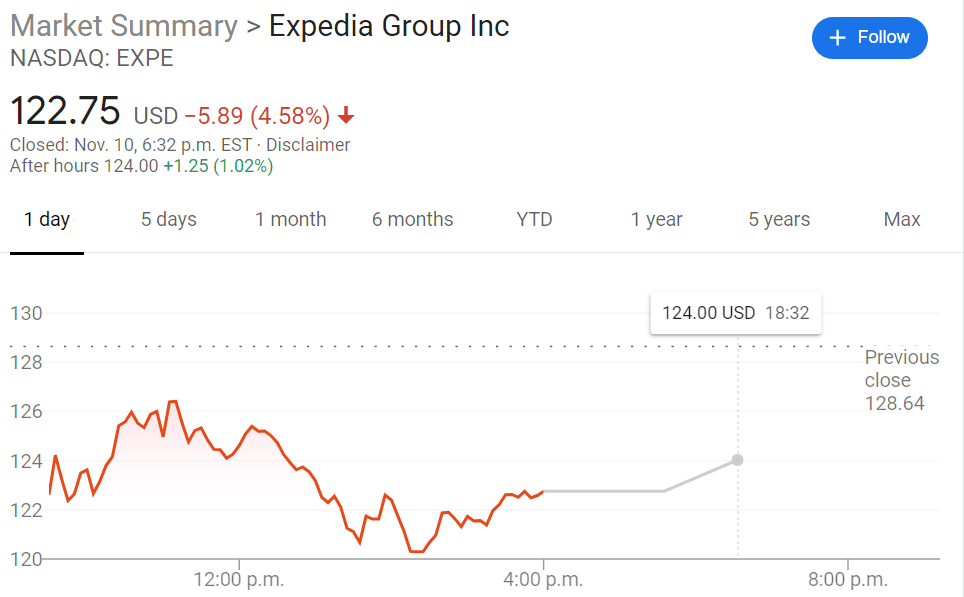

- NASDAQ:EXPE drops by 4.58% on Tuesday as broader markets sell-off.

- Expedia surged alongside the travel industry on the news of Pfizer’s COVID-19 vaccine trial results.

- Expedia beat earnings expectations on a rise in summer travel.

NASDAQ:EXPE investors have finally received some good news after months of training at lower prices due to the COVID-19 pandemic causing a lockdown on global travel. On Monday, the stock gained more than 20% on the news of Pfizer’s (NYSE:PFE) successful coronavirus vaccine candidate clinical trials. On Tuesday, investors sold off on that good news as shares dipped by 4.58% to close the trading session at $122.75. Still, the stock has rebounded over 200% since its March lows of $40.76, so savvy investors who bought during the sudden bear market have reaped the benefits.

Industry rivals saw the same pattern of trading as Expedia from Monday to Tuesday; Booking.com (NASDAQ:BKNG) and Trivago (NASDAQ:TVGO) both fell after their huge spikes. Interestingly, Tripadvisor (NASDAQ:TRIP) continued its surge on Tuesday, as the stock was up by a further 10%. Travel sites were not the only industry to gain off of the news, as the dormant airline and hotel/casino stocks went parabolic as well. It is a welcome sight for investors and travellers as a return to normalcy now seems closer than before.

EXPE Stock Quote

It has not been all bad news for Expedia as they did exceed recent expectations for its quarterly earnings from the summer. A gradual rise in summer travel allowed Expedia to recuperate some of its losses from earlier in the year, and while the Pfizer (NYSE:PFE) vaccine news is well received, there's still a way to go for global travel fully re-opening. Investors may have realized their over-exuberance on Monday which would explain the sell-off on Tuesday morning.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'