- Gold prices on the verge of significant upside correction.

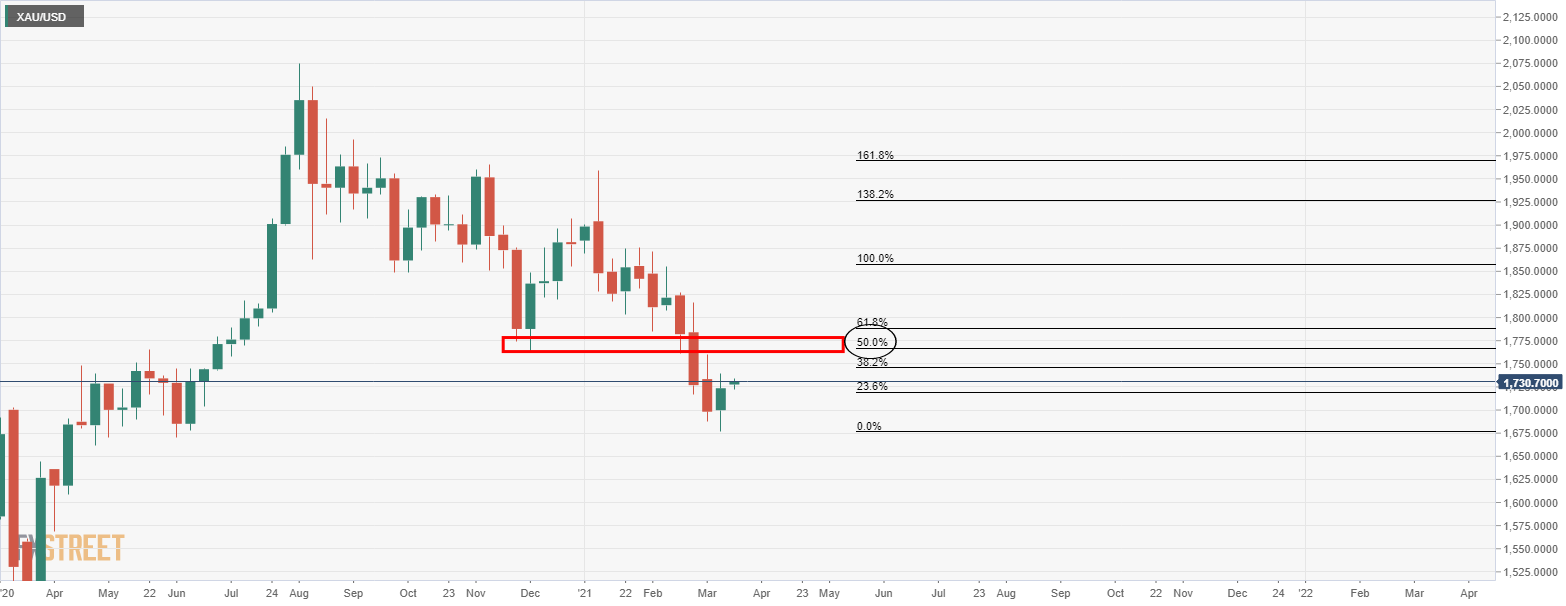

- A weekly 50% mean reversion of the bearish impulse could be on the cards.

The price of gold is trading at $1,731 in a tight range in very quiet markets on Tuesday in early Asia,

Overnight, the yellow metal was attempting to break a key resistance area, albeit without conviction, travelling within a tight $1,721.72 and $1,734.57 range and ended by the bell on Wall Street up 0.25%.

Meanwhile, gold was robust no matter that the US dollar was also firmer.

The US dollar was taking its cues from a more positive outlook for the US economic recovery as traders get set for this week’s FOMC meeting.

Markets expect that the Fed will upgrade growth projections due to the successful vaccine rollout and recently agreed on fiscal stimulus.

A more hawkish bias would be strongly bullish for the US dollar and gold will be weighed by bond markets in decline for the foreseeable future.

The outflows from the precious complex would be expected if real rates continue to rise and so long as such heads as US Treasury Secretary and Fed speakers continue to play down inflation risk, seeing the risk as only small, transitory and manageable.

Gold technical analysis

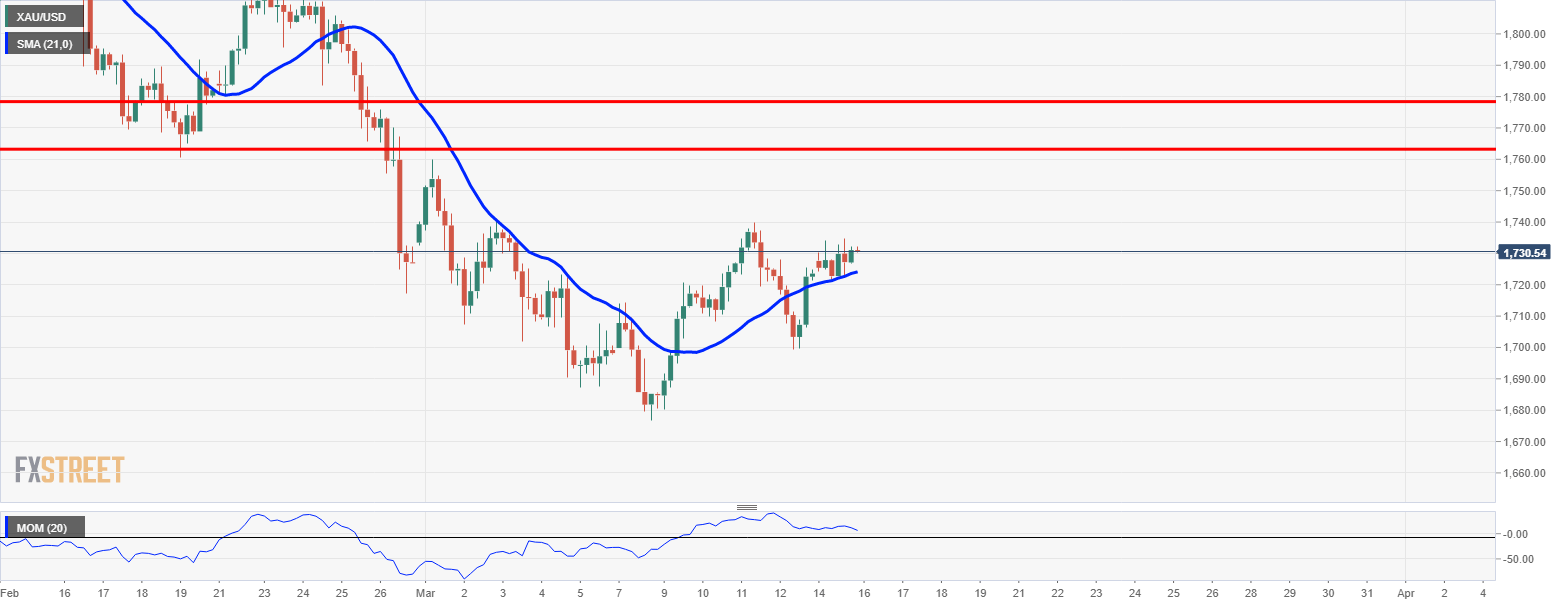

With the price supported by the 21 month SMA, the bears ate being held in check, for now.

From a weekly perspective, the bulls are looking to old support to act as resistance around a 50% mean reversion of the bearish impulse at $1,765.

Weekly chart

4-hour Momentum is bullish also. The price is above the 21 SMA and a break of current highs at $1,740 will be highly bullish.

4-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.