Currently, Gold spot is trading at 1203.09, up +0.48% on the day, having posted a daily high at 1208.72 and low at 1196.86.

Risk-off accelerates over the weekend

Bloomberg reports, "The pound fell, equities slid and gold climbed on concern U.K. Prime Minister Theresa May is prepared to lead Britain out of the European Union’s single market and as the U.S. President-elect suggested other countries could break from the bloc."

Gold: Targets Further Upside Pressure On Price Extension

The report continues, "Caution dominated markets amid tough talk from May and Donald Trump about Europe’s economic and political institutions. British government officials trying to limit damage to the pound will speak to major banks in London before the U.K. leader sets out her vision for leaving the bloc in a speech on Tuesday, according to people familiar with the situation. Meanwhile, Trump predicted that Britain’s exit will be a success that will encourage others to do the same. He also branded NATO obsolete."

Valeria Bednarik, Chief Analyst at FXStreet, noted on the current risk environment pushing Gold prices higher, "As news released over the weekend, suggest Tuesday's Theresa May speech will be lean towards a "hard-Brexit." .The logic behind the speculative headlines says that the UK should leave to EU Single Market to secure free-trade deals with other countries across the world, and regain full control of the kingdom's borders. Although, it's mere speculation, it was enough to take the Pound sharply lower at the opening."

Gold Levels to consider

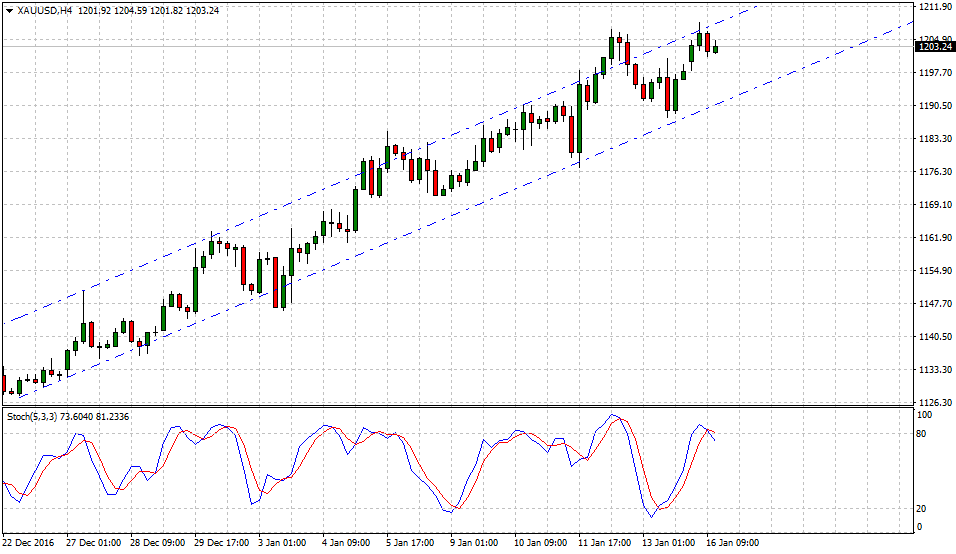

There is technical evidence to support the ongoing bullish momentum fueled via palpable risk events. Currently, price behavior has been in a good mood since Dec. 2016 last days. The short-term bullish ascendant channel keeps gold bugs adding long positions on every $15.00 pullback; how far can things get from here? It all depends, on the risk appetite and the commodity demand to hedge risk and currency exposure if that's the case more sterling losses may boost higher Gold prices. Nevertheless, Stochastic (5,3,3), which moves in the overbought territory indicates a slowdown and a pullback towards 1190.50/1180.30 range is not out of the table.

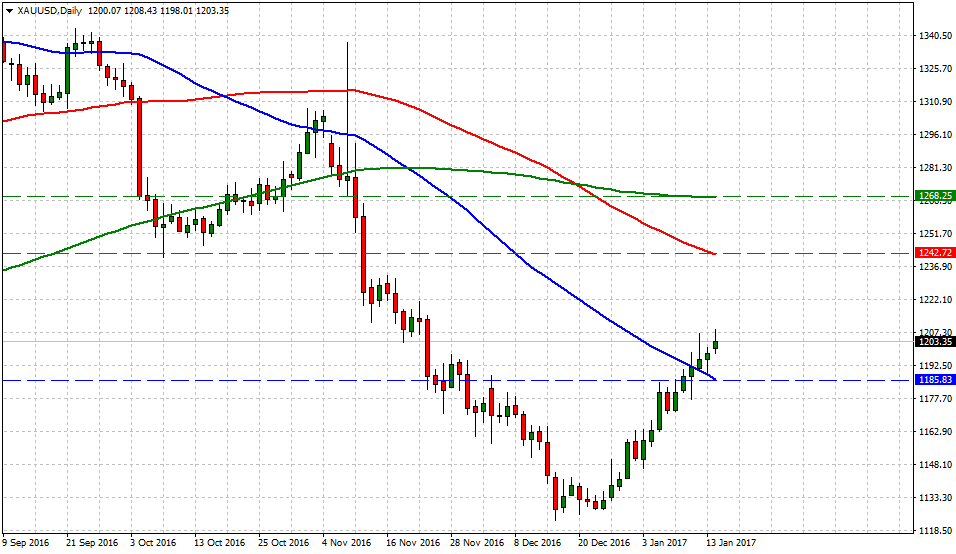

In terms of technical levels, upside relevant barriers are lined up at 1242.70 (100-SMA), and 1268.20 (200-SMA). While supports are aligned at 1185.80 (50-SMA), and below that at 1162.90 level (previous support Dec. 2016, later resistance, then support).

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.