- GBP/USD plummeted on Wednesday but bulls are moving in.

- US dollar rallies to fresh daily highs as US yields soar on Fed narrative.

GBP/USD was sent packing all the way to the lowest levels since the end of 2020 with two-fold risk sentiment. These included soaring natural gas prices and petrol shortages in Britain due to Brexit Supply chain constraints as well as a global equity selloff on Tuesday.

A post-Brexit shortage of lorry drivers has sown chaos through British supply chains in everything from food to fuel, and the concern for emergency services is a critical point, especially given the Delta coronavirus crisis. Supply chain constraints exacerbated by Brexit means that UK consumers are facing surging food and energy bills at the same time that pandemic support measures are being unwound.

''Labour shortages and supply chains disruptions are currently common across the globe,'' analysts at Rabobank said. ''However, it is likely that Brexit is worsening these issues for the UK with price pressures also likely to be enhanced by extra regulations and paperwork that are now necessary on many goods traded between the UK and the EU. This may be increasing the vulnerability of the pound.''

BoE backpeddles

Meanwhile, the Bank of England Governor Andrew Bailey said on Wednesday that he expected Britain’s economy to recover its pre-pandemic level of output early next year, a little later than the central bank had predicted last month.

''His new forecast reflects signs that Britain’s economic recovery has slowed by more than expected following its initial rebound from the last COVID-19 lockdown.

Complicating the outlook for the BoE, inflation is also surging, fuelled by widespread supply chain disruption including the panic-buying of petrol over the last week,'' Reuters reported.

GBP/USD technical analysis

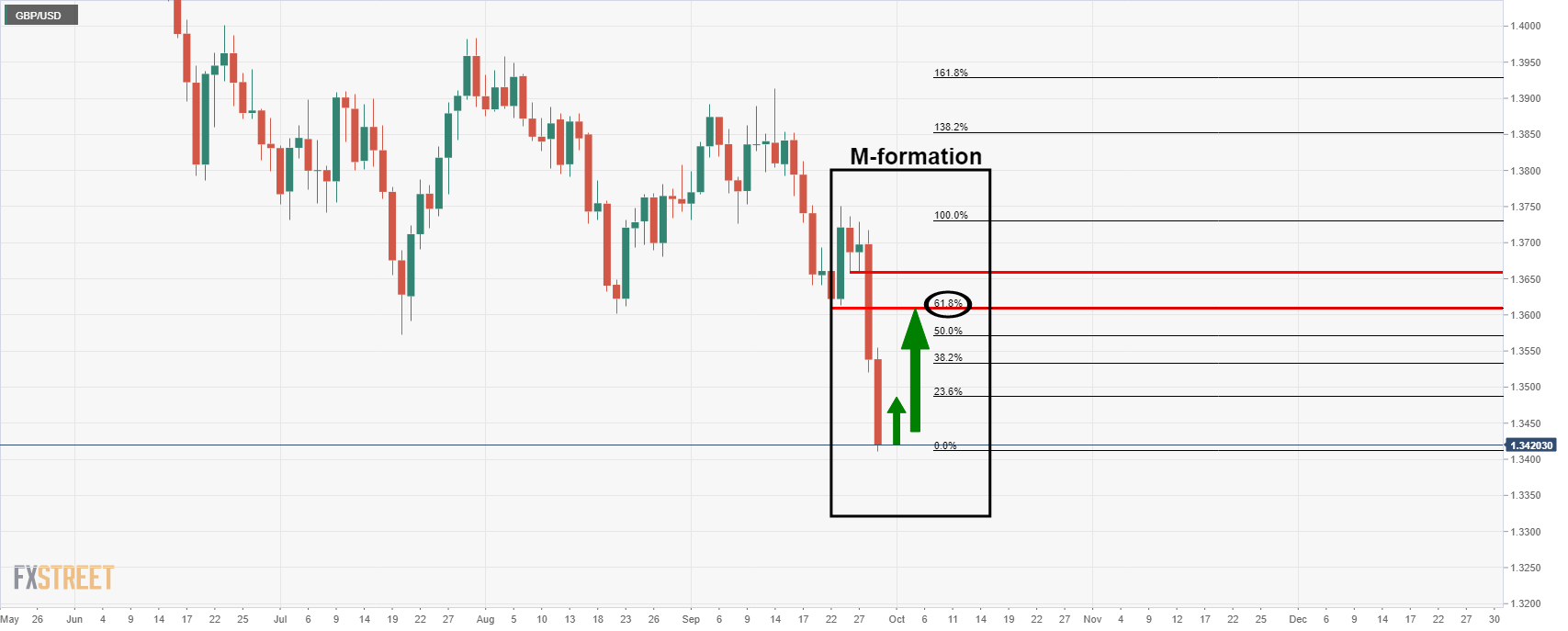

GBP/USD Price Analysis: Bullish M-formation argues test of 1.3610

''As illustrated above, the daily chart has formed an overextended M-formation and the bulls could be encouraged to restest the confluence of the 61.85 Fibonacci level and the 22 Sep lows.''

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.