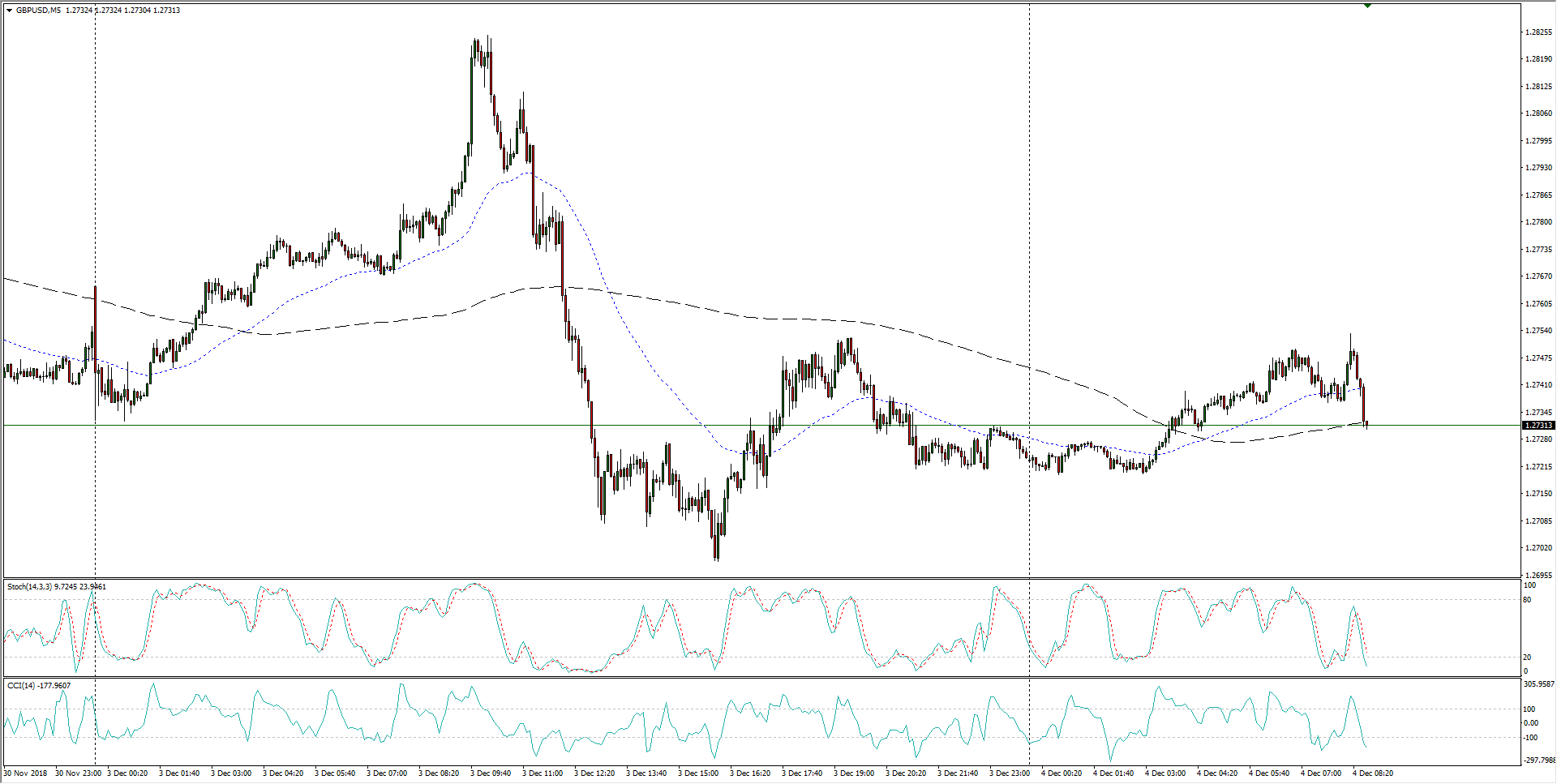

- GBP/USD trading into 1.2730 after mild lift through Tuesday's early session in a frequently-repeated pattern, catching bids into the pre-London markets and then selling off at the opening bell.

GBP/USD, 5-Minute

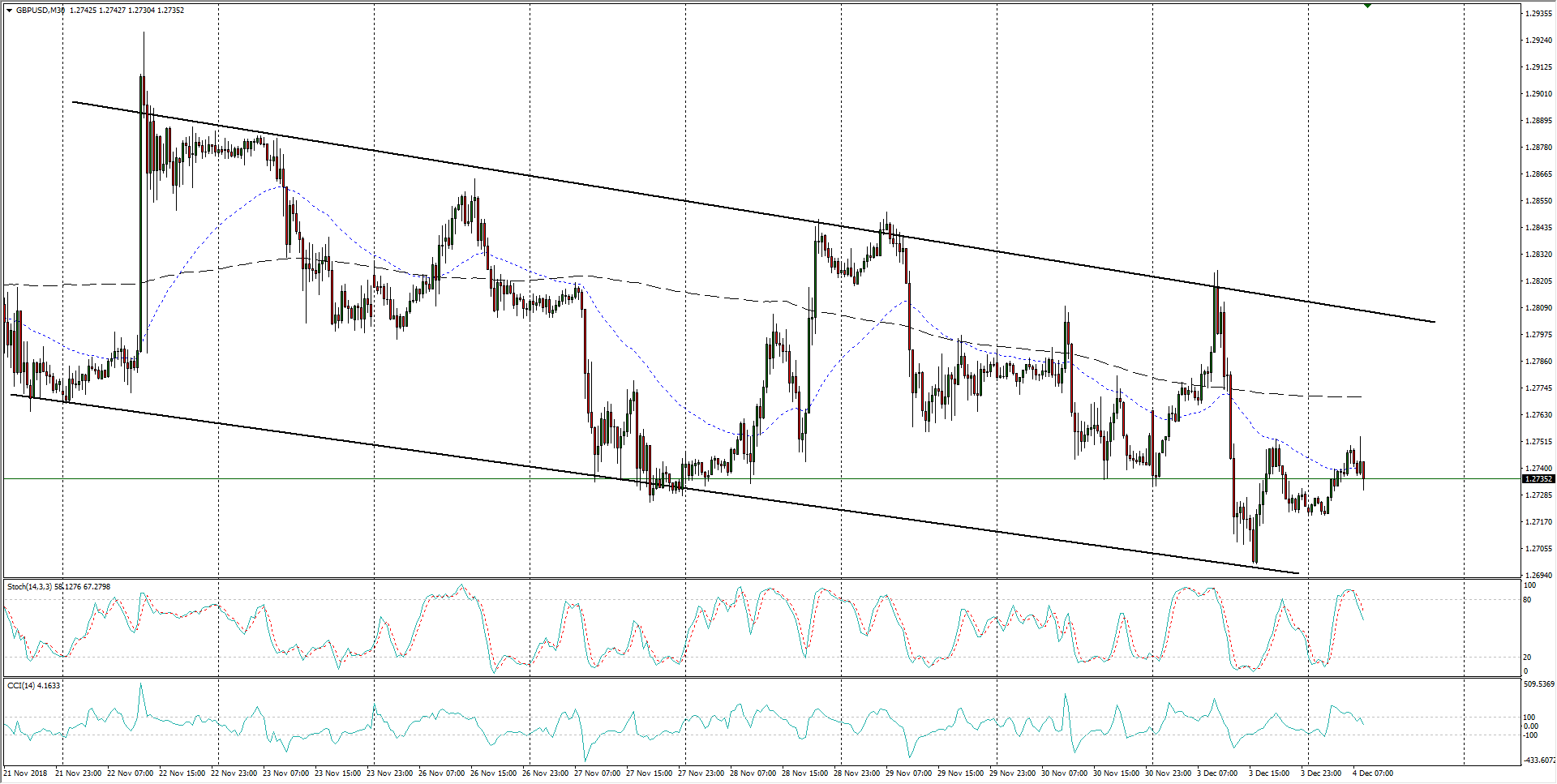

- Rapid periods of Brexit-based bidding is frequently sending the Cable higher, but the pair remains in a rough downside channel, and the GBP is spending less and less time on the north side of the 200-period moving average.

GBP/USD, 30-Minute

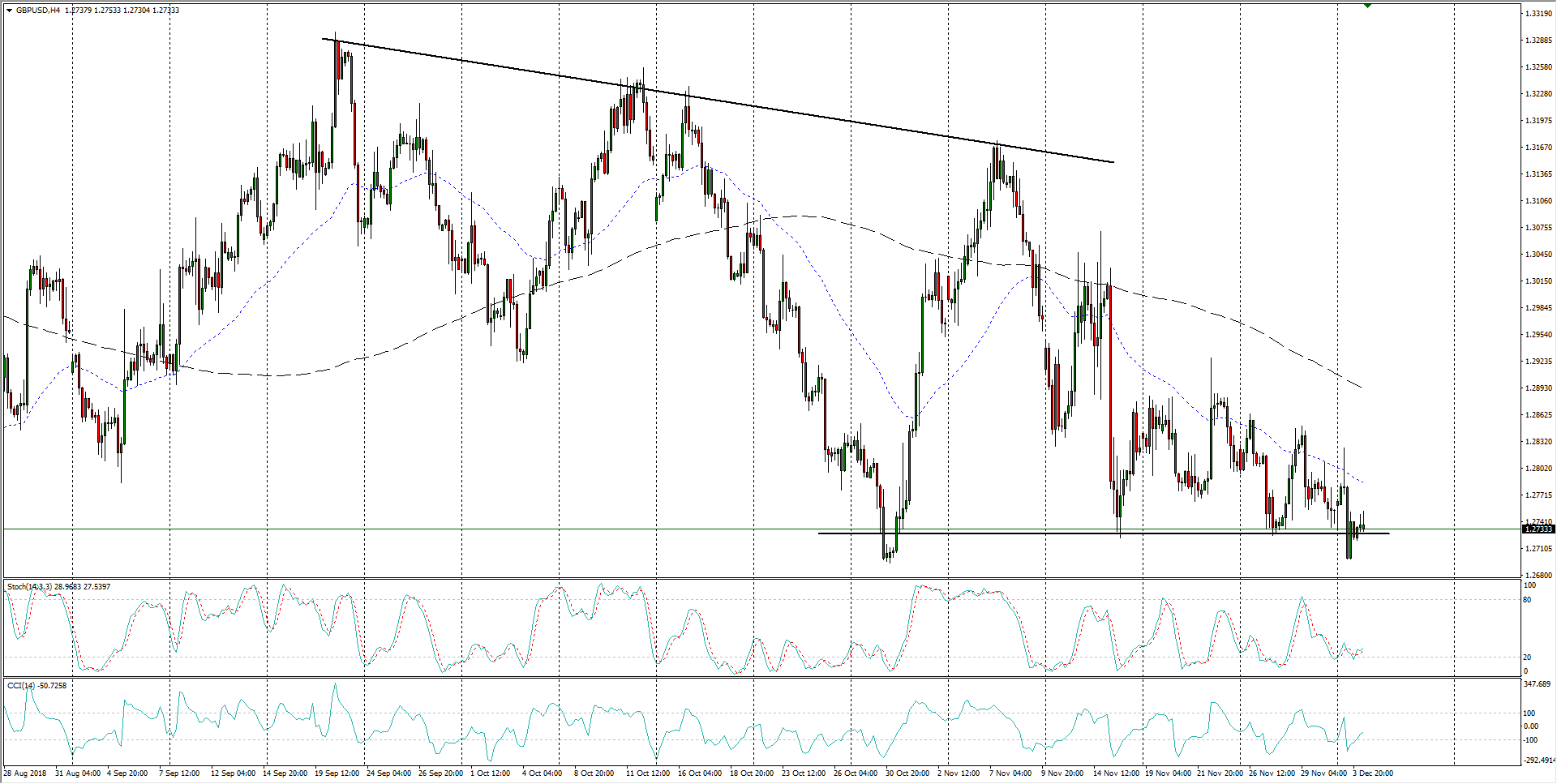

- The Cable has accelerated recent losses, running into a stiff support zone from the 1.2700 major handle, and the past few months have seen GBP/USD struggle to develop bullish momentum, remaining constrained by the 50-period moving average currently priced in near 1.2770.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2746

Today Daily change: 18 pips

Today Daily change %: 0.141%

Today Daily Open: 1.2728

Trends:

Previous Daily SMA20: 1.2871

Previous Daily SMA50: 1.2962

Previous Daily SMA100: 1.2972

Previous Daily SMA200: 1.3311

Levels:

Previous Daily High: 1.2826

Previous Daily Low: 1.2699

Previous Weekly High: 1.2864

Previous Weekly Low: 1.2725

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2747

Previous Daily Fibonacci 61.8%: 1.2777

Previous Daily Pivot Point S1: 1.2676

Previous Daily Pivot Point S2: 1.2624

Previous Daily Pivot Point S3: 1.2549

Previous Daily Pivot Point R1: 1.2803

Previous Daily Pivot Point R2: 1.2878

Previous Daily Pivot Point R3: 1.293

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus.