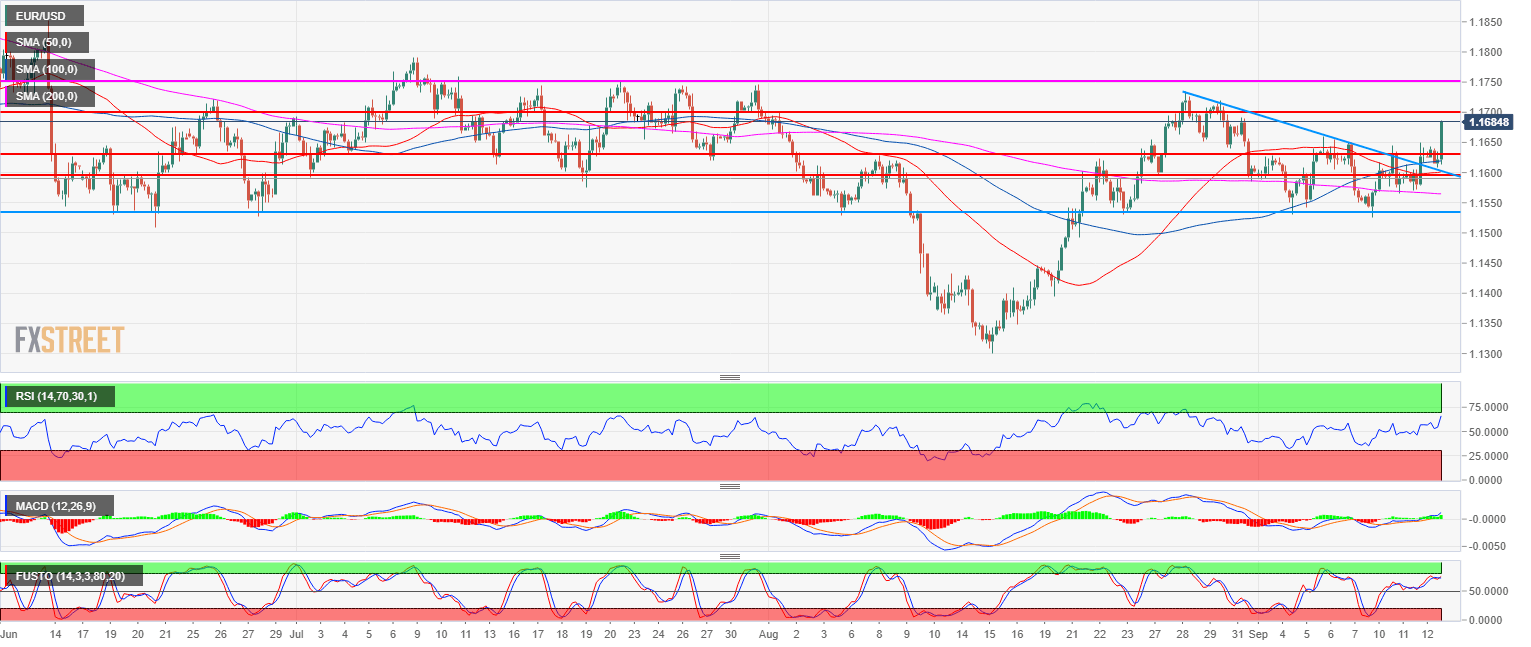

- EUR/USD bear trend is on hold since mid-August when EUR/USD found a floor at 1.1300 figure.

- EUR/USD broke from the triangle compression pattern as it is trading above its 50, 100 and 200-period simple moving averages, which is bullish. The RSI, MACD and Stochastics are all bullishly configured.

- The next target is 1.1700 followed by 1.1750 (July resistance). This last one can be a tough one to break above since it was strong resistance this summer. After it comes the 1.1800 figure resistance.

- Conversely, a bear breakout below 1.1530 would be seen as a strong bearish signal and would invalidate the bullish bias.

Spot rate: 1.1678

Relative change: 0.45%

High: 1.1688

Low: 1.1608

Main trend: Bearish

Short-term trend: Bullish above 1.1530

Resistance 1: 1.1700 figure

Resistance 2: 1.1750 key resistance (July)

Resistance 3: 1.1800 figure

Support 1: 1.1654 August 27 high

Support 2: 1.1630 August 8 high key level

Support 3: 1.1600 figure

Support 4: 1.1572 July 19 low

Support 5: 1.1542 supply/demand level

Support 6: 1.1530 August 23 swing low

Support 7: 1.1508 June 8 low

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.