- EUR/USD regains the smile and retakes 1.2100 and above.

- German, EMU Economic Sentiment surprised to the upside.

- Janet Yellen testifies before the Senate later on Thursday.

Sellers seems to have turned up around the greenback and lift EUR/USD back above the 1.2100 mark on turnaround Tuesday.

EUR/USD up on USD-selling, looks to Yellen

EUR/USD finally regains the smile following four consecutive daily pullbacks and looks to extend the rebound from Monday’s new 2021 lows in the mid-1.2500s.

The softer tone surrounding the buck gives extra legs to the recovery in EUR/USD beyond 1.2100 the figure, while positive results from the euro area also collaborates with the bid bias in EUR.

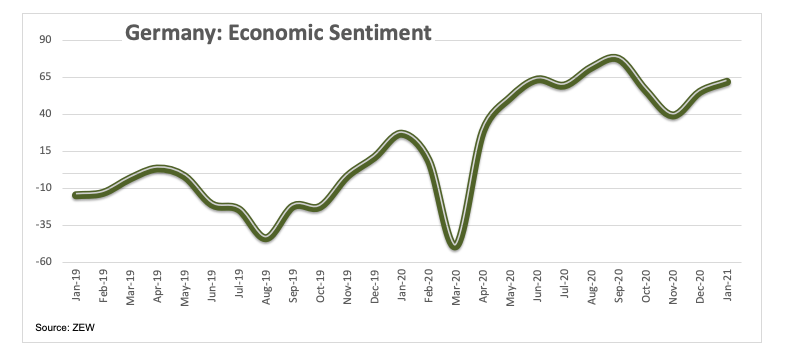

In fact, and tracked by the ZEW survey, the Economic Sentiment in Germany improved to 61.8 for the month of January and rose to 58.3 in the broader euro area, confirming the upbeat morale in the region amidst the vaccine rollout and despite rising coronavirus cases.

Across the pond, ex Fed Chief Janet Yellen will testify before the Senate Finance Committee, as President-elect Joe Biden nominated her to Treasury Secretary.

In the US data space, November’s TIC Flows will be the only release later on Monday.

What to look for around EUR

The leg lower in EUR/USD seems to have met decent contention in the mid-1.2000s for the time being. Despite the recent corrective downside, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is up 0.47% at 1.2131 and a break above 1.2349 (2021 high Jan.6) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018). On the flip side, the next support is located at 1.2046 (55-day SMA) seconded by 1.2053 (2021 low Jan.18) and finally 1.1976 (50% Fibo of the November-January rally).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.