- GBP/USD has rallied beyond previous yearly highs to test the 1.3500 level for the first time since December 2019.

- Bullish Brexit bets are driving the move amid indications of progress on the issue of level playing field.

GBP/USD has rallied hard on Thursday and in recent trade surpassed the previous yearly high at 1.3485 to print new yearly highs at 1.3500. A combination of bullish Brexit bets and continued USD weakness is driving the upside and the pair trades with gains of over 120 pips or nearly 1.0% on the day.

GBP dominates G10

The GBP rollercoaster continues amid a revival in hopes that the EU and UK might be able to reach a deal on their future trading relationship in the coming days; reports that significant progress has been made on the issue of level playing field (one of the three key outstanding issues in talks) has injected GBP with bullish sentiment and the currency is currently the best performer out on the day in the G10.

A bombardment of commentary on the state of talks from a variety of journalists and sources has delivered mixed messages, but a few underlying factors seem to be consistent across reporting; significant differences remain and talks appear to be coming to their climax (with either a deal or complete collapse of talks likely by the end of the week). Meanwhile, hard-line EU countries led by the French are still pushing for further concessions from the UK.

Elsewhere, a surprising large upwards revision to final UK services PMI numbers for November during the early part of Thursday’s European session (to 47.6 from 45.8) might also be helping lift some concerns about economic weakness during November’s national lockdown, which ended on Wednesday.

Broad USD slide continues

Contributing to GBP/USD upwards surge on Thursday has been a continuation in the broad USD decline, with the Dollar Index (DXY) sliding to the 90.50 mark in recent trade, down nearly 1.4% now on the week.

No specific catalysts appeared directly responsible for USD’s early decline on Thursday, though a recent batch of strong US services PMI data for November appears to have spurred further losses;

Markit released its final services PMI reading for November, which was revised higher to 58.4 from the preliminary estimate of 57.7, the highest reading in over five years. Shortly after, the Institute of Supply Management released their estimate of services PMI for November, which came in at a solid 55.9, only very marginally below expectations for 56.0. Importantly, the employment subindex remained above the 50 mark, implying that service sector employment was in expansion in the month just gone despite the worsening virus situation.

Going into the data, some had argued that strong numbers might be USD bullish as it might discourage the Fed from providing further accommodation at the FOMC meeting later this month. However, this has not been the case.

US equity markets were given a boost by the data, with the S&P 500 hitting fresh all-time highs in its aftermath. Risk on flows have also been seen in FX markets, hurting demand for safe-haven currencies like the USD.

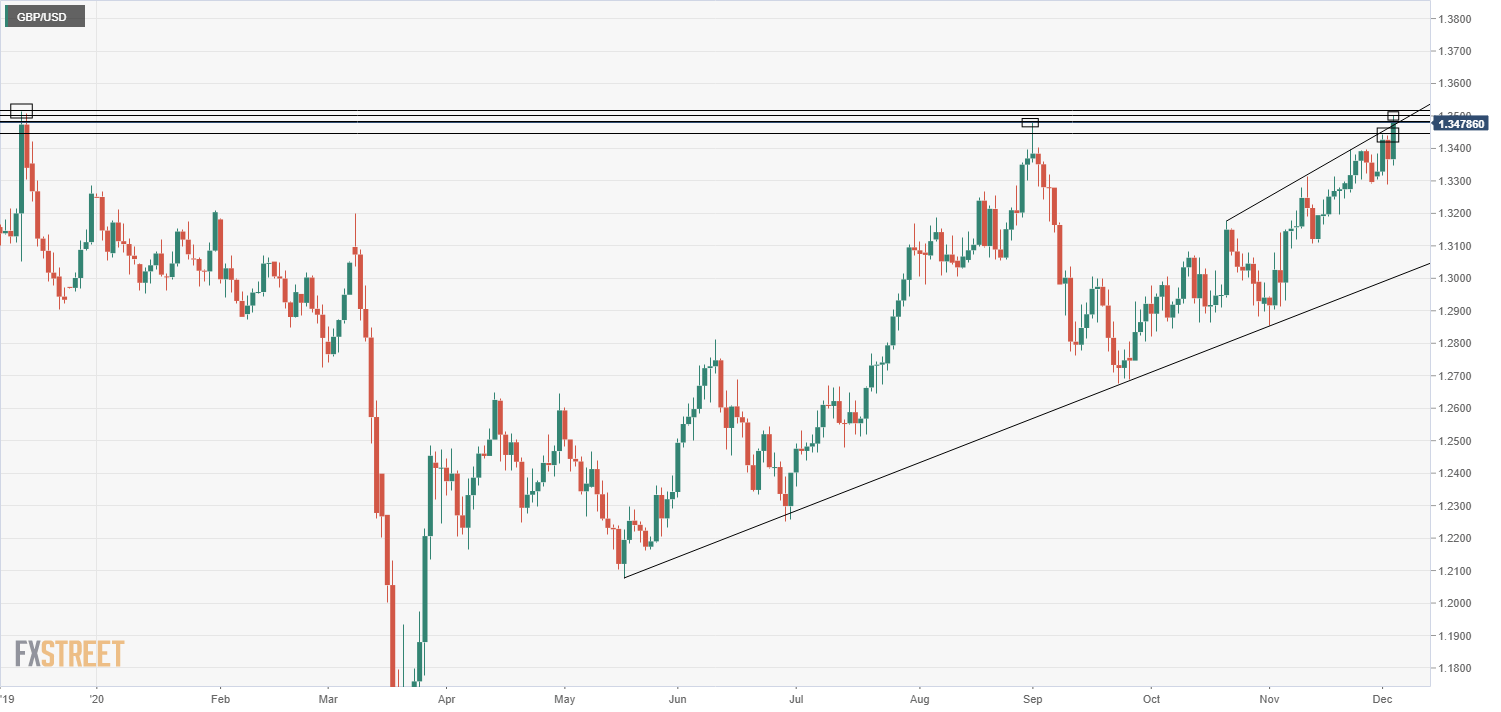

GBP/USD testing 1.3500 for the first time since December 2019

GBP/USD has surpassed its previous year-to-date highs at 1.3485 in recent trade and hit the 1.3500 level, which was last hit in wake of the December 2019 UK general election after the Conservative Party won a much larger than expected majority. Just beyond the 1.3500 level is the post-election high at 1.3516, which ought to offer solid resistance. Should this level go, the next key area of resistance to watch out for is the February 2016 lows just above 1.3700.

Meanwhile, if GBP/USD goes into consolidation close to the 1.3500 level or just under it, the previous yearly high at 1.3485 might offer some support, as might Tuesday’s and Wednesday’s highs at 1.3440.

GBP/USD daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.