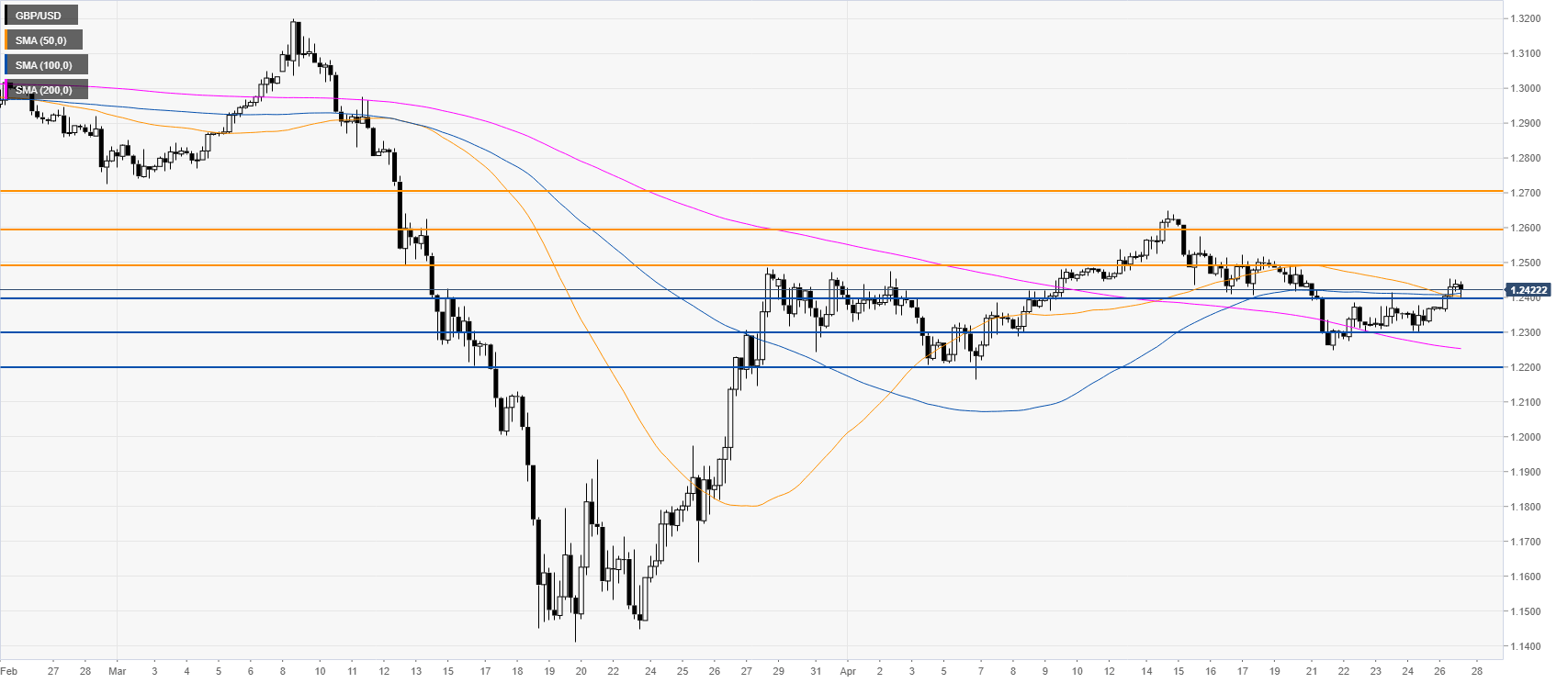

- GBP/USD bullish recovery stays intact as the spot holds above the 1.2400 figure.

- The level to beat for bulls the 1.2400 resistance.

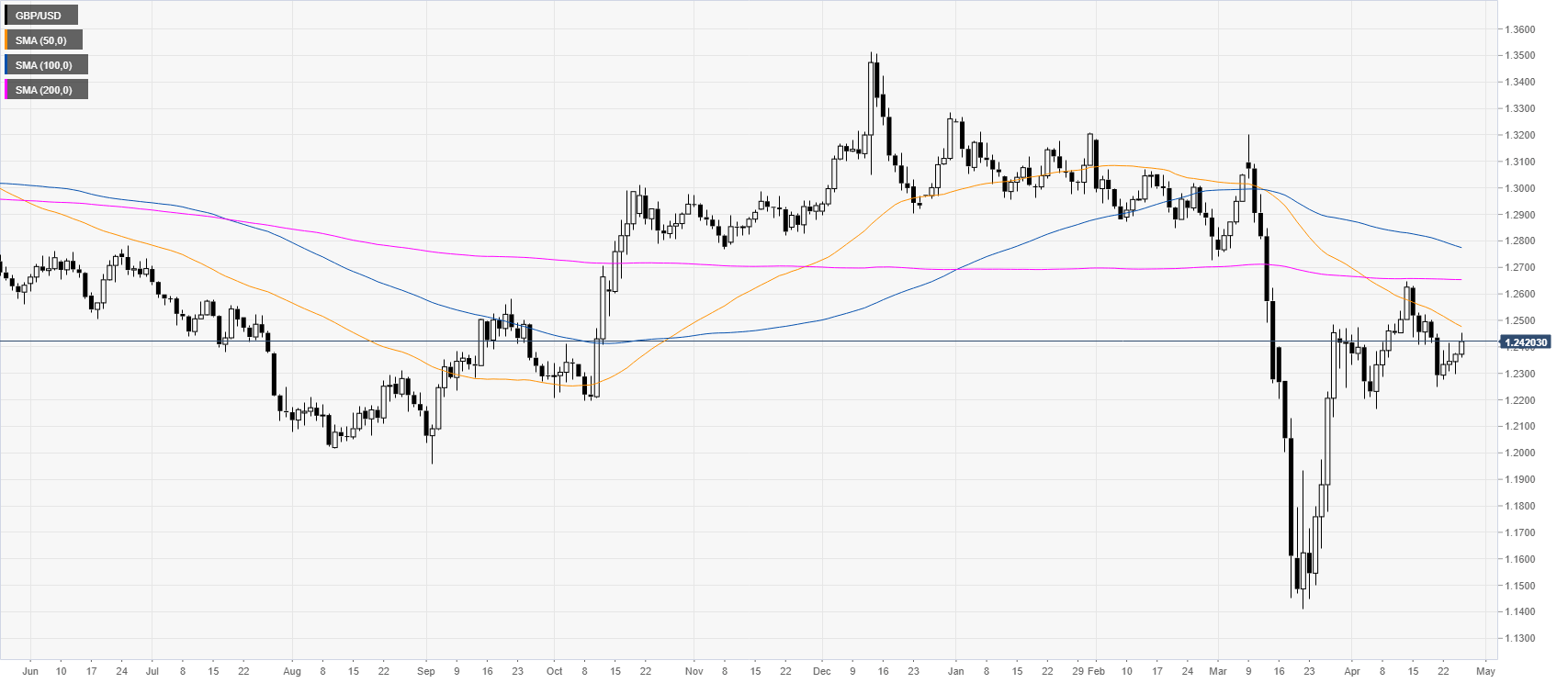

GBP/USD daily chart

GBP/USD four-hour chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD stays in positive territory near 1.0650

EUR/USD clings to modest daily gains at around 1.0650 in the American session on Wednesday. The US Dollar struggles to gather strength amid a modest improvement seen in risk mood and helps the pair hold its ground.

GBP/USD stabilizes at around 1.2450 after UK inflation data

GBP/USD consolidates its daily gains near 1.2450 after recovering toward 1.2500 with the immediate reaction to stronger-than-expected inflation data from the UK. The renewed US Dollar weakness also helps the pair hold its ground.

Gold fluctuates near $2,390 as markets keep an eye on geopolitics

Gold trades in a relatively tight range near $2,390 in the second half of the day on Wednesday. In the absence of high-tier data releases, investors keep a close eye on headlines surrounding the Iran-Israel conflict.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.