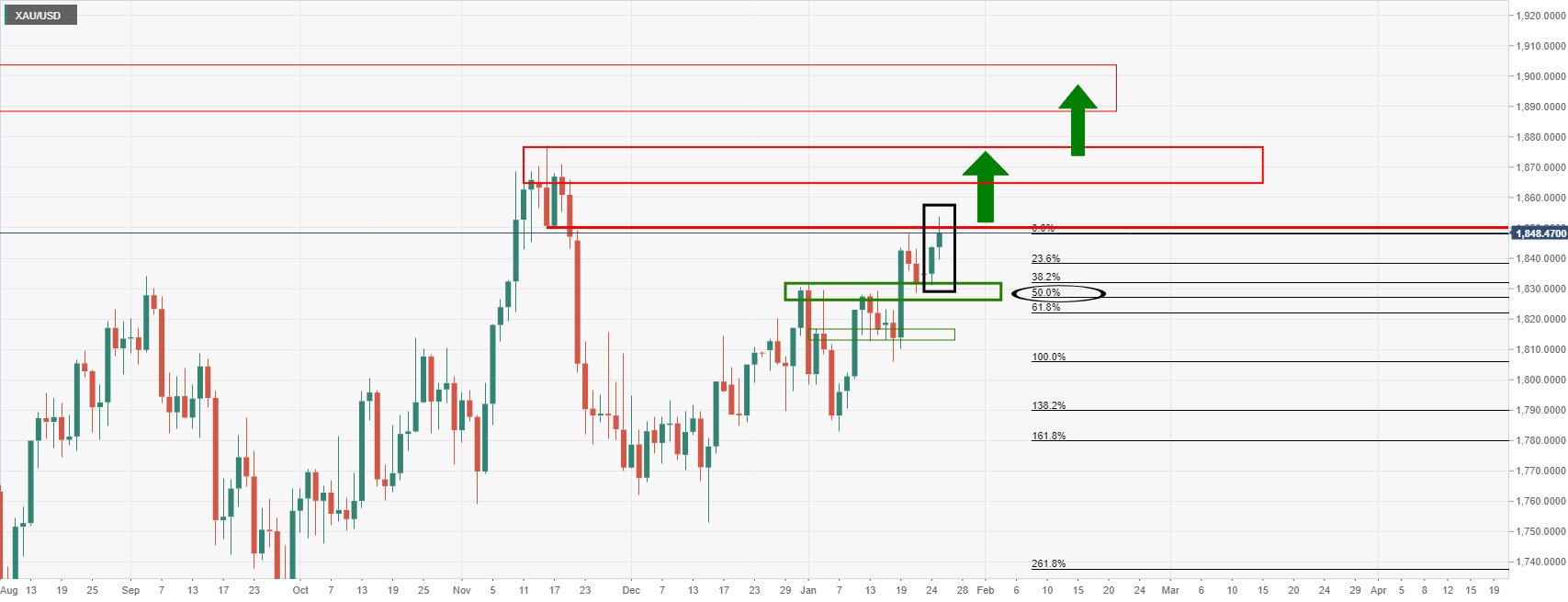

Meanwhile, as per the start of the week's analysis, Chart of the Week: Bulls pining for $1,850+, could be just a Fed away, the bulls have reached the psychological $1,850 target. This was forecasted to leave the bulls in good stead towards the $1,870's as the last major defence for the $1,900s:

Gold's prior analysis

Gold live market, daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.