The Sterling is trading on a better mood vs. the buck ahead of the opening bell in Europe on Tuesday, taking GBP/USD to the 1.2370/80 band for the time being.

GBP/USD focus on UK data

Spot is reverting yesterday’s pullback despite coming down from recent highs in the 1.2440 region in a context of broad-based offered bias around the greenback.

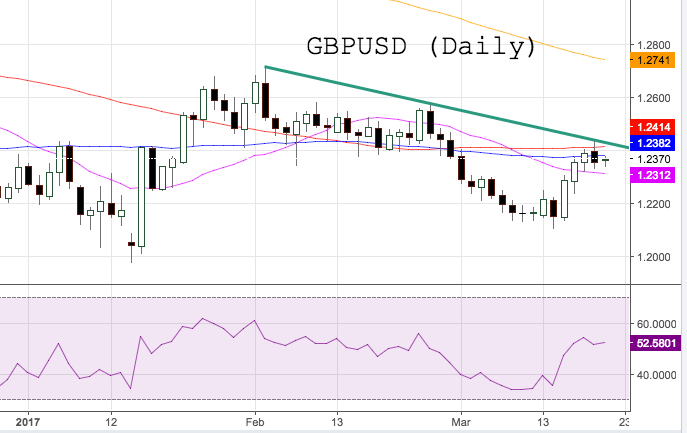

The pair seems to have difficulty to overcome the tough resistance line off YDT tops beyond 1.2700 the figure recorded in early February, however, which is currently located in the 1.2420 zone.

News from the UK cited PM Theresa May is expected to trigger Article 50 on March 29. The upcoming (and presumably long) negotiation process of the UK-EU divorce should be the main driver for GBP’s price action in the next months.

On another direction, the British Pound remains under pressure from the positioning side, as speculative net shorts climbed to record levels during the week ended o March 14 according to the latest CFTC report.

Data wise today, UK’s inflation figures for the month of February are due along with Public Sector finances, CBI’s Industrial Trends Orders and the speech by Governor M.Carney.

Across the pond, all the attention should be on the speeches by Ney York Fed W.Dudley (permanent voter, centrist), Kansas City Fed E.George (2019 voter, hawkish) and Cleveland Fed L.Mester (2018 voter, hawkish).

GBP/USD levels to consider

As of writing the pair is up 0.12% at 1.2372 and a breakout of 1.2414 (100-day sma) would aim for 1.2437 (high Mar.20) and finally 1.2572 (high Feb.24). On the flip side, the next support aligns at 1.2333 (low Mar.20) followed by 1.2313 (20-day sma) and then 1.2239 (low Mar.16).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.