- EUR/USD reverses Wednesday’s pullback and targets 11950.

- German IFO survey surprised to the upside in June.

- Final Q1 GDP, weekly Claims next of relevance in the US docket.

The single currency regains the smile and pushes EUR/USD back to the vicinity of the 1.1950 area in the second half of the week.

EUR/USD up on data, looks to US calendar

EUR/USD regains the positive mood following Wednesday’s pullback despite testing fresh weekly tops around 1.1970.

The better tone in the risk complex coupled with the march higher in German yields and the softer note surrounding the buck all collaborates with the current buying interest in spot.

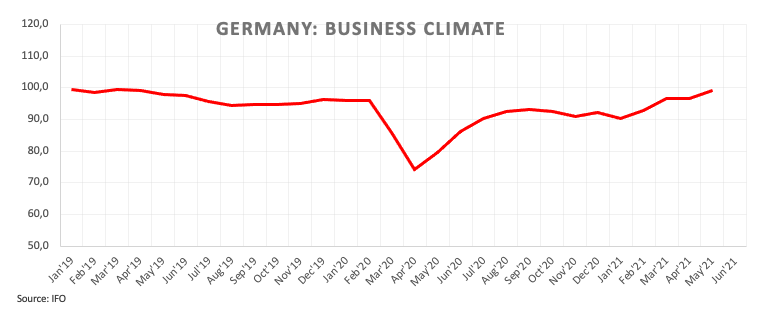

In addition, the German Business Climate improved to 101.8 for the current month, as per the latest report from the IFO survey, and also lends legs to the European currency. Furthermore, IFO economists noted the economy is recovering at a fast pace, while they see the GDP expanding 1.3% in Q2. Other comments from IFO officials noted that big bottlenecks in industry still persist and that input costs have been on the rise.

Later in the US data space, the focus of attention will be on the final Q1 GDP figures followed by Durable Goods Orders, advanced Goods Trade Balance results and Initial Claims. In addition, NY Fed J.Williams (permanent voter, centrist) is also due to speak.

What to look for around EUR

EUR/USD’s recovery lost momentum in the 1.1970/80 band for the time being. Price action around the pair is expected to exclusively follow the dollar dynamics, at least in the very near term and particularly after the latest FOMC event. In the meantime, support for the European currency comes in the form of auspicious results from fundamentals in the bloc coupled with higher morale, prospects of a strong rebound in the economic activity and the investors’ appetite for riskier assets.

Key events in the euro area this week: German GfK Consumer Confidence, European Council meeting (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities.

EUR/USD levels to watch

So far, spot is gaining 0.14% at 1.1942 and faces the next resistance at 1.1993 (200-day SMA) followed by 1.2030 (100-day SMA) and finally 1.2064 (38.2% Fibo retracement of the November-January rally). On the other hand, a break below 1.1847 (monthly low Jun.18) would target 1.1835 (low Mar.9) and route to 1.1704 (2021 low Mar.31).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.