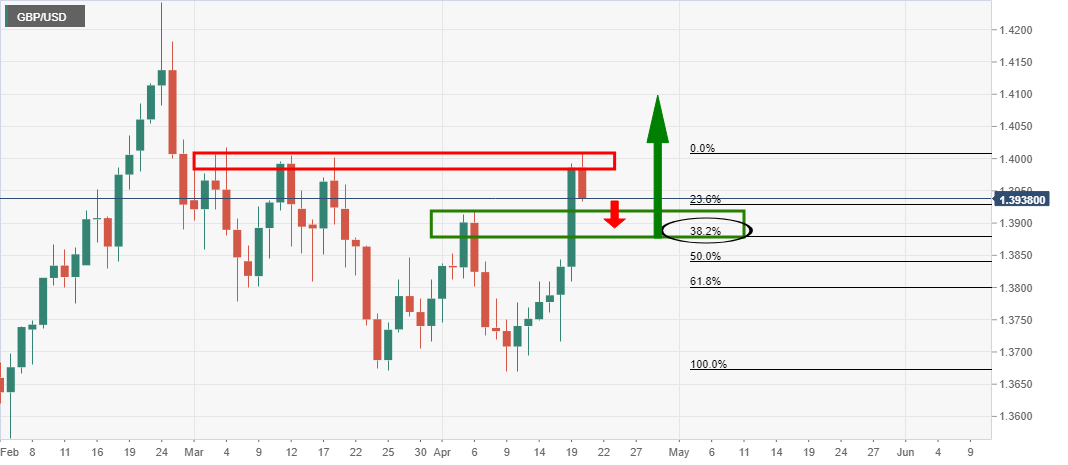

- GBP/USD bears stepping in at the psychological 1.4000 area.

- Bears look for a test of the prior resistance and a 38.2% Fibo confluence level in 1.3880.

Despite the better than expected labour market data and anticipation of more solid data outcomes on a busy week ahead of the UK calendar, the pound is falling.

At the time of writing, GBP/USD is close to 0.4% lower on the day after sliding from 1.4008 to a low of 1.3929.

Stronger data on Tuesday reflected the reopening of the UK economy with the February Unemployment dropping a decimal point to 4.9% vs. 5.0% consensus, while the 3-month Employment Change was -73k vs. -150k expected.

Also, March Jobless Claims rose only 10.1k while February was revised to 67.3k from 86.6k previously.

The consensus is that the second and third quarters are likely to remain elevated, but investors will be hesitant to bank on any rate hikes from the Bank of England any time soon.

''BOE tightening expectations have been pared back a bit from their peak in mid-March, though the short sterling strip still shows a rate hike fully priced in by Q4 2022,'' analysts at Brown Brothers Harriman explained.

Moreover, analysts at Rabobank argued that ''it is too early to expect official data to start painting a picture of activity levels in the UK economy.''

The analysts explained that the labour market data was mixed and referred to the pound's latest surge to the upside.

''Perhaps unsurprising given the extent of this upswing and following this morning’s mixed set of labour data, some profit-taking has subsequently emerged.''

The analysis also highlighted that ''not only is there a lot of good news priced into the pound but there is likely to be some degree of ‘catch-up’ in the vaccine rollout.''

''We are assuming the USD can recover some ground into the summer and thus look for cable to trade mostly in a GBP/USD1.38-1.40 range in the coming months.''

Meanwhile, from a positioning standpoint, leveraged funds change in longs was five times the increase in shorts driving net-long GBP positioning higher.

The week ahead

Further to the labour data, investors are anticipating that the rest of the week will provide extra evidence that the UK's economy is rebounding from its deepest recession in 300 years.

March Consumer Price Index on Wednesday is expected to bounce back from February's low reading.

On Friday, the focus will turn to the April PMI Services and Retail Sales.

Given the optimism about reopening, the readings are expected to be encouraging.

As for the greenback, the correlation seems to be back with US stocks, so these too are worth keeping an eye on.

US dollar analysis

DXY remains in a downdraft for the seventh consecutive session.

However, it is attempting to recover from the fresh weekly lows at 90.8560 to print 0.17% higher on the day so far having drifted back to 91.2580.

The prospects of narrowing the vaccination gap with Europe is weighing on the dollar and so too are lower US yields.

Having said that, the 10-year yield traded near 1.63% today, the highest since last Thursday and above the 1.53% low posted last week which gives some prospects of recovery from weekly lows.

''We still like the dollar higher but this drop in US yields from the 1.77% high on March 30 continues to weigh on the greenback,'' analysts at BBH said, noting that the bond markets await a $24 bln 20-year bond auction tomorrow and a $18 bln 5-year TIPS auction Thursday.

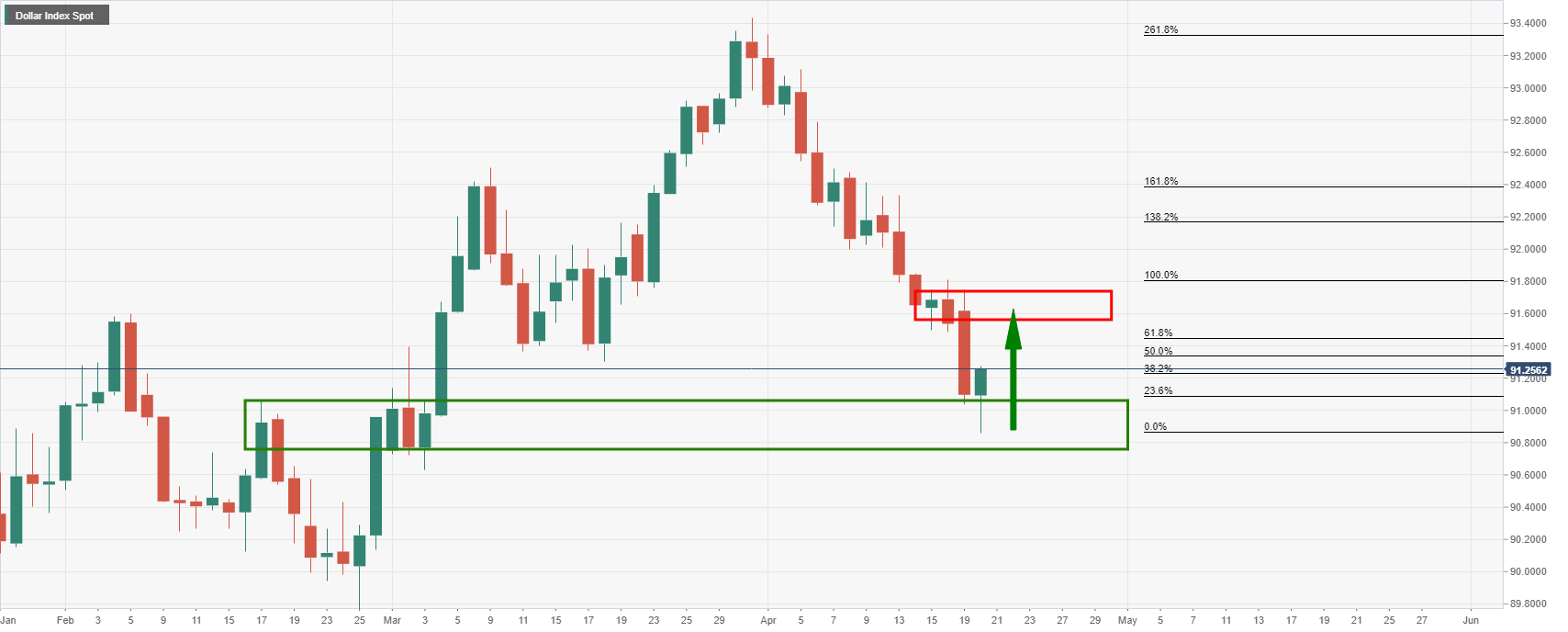

DXY daily chart

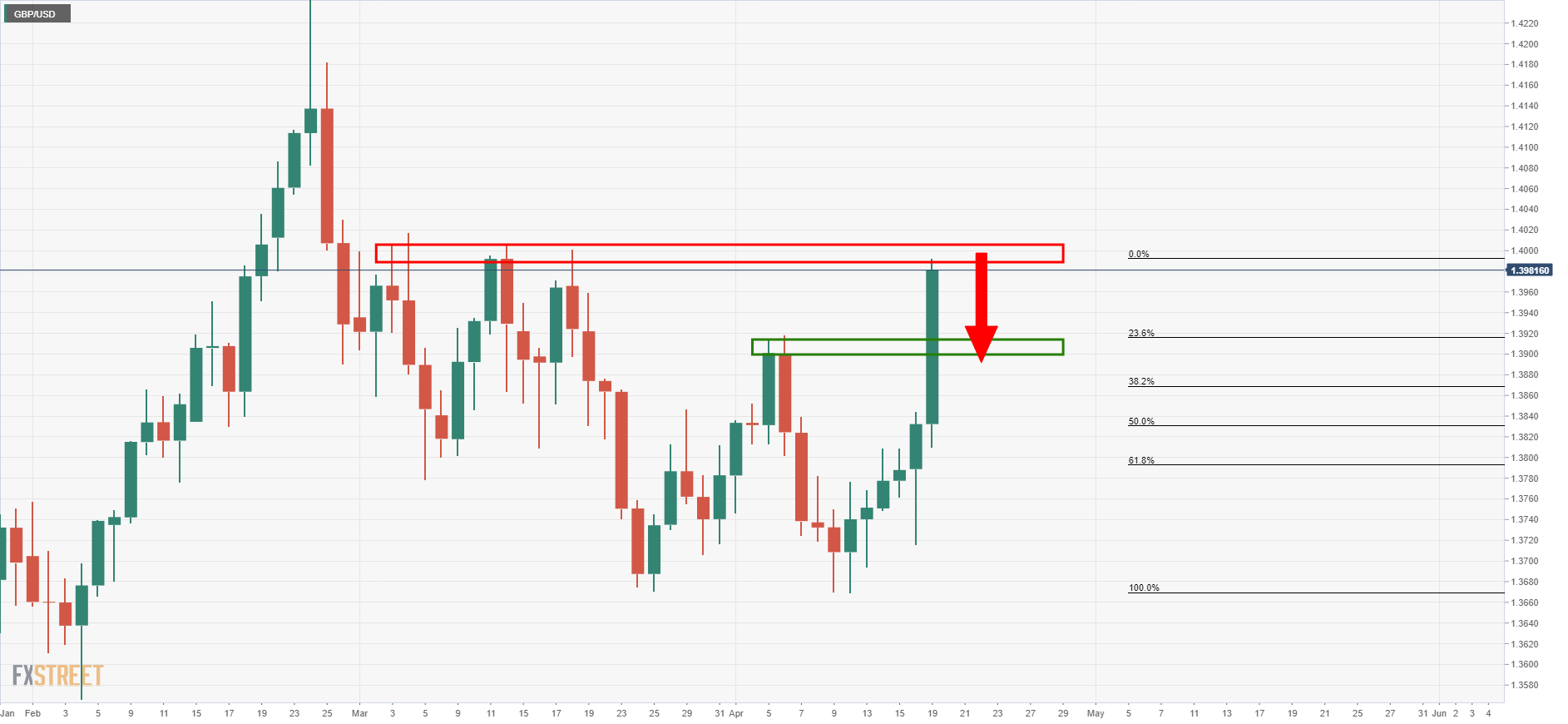

GBP/USD technical analysis

As per prior analysis, as illustrated in the chart below, the area of resistance was cited as follows:

Live market analysis

There are now expectations of a significant correction to test the prior resistance which has a semi-confluence with a 38.2% Fibonacci retracement level near to 1.3880.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.