- Gold hits record high in EUR terms, surges 10% on a year-to-date basis.

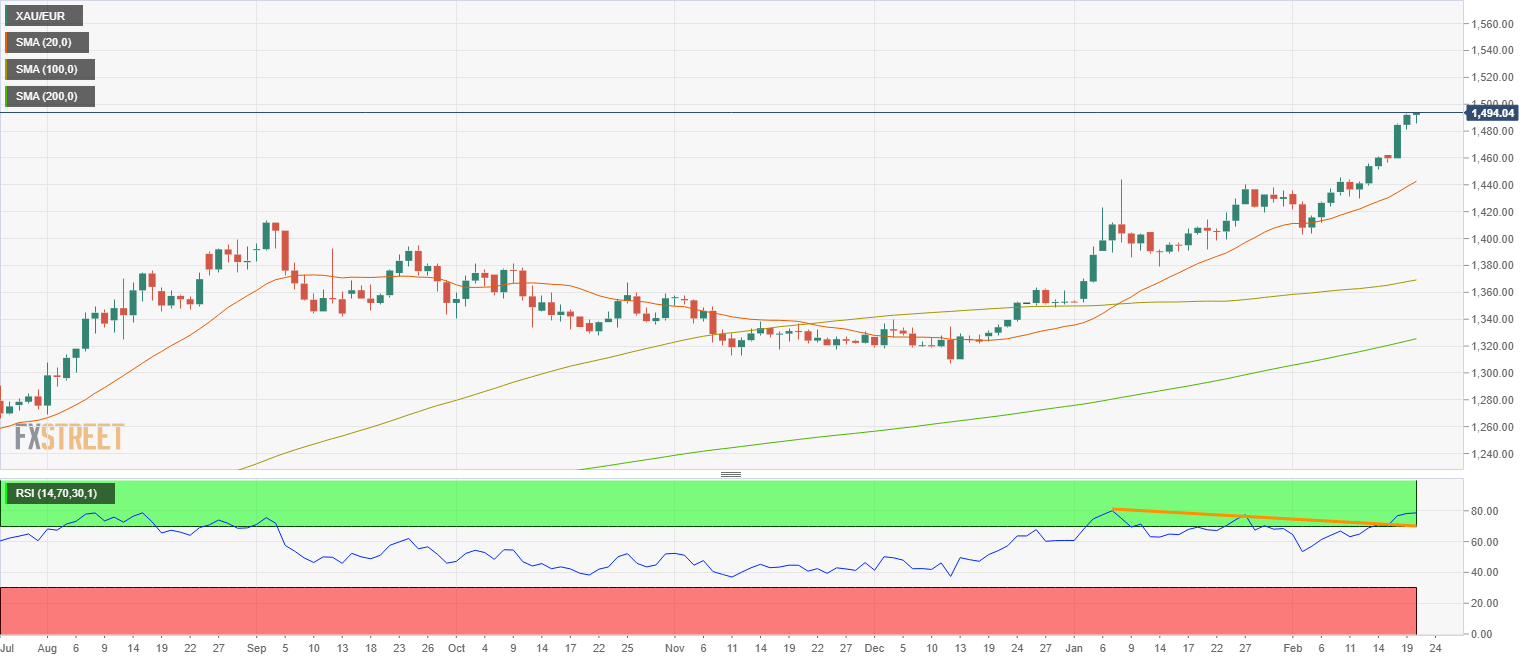

- Daily chart RSI has violated the bearish divergence.

A combination of gold price rally in the US dollar terms and a sell-off in EUR/USD has pushed the yellow metal to record highs in the single currency terms.

XAU/EUR or gold in EUR terms is currently trading at 1,490 per Oz, having hit a lifetime high of 1,494 during the overnight trade.

Gold rose to a fresh seven-year high of $1,613 earlier today, taking the cumulative year-to-date gains to over 5%. Notably, prices have risen by more than 4 percent from $1,547 to above $1,600 over the last two weeks on coronavirus fears and the resulting haven demand.

Meanwhile, EUR/USD fell to multi-year lows below 1.08 on Wednesday, having topped out at 1.1240 at the end of December.

As a result, XAU/EUR has gained more than 10 percent so far this year. The daily chart relative strength index (RSI) is reporting overbought conditions with an above-70 print. The price chart, however, is showing no signs of buyer exhaustion. The rally, therefore, could continue.

In fact, the RSI has risen past a descending trendline, invalidating the bearish divergence confirmed at the end of January. A failed bearish divergence is a powerful bullish signal.

Daily chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays in positive territory near 1.0650

EUR/USD clings to modest daily gains at around 1.0650 in the American session on Wednesday. The US Dollar struggles to gather strength amid a modest improvement seen in risk mood and helps the pair hold its ground.

GBP/USD stabilizes at around 1.2450 after UK inflation data

GBP/USD consolidates its daily gains near 1.2450 after recovering toward 1.2500 with the immediate reaction to stronger-than-expected inflation data from the UK. The renewed US Dollar weakness also helps the pair hold its ground.

Gold fluctuates near $2,390 as markets keep an eye on geopolitics

Gold trades in a relatively tight range near $2,390 in the second half of the day on Wednesday. In the absence of high-tier data releases, investors keep a close eye on headlines surrounding the Iran-Israel conflict.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.