- For GBP, all eyes are on the sentiment surrounding the BoE.

- GBP/USD is stalled within a channel between 1.2160 and 1.2315.

- Should the bulls commit, then there will be prospects of a large area of imbalance (PI) between 1.2469 and 1.2414.

At 1.2220, GBP/USD is down on the day so far by some 0.33%, falling from a high of 1.2294 to a low of 1.2170 so far after UK PMIs came in roughly in line with expectations in June and in choppy market conditions.

It's been a two-way street in global equities, with a rally in the US session vs risk-off day overnight with European bourses pressured overall. The euro was impaired by poor local PMIs which lifted the US dollar index, DXY, to a 104.78 peak that pressured peers in turn, including the pound.

UK economy and BoE in focus

However, yesterday’s UK inflation print coupled with today's UK PMI outcome underpins sentiment that the UK's central bank, the Bank of England, BoE, is on track to hike by 50bps rate hike in the next meeting. The Bank of England is watching for signs that the recent jump in inflation, which hit a 40-year high of 9.1% in May, might turn into a permanent problem for the British economy.

However, observers will argue that Britain's economy is showing signs of stalling as high inflation hits new orders and businesses report levels of concern that normally signal a recession. This was evident in today's S&P Global's Purchasing Managers' Index (PMI), that was covering services and manufacturing firms. The data showed companies were raising pay and passing higher costs on to clients, which is a concern for the Bank of England.

The PMI's preliminary composite index held at 53.1 in June, above the median forecast of 52.6 in a Reuters poll of economists and unchanged from May. But the PMI's measure of new orders effectively stagnated as it fell to 50.8, the lowest in over a year. Factory orders dipped below the 50.0 growth threshold to 49.6.

"The economy is starting to look like it is running on empty," Chris Williamson, a chief business economist at S&P Global Market Intelligence, said, adding that the economy was likely to show a fall in output in the second quarter that could deepen in the third quarter. "Business confidence has now slumped to a level which has in the past typically signalled an imminent recession," he also explained. Growth was being propped up by previously placed orders. Manufacturers had reported especially weak demand for exports, and service firms were seeing their post-lockdown bounce reverse as the cost of living rose, Williamson explained further.

Moreover, the PMI's business expectations index fell by 4.6 points in June, the largest monthly decline since the start of the COVID-19 pandemic, with manufacturers and service providers both reporting their lowest business optimism levels since May 2020.

On the upside, job creation was the strongest in three months, in the latest sign of the strength in the labour market.

''The UK is in danger of being the slowest-growing major advanced economy next year, with the highest inflation rate and the biggest current account deficit,'' Kit Juckes at Societe Generale said.

''That's quite a collection, and it represents a clear threat to the pound. Sentiment is already poor and there are plenty of speculative shorts out there too, but further weakness is likely. Whether it falls more as the US dollar continues to rise, or under-performs a recovering euro, it will struggle. Longer-term, we will see sterling make new trade-weighted lows.''

Meanwhile, the BoE said last week it was ready to act "forcefully" if it saw signs of persistent inflation pressures, suggesting it might raise interest rates by more than its standard quarter-point increase despite fears of a recession. Overnight index swaps are continuing to price in 50bp moves by the BoE at the next 3 meetings. This lays out a path that would leave Bank Rate above 3% by year-end.

On the charts, this could see the pound steady from the monthly support area and there are upside prospects in the near term so long as the market structure on the four-hour chart holds up.

GBP/USD technical analysis

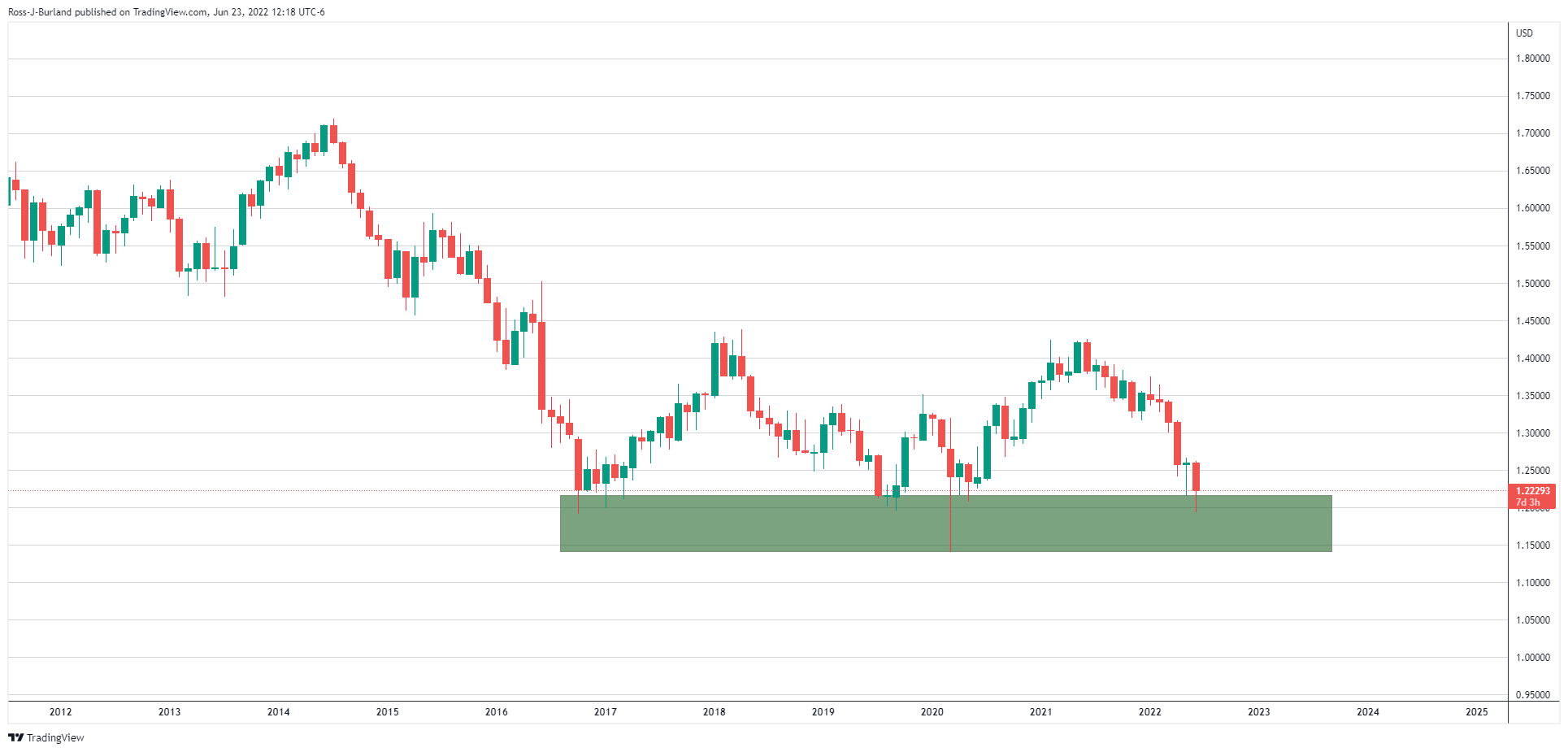

The monthly chart above is concerning given the strong bearish bias in 2022. However, there are some bullish features on the nearer-term charts that are encouraging as follows:

GBP/USD H4 chart, bullish mitigation prospects

As illustrated, the price recently moved sideways out of an uptrend but has since stalled within a channel between 1.2160 and 1.2315. Should the bulls commit, then there will be prospects of a large area of imbalance (PI) between 1.2469 and 1.2414 that could be mitigated giving way to chances of a move in to test 1.25 the figure thereafter, the highs o the order block (OB). However, there is still a slight inefficiency of price to the downside to 1.2154 that could be mitigated first of all as a last defence. If the bears commit through there, then the market structure will be broken and the bias will shift bearish again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.