- GBP/USD has been on the back foot in recent trade, having failed a third attempt to break above the 1.3400 level.

- Expectations that a deal will eventually be struck on trade between the EU and UK is keeping the pair broadly underpinned.

- However, the bulls seem reluctant to push cable above 1.3400 in absence of further progress in negotiations.

GBP/USD continues to hit a brick wall at 1.3400, with the pair unable to surpass Asia session highs at 1.3398 during this morning’s European session before the sellers came in drove the action back as low as the 1.3320s. The latest downside moves put GBP amongst the worst performers on the day out of the G10 currencies (with only NOK and SEK doing worse). Currently, cable trades with losses of around 40 pips on the day or 0.3%.

GBP/USD price action once again implies that bulls not ready to push beyond 1.3400 in absence of Brexit progress

Despite Thursday’s downside, cable remains significantly elevated from monthly lows set on 2 November at roughly 1.2850. Much of that can be attributed to USD weakness following US President-elect Biden’s victory at the start of the month, which has since been exacerbated by a combination of vaccine optimism and the increasingly dovish tone of the FOMC, who are now expected to tweak their asset purchase programme in December in order to offer the economy more stimulus as virus numbers rise, states return to some form of second lockdown and fiscal stimulus from Congress remains elusive.

However, GBP has also significantly outperformed the likes of EUR and CAD (GBP/USD is up 3% on the month to CAD/USD’s 2.3% and EUR/USD’s 2.2% rise respectively). Growing hopes for a Brexit accord have seemingly been pumping the pair higher; the situation now seems as though a deal is there to be had (with 95% of the text already agreed on) as long as agreement can be found on a few key sticking points. These sticking points, as has been the case for months and months now, are continued EU access to UK fishing waters, state aid and level playing field.

Despite various reports towards the end of last week claiming that this week could be the week where an agreement is finally had, news flow on the topic of Brexit has been far from upbeat so far this week. During Thursday’s European morning session, the Irish Foreign Minister said that outstanding issues on Brexit are proving very difficult, while various EU sources were reported to have said that talks are not going well on Wednesday. Moreover, the French Foreign Minister on Wednesday appeared to put public pressure on the UK to adopt a more realistic negotiating stance.

Sterling traders appear to have shrugged off this week’s updates as a “final round of brinkmanship”, hence why cable still trades to the north of 1.3300. However, despite getting within earshot of the 1.3400 multiple times over the past few days, GBP/USD bulls appear to be holding their horses. Until evidence of significant progress towards a deal emerges, GBP/USD is likely to continue to feel uncomfortable the closer it gets to 1.3400.

GBP/USD eyes a retest of 1.3300 support area

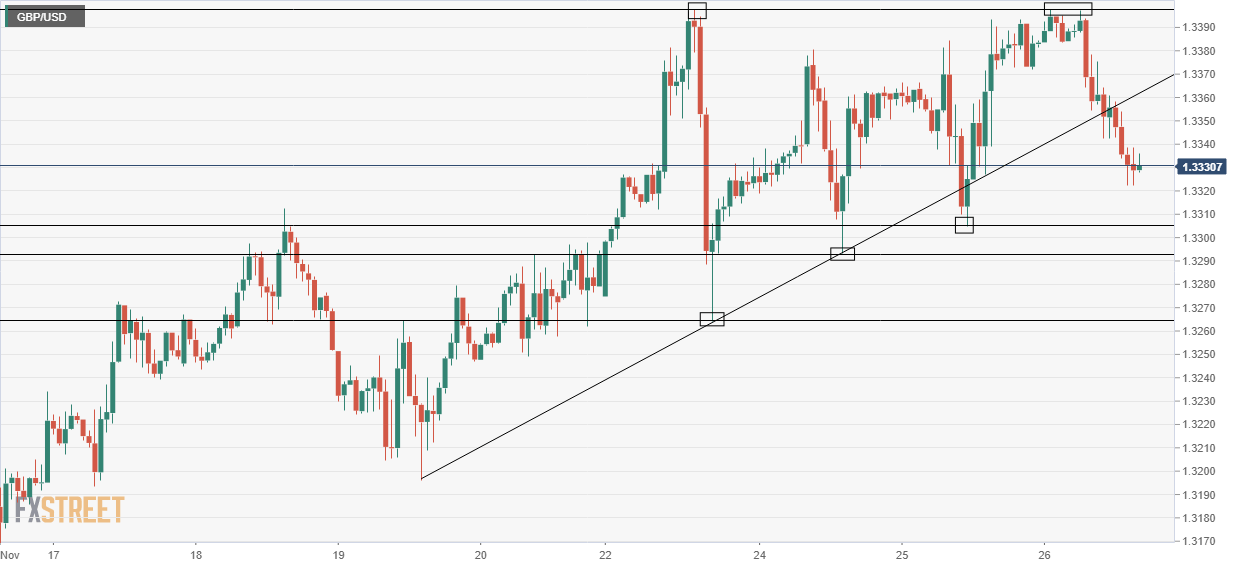

GBP/USD broke to the downside of a short-term uptrend on Thursday that connected the 19, 23 and 24 lows and came into play around the 1.3350 level. That opens up the door to a gradual grind lower towards support on either side of the 1.3300 level; Wednesday’s low at 1.3305 and Tuesday's low at just above 1.3290.

GBP/USD hourly chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.