- The GBP/JPY fell to lower ground, bouncing at the same point it fell to last week.

- Higher UK inflation had a limited positive effect while uncertainty about the next Governor of the BOJ was a significant mover for the yen.

- The technical picture leans lower.

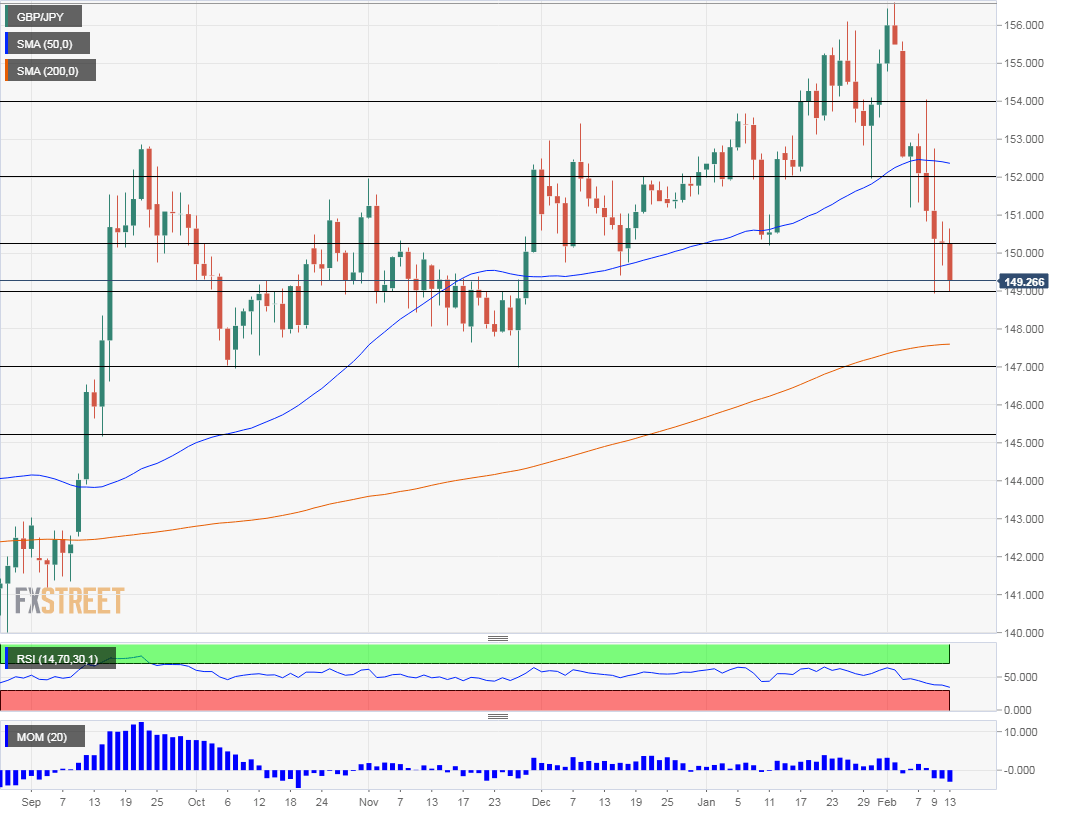

The GBP/JPY is trading above 149 after reaching a session low of 148.95, very close to the previous low of 148.90, thus creating a double-bottom.

Global stock markets are not playing a significant role in moving currencies, different from their leading role in the past few days. Shares are stable in US trading.

In the UK, inflation came out at 3% y/y, above 2.9% that was expected. Core CPI also exceeded early forecasts by rising 2.7% y/y. The Bank of England had already forecast high levels of price rises last week, thus limiting the impact of the inflation data.

In Japan, Prime Minister Shinzo Abe did not commit to reappointing BOJ Governor Haruhiko Kuroda to a second term. Kuroda enacted a very dovish policy with the QQE program. Another Governor at the helm may oversee a more hawkish policy. The speculation pushed the yen to higher ground across the board.

GBP/JPY technical analysis: leans lower

The 148.90 level is now an even more critical support line after holding the cross on two separate occasions. Further below, the round number of 147 is also a double-bottom after supporting the pair twice: in October and November. Even lower, 145.20 was a stepping stone as the pair was rising in September.

Looking up, 150.25 cushioned the pair in January and is the immediate resistance line above the round number of 150. Further above, the swing low at 152 seen in late January is another cap. Another round number, 154, was a swing high in early February.

Other technical indicators lean lower. Momentum points to the downside in the past three days. The RSI is well below 50 and still above 30, avoiding oversold territory for now. The pair is below the 50-day SMA but above the 200-day SMA and this is already more mixed.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.