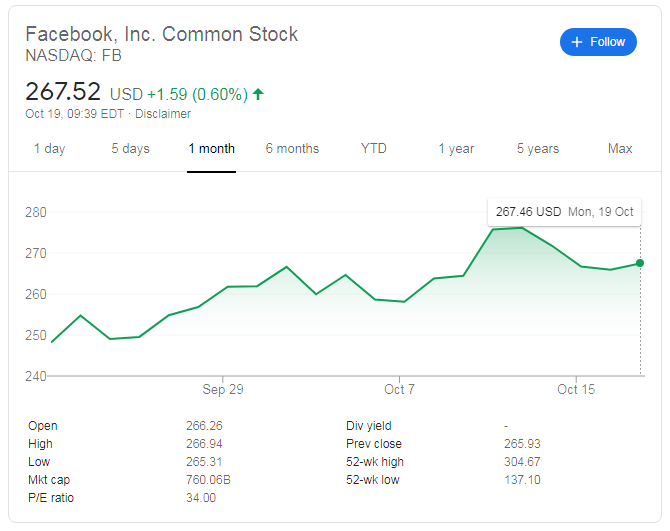

- NASDAQ: FB is rising amid hopes for a fiscal stimulus package that may come before or after the elections.

- Ad spending on Facebook is set to increase in the long "election month."

- Rising coronavirus cases could drive more shopping online, benefiting the social network.

Facebook Inc. (NASDAQ: FB) is on the rise – and that is unlikely a surprise when all tech shares are on the rise. Mark Zuckerberg's firm is edging higher as investors anticipate Congress to strike a deal on a new fiscal stimulus package. President Donald Trump said that he would offer more than Democrats.

It remains unclear if Senate Republicans would back their standard-bearer as they prefer only a minor support package – and as Trump is trailing rival Joe Biden in the polls. However, the social media behemoth has other reasons to advance.

FB Stock Forecast

1) Economic relief is coming after the elections: Democrats and Republicans are set to posture ahead of the vote and fail to strike a deal. However, they may reach one after the vote, boosting the American economy and indirectly affecting Facebook.

If Dems win the Senate – and they have a good chance of doing so – a more generous package is likely. The party has criticized FB for serving as a platform for fake news supporting Trump. However, Kamala Harris, the Vice-President candidate, has been friendly to tech firms in her home state of California. At least initially, a Biden administration is likely to only "slap tech on the wrist" rather than try to break it up.

2) Election spending unlikely to end: Facebook depends on ad spending, including political propaganda. With record mail-in and early votes, the elections are unlikely to end on the night of November 3, but more likely to extend for several weeks. Apart from a potential battle in courts, both parties will fight for public opinion – and that could extend spending throughout November – perhaps bridging the gap between election day and Black Friday shopping.

3) More online shopping: The world is watching the US elections and rising COVID-19 cases in Europe – but infections are also surging in the US and elsewhere. With more people staying at home once again, online consumption may reach new highs – and that means more spending as well.

Moreover, Zuckerberg and co. are expanding their e-commerce abilities, right in time for the peak of the second wave of the virus.

Overall, there are reasons for Facebook to rise.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.