- Gold remains pressured towards $1730 amid a broadly firmer US dollar.

- US infrastructure plans help the rebound in the Treasury yields.

- Technical setup favors XAU/USD bears ahead of US data, Powell.

Having faced rejection above $1740 on several occasions, Gold (XAU/USD) lost ground on Wednesday, now heading towards $1730 amid higher US dollar as well as Treasury yields.

Gold remains on the defensive, as the greenback holds the higher ground amid a tepid risk tone, as Treasury yields resume its uptrend on hopes of President Joe Biden’s $2.25 trillion infrastructure plan making it through Congress.

Meanwhile, markets ignored the dovish FOMC March meeting’s minutes, as worries over the US economic recovery and nervousness ahead of the earnings season tempered the mood. Risk-aversion boded well for the greenback while exerting downward pressure on gold.

At the time of writing, gold posts small losses on the day, trading at $1736. The bears look to retest Wednesday low at $1731 ahead of the Fed Chair Powell’s speech due later in NA session this Thursday. The weekly US Jobless Claims will also gain some market attention.

Gold: Technical outlook

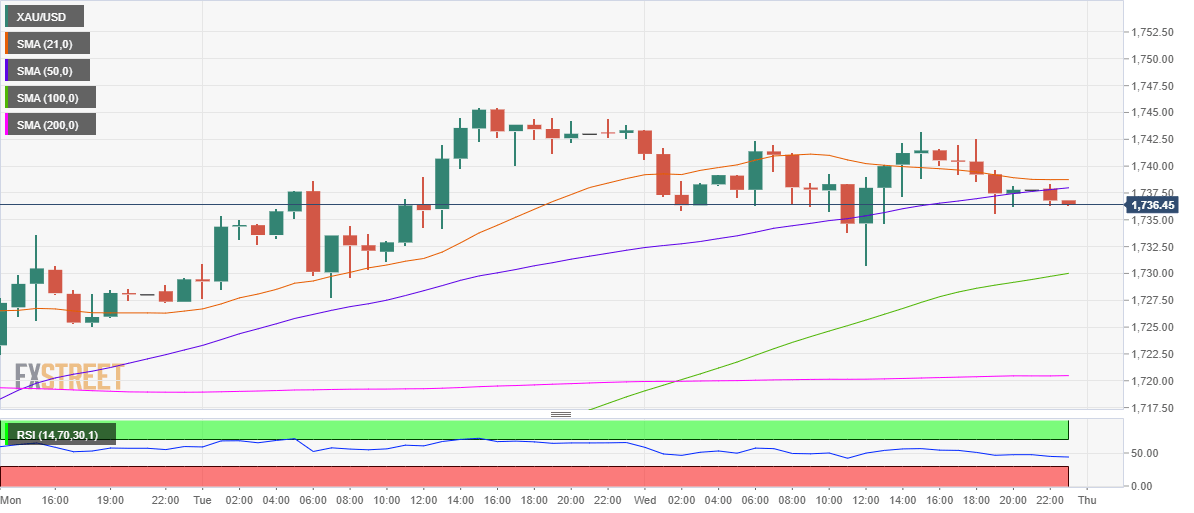

Gold seems to have found a strong foothold below the upward-sloping 50-hourly moving average (HMA) at $1738, as the Relative Strength Index edges lower near 44.00, as of writing.

Gold Price Chart: One-hour

The XAU/USD pair risks breaching the Wednesday low, which also coincides with the ascending 100-HMA.

Further south, the critical horizontal 200-HMA at $1720 remains on the sellers’ radars if the downside momentum accelerates.

Alternatively, the XAU buyers need acceptance above the powerful resistance around $1738 (confluence zone of the 21 and 50-HMAs) for any meaningful recovery towards the $1750 mark.

Gold: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.