Here is what you need to know on Thursday, August 13:

The US dollar is on the back foot after the large bond auction and as optimism prevails in markets despite the fiscal impasse in Washington. Sino-American tensions and a US-EU are eyed ahead of weekly jobless claims.

Investors are pushing bond yields down once again – after a record $38 billion auction. In turn, the pendulum is swinging against the greenback after it rose earlier in the week. Another factor weighing on the world's reserve currency is market optimism about achieving a vaccine. The upbeat mood is diminishing demand for the safe-haven dollar.

The S&P 500 Index briefly topped the previous all-time high recorded in mid-February. Robust earnings from tech firms have underpinned the gains, in addition to hopes for a recovery.

Gold is holding onto its recovery, trading around $1,930. It shed $200 earlier in the week and is now rising with other assets.

See Gold Price Analysis: $1907 is the last straw for the XAU/USD bulls – Confluence Detector

At the same time, Democrats and Republicans remain far apart on the next fiscal stimulus package, as described by both sides. The longer the impasse continues, the more significant the damage to the world's largest economy.

Officials at the Federal Reserve have urged lawmakers to act and provide support. The list includes Mary Daly, Robert Kaplan, and most vocally, Eric Rosengren, President of the Boston branch of the Federal Reserve. who said this is an appropriate time to take strong fiscal actions.

After inflation figures beat estimates in July, the focus shifts to weekly jobless claims, which are projected to remain around 1.1 million.

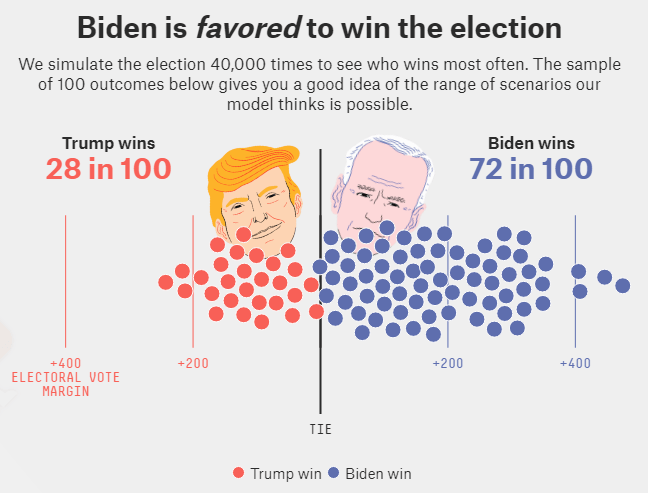

The US electoral campaign heats up after Democratic Challenger Joe Biden made his first appearance with Senator Kamala Harris, his running mate. The highly regarded election forecast by FiveThirtyEight has been published and it shows Biden leading over President Donald Trump, albeit with a high level of uncertainty at this point.

Source: FiveThirtyEight

Sino-American tensions remain elevated ahead of a trade review by the world's largest economies. China aims to put America's sanctions on TikTok and WeChat on the table. Washington slapped tariffs Berlin and Paris, related to the long-running dispute around Airbus.

AUD/USD is on the rise amid robust employment figures – Australia gained 114,700 jobs in July and the unemployment rate fell to 7.5%.

NZD/USD is on the back foot after Young Ha, the Reserve Bank of New Zealand's Chief Economist, said that his institution would like a weaker kiwi. The nation reported 14 additional coronavirus cases with Auckland, the largest city, remaining under lockdown.

Oil prices are holding onto high ground with WTI trading near $43. USD/CAD is changing hands below 1.33.

Cryptocurrencies have stabilized, with Bitcoin trading around $11,500.

More Traders are looking at the shiny thing and not the big picture

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.