- EUR/USD keeps the trade near the 1.1200 handle.

- German Economic Sentiment plummets in August.

- US CPI results next of relevance later in the day.

The selling bias around the European currency stays well and sound on Tuesday, taking EUR/USD to the 1.1190/80 band.

EUR/USD unfazed by German, EMU data

The pair so far manages well to keep business in the vicinity of 1.1200 the figure, always sustained by (near term) repatriation flows and amidst absence of extra headlines on the US-China trade war.

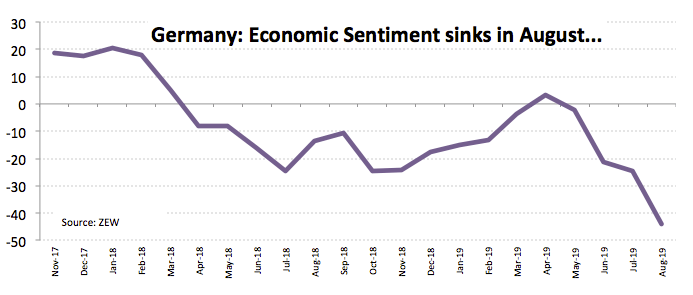

EUR keeps the composure so far despite the German Economic Sentiment sunk to -44.1 for the current month, the weakest print since December 2011. Today’s results signal further deterioration in the German economy and also point to a poor performance during Q3, opening the door at the same time for a potential technical recession in the country if advanced Q2 GDP results – due tomorrow - forecast a contraction of the economic activity in the April-June period.

Additional data saw German Current Conditions at -13.5 and Economic Sentiment in the broader euro area at -43.6.

What to look for around EUR

The reluctance of EUR to edge lower in the current risk-off environment could be reflected in ‘repatriation’ forces currently at play as well as the potential funding stance of the currency. Italian politics has resurfaced as a source of uncertainty as of late and is expected to weigh on the sentiment sooner rather than later. Sustained bullish attempts in the pair still look flimsy amidst ECB’s preparations for a fresh wave of monetary stimulus (most likely to be announced in September), including a potential reduction of interest rates, the re-start of the QE programme and a probable tiered deposit rate system. In the meantime, the unremitting deterioration of the economic outlook in the region and the lack of traction in inflation are seen capping extra gains and are also lending extra support to the dovish stance of the ECB.

EUR/USD levels to watch

At the moment, the pair is retreating 0.15% at 1.1196 and faces the next down barrier at 1.1161 (low Aug.12) seconded by 1.1101 (monthly low Jul.25) and finally 1.1026 (2019 low Aug.1). On the flip side, a breakout of 1.1232 (55-day SMA) would target 1.1282 (high Jul.19) en route to 1.1292 (200-day SMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.