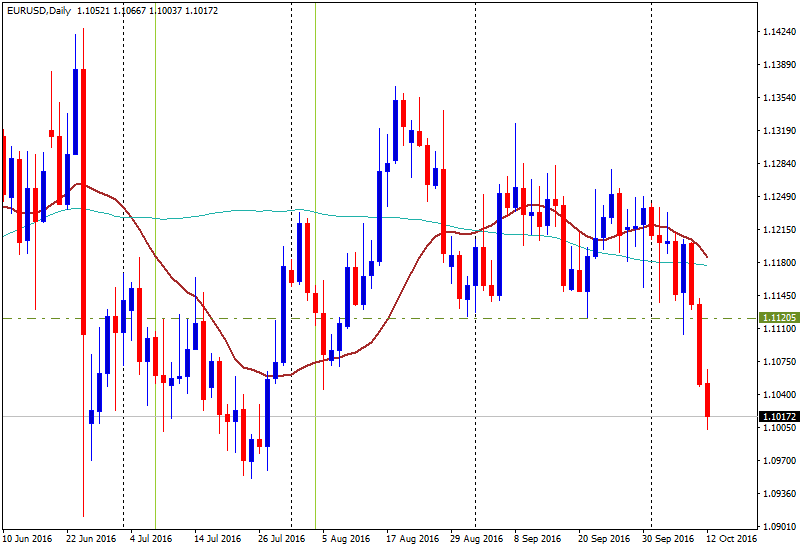

EUR/USD holds a strong bearish tone, after breaking decisively the 1.1120 area yesterday, where September lows were located. The pair continued to decline and before the FOMC minutes dropped to test the 1.1000 handle. So far it has been able to hold on top but still remains under pressure from a technical perceptive. The last time it traded under 1.1000 was back in late July.

Today not even better-than-expected Eurozone industrial production data offered some support to the pair, that continues to be affected by a stronger US dollar in the market.

Greenback is among the top performers in the market ahead of the minutes, with bond yields rising further to fresh multi-month highs and while US stock prices in Wall Street were shuffling between gains and losses.

FOCM minutes

At 18:00 GMT the Federal Reserve will release the minutes from the September 21 meeting. Back then, market consensus pointed toward no rate hike and that was what finally happened. The US central bank kept rates unchanged but with three FOMC members dissenting (they asked for a rate hike).

The meeting was followed by the release of new FOMC economic projections (dot plot) and by a press conference, so a lot about that meeting has already being said. Investors will read into the minutes for clues about the possible timing of the next move and how close is the Fed to raise rates again.

“Many investors are warming to the idea that the Fed will hike rates in December. Today's FOMC minutes will be looked at for fresh insight. The fact of the matter is there were three dissents to the FOMC statement in favor of an immediate hike, and subsequent comments suggest others were sympathetic. Both Yellen and Fischer have acknowledged it was a close call”, said analysts from Brown Brothers Harriman.

If the minutes sound “hawkish”, signaling that a rate hike is very likely the US dollar could receive an extra impulse. While on the contrary side, if the tone is perceived by market participants as “dovish”, signaling that there are still many risks of a rate hike, Greenback could retreat in the market.

The next meeting will be on November 2, a week before the US presidential elections. Most analysts expect no rate hike at that meeting and look into the December 14 meeting for a potential move. According to the FedWatch Tool from CME Group, the probability of a rate hike before year-end stands around 66%.

EUR/USD Levels to watch

The psychological support area round 1.1000 is exposed at the moment, and a boost to the US dollar could send EUR/USD below. The next relevant support could be seen at 1.0950 (July low). On the flip side, in the very short term a consolidation above1.1040 could give momentum to the euro, but as long as it remains under 1.1120, any upside moves could be considered as a correction.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.